|

Deficits to Power Gold Higher

Daniel Oliver

Milton Friedman’s most famous line was: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” We assert that Friedman should have used the word debasement instead of inflation, that debasement occurs when the state increases the quantity of money regardless of growth in output, that inflation (as colloquially understood as rising consumer prices) is a lagged effect of debasement, always proceeded by bubbly asset markets, overinvestment in fixed capital, and then a market crash. Quibbles aside, it would seem unbalanced to dispute the connection between debasement of the coinage (or currency) and rising prices. Milton Friedman’s most famous line was: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” We assert that Friedman should have used the word debasement instead of inflation, that debasement occurs when the state increases the quantity of money regardless of growth in output, that inflation (as colloquially understood as rising consumer prices) is a lagged effect of debasement, always proceeded by bubbly asset markets, overinvestment in fixed capital, and then a market crash. Quibbles aside, it would seem unbalanced to dispute the connection between debasement of the coinage (or currency) and rising prices.

Yet those in power do dispute this connection. Diocletian become the emperor of Rome after the silver content of the standard coin of commerce, the denarius, had already been stripped of 98.2% of its silver content. He proceeded to mint bronze denarii and became enraged when prices jumped even higher, blaming merchants: “Who has so dull a breast . . . that he can be ignorant, nay rather has not actually observed that in commodities which are bought and sold in markets or handled in the daily trade of cities, the wantonness in prices had progressed to such a point that the unbridled greed for plundering might be moderated neither by abundant supplies nor by fruitful seasons? . . . that it forces up the prices of commodities not fourfold or eightfold, but to such a degree that human language cannot find words to set a proper evaluation upon their action?”

Two thousand years later, President Carter was faced with similar problems and reacted in kind: “It is a myth that the government itself can stop inflation. Success or failure in this overall effort will be largely determined by the actions of the private sector of our economy. . . . Our national interest simply can’t withstand unreasonable increases in wages and prices.”

Last year Biden said exactly the same thing: “So, I’m sick of this stuff. We have to talk about it because the American people think the reason for inflation is the government is spending more money. Simply. Not. True.”

The economics profession evolved to give the politicians cover. In 2022, former Fed chairman Bernanke lectured: “The conventional story, which is dominant in central banks around the world, rests on two key premises. First, that inflation expectations

. . . are an important determinant of realized inflation. . . . The second key premise is that central bank behavior and possibly central bank communications can influence inflation expectations and through them macroeconomic outcomes. . . . If inflation expectations are well-anchored in the sense that they don’t respond very much to short-term movements in realized inflation and other variables, then policymakers can respond more aggressively to recessionary demand shocks and less aggressively to inflationary supply shocks, leading to better dual mandate outcomes.”

To translate, responding “more aggressively to recessionary demand shocks” means printing money really quickly when the default cycle hits, and responding “less aggressively to inflationary supply shocks” means not having to stop printing money when prices start rising.

Jerome Powell may be the current Fed chairman, but he is a slave to Bernanke’s New Keynesian dogma. In a speech last year he parroted Bernanke’s words, revealing who is really in charge: “If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will. Unfortunately, the same is true of expectations of high and volatile inflation.”

This is nonsense, of course. Consumer price inflation is caused—ultimately—by debasement of the currency, which in our system is determined by federal budget deficits, not by expectations of the public. Every transaction in the economy, save for final sale of consumer goods, involves expectations about the future. Those speculations do not determine the future; rather, those whose expectations are frustrated are soon relieved of their capital. We will concede that the precise moment that inflation manifests may be influenced by psychological factors. But the ultimate cause and inevitable driver of debasement is deficit spending.

The mechanism by which deficits cause inflation are two-fold. First, and most obviously, when the central bank issues new currency to purchase government debt, the increased supply must reduce the currency’s value below that which it would otherwise have been. Inflation also manifests when it is the private market purchasing the bonds because the government gets to spend the money but the bondholder does not surrender any purchasing power, for reasons Adam Smith described:

By lending money to government, they do not even for a moment diminish their ability to carry on their trade and manufactures. On the contrary, they commonly augment it. The necessities of the state render government upon most occasions willing to borrow upon terms extremely advantageous to the lender. The security which it grants to the original creditor, is made transferable to any other creditor, and, from the universal confidence in the justice of the state, generally sells in the market for more than was originally paid for it. The merchant or monied man makes money by lending money to government, and instead of diminishing, increases his trading capital.1

Consumer price inflation is a poor measure of debasement. Technology and economic progress lower prices; that is their function, to make consumer goods better and cheaper. Given the extraordinary rate of economic progress since the industrial revolution, nearly all consumer prices should be crashing ever lower. They have been in terms of gold, in fact. But for this reason, the Fed’s goal of 2% annual inflation is

closer to 5% annual debasement. That 5% represents 5% of the entire economy being captured by the state every year on top of annual tax receipts—the U.S. already has a wealth tax. This is why the government is so bloated and also why gold has been rising so quickly over the past twenty years—not because of consumer inflation but because of debasement.

If the world were simple and purely rational, a constant deficit (or a constant percentage debasement) should produce a steady increase in the nominal gold price. As annual deficits increase, so should the rate of increase in the gold price; and the best way to depict that is by using a logarithmic scale.

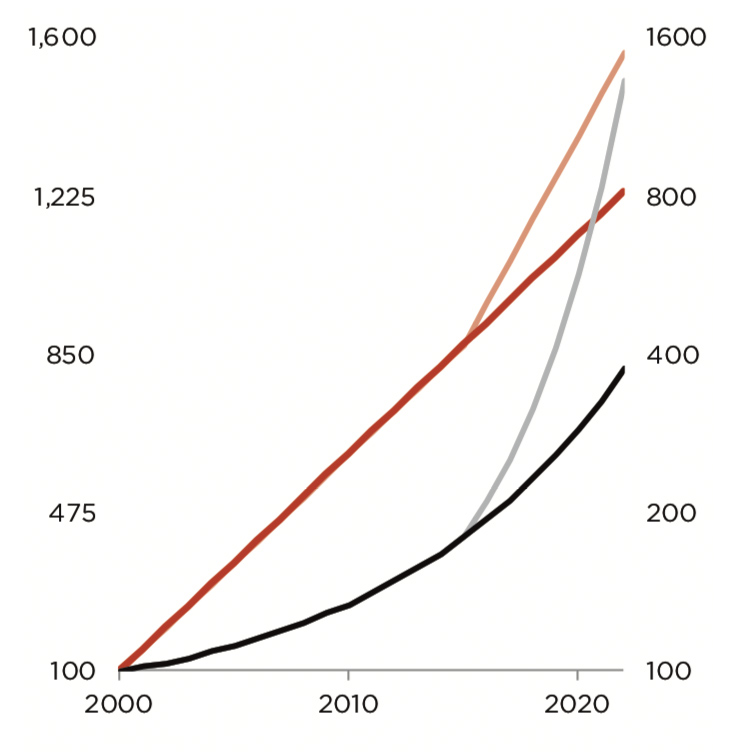

Some readers may be intimated by logarithmic scales, but they are simple and critical for depicting growth over time. Posit a data series that begins at 100 in the year 2000 and grows 10% per year. The first year’s increase would be 10, whereas the twentieth year’s increase would be 73 even though the growth rate is the same.

The black, curved line on the chart at right depicts the dataset on the arithmetic scale at left. The straight red line depicts the

same data on the logarithmic scale at right. Note that numbers on the scale double for

each increment. If we were to increase the rate of increase from 10% to 20%, the black line would become more curvy, whereas the red line would remain straight but have a higher angle. The faded lines show the result if this shift occurred in year 15.

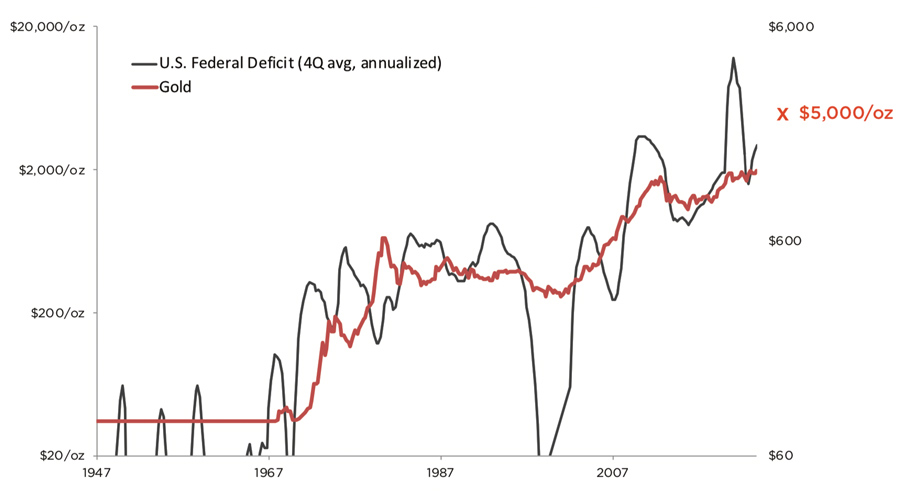

The red line on the chart below is the gold price on a logarithmic scale. The black line is the nominal federal deficit also on a logarithmic scale. We use the nominal federal deficit (not the inflation adjusted figure) because the current large numbers are only possible because of past debasement, which is also the reason why gold’s nominal price is so high. A constant federal deficit in nominal terms (at whatever level) would gradually become less in inflation-adjusted terms, which should then gradually flatten the increase in the gold price. The only way to get gold to go down persistently would be to run persist budget surpluses, which is for practical purposes impossible. The data does not match the theory perfectly: the chart shows that the improved deficit situation during the Clinton internet bubble sent gold modestly lower, but the movement is nothing like the dramatic moves in the 1970s and the 2000s, and the general relationship holds.

The chart above may be divided into four periods. From 1947 to 1971, the gold price was fixed. Instead of deficits acting to increase the gold price, they prompted foreign governments to redeem their dollars for gold, and the U.S. saw its physical gold reserve shrink by more than half.

The 1970s had sharply increasing federal deficits and an exploding gold price, from $35/oz up twenty-five times to $875/oz. Gold settled at around $350/oz, so it would be more accurate to say that the dollar lost 90% of its value during this period.

From the 1980s through 2000, the growth rate in the federal deficit fell nearly to flat and the gold price was relatively stable, aside from the dip during the internet bubble. Then the 1970s began again, with the 2000s seeing sharply rising deficits. The angle of the trend line is not as steep, but the trend has been ongoing for twenty years, twice that of the 1970s. Gold has increased nearly as much as during the 1970s: from $250/oz to $2,000/oz, another 87% decline in the dollar.

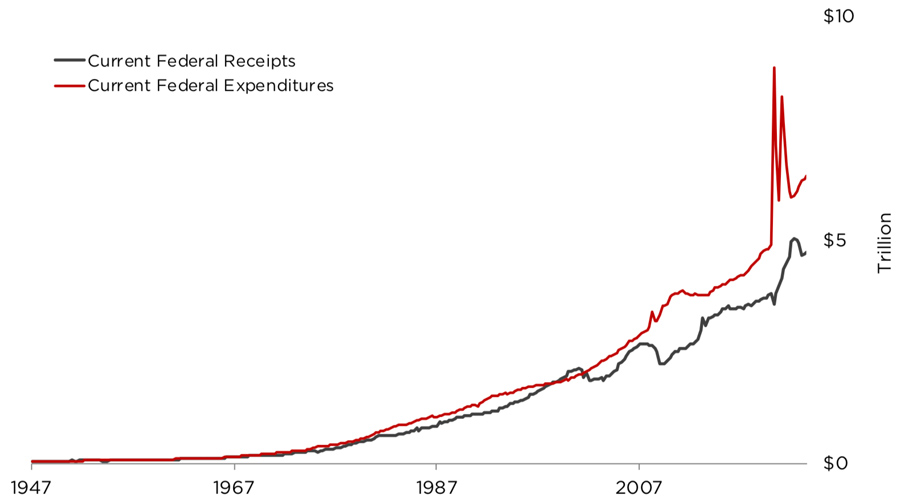

The trend in rising deficits shows no sign of abating. The absurd spending programs of the COVID hysteria have expired, but now the automatic growth of entitlement spending plus war spending plus the increased costs of buying votes have sent federal expenditures higher again just as tax receipts stutter.

The economists tell us we are not in a recession. When recession does arrive, which it must, given the emerging lagged effects of the massive increase in interest rates, Keynesian “automatic stabilizers” will meet collapsing tax revenue that will power the deficit sharply higher. No one could conceive of trillion dollar deficits until the 2008 financial crisis made them necessary; then they became commonplace. Even so, a $5 trillion deficit would have seemed impossible, until COVID paved the way. Now the Congressional Budget Office is projecting $2 trillion deficits as commonplace, and why can’t they be $3 trillion in a mild recession or $5 trillion in a severe one? Such deficits will send gold sharply higher again (or, rather, the dollar lower), and once deficits reach a higher threshold, they never come down again.

The chart at bottom on page 3 demonstrates the power of logarithmic growth. Market commentators projecting a move to $2,200/oz or $2,500/oz once the all-time high is cleared convincingly are too timid. Gold bull markets, when they get going, typically run tenfold not ten percent. We’ve already run nearly tenfold since 2000, but deficits are still accelerating higher, and so, suddenly, is the gold price.

Gold spiked briefly last Sunday night to $2,152/oz and—having sucked in all of the buy-stops and momentum chasers—has been in a tailspin, sending sentiment sliding back into depression and taking out all of the sell stops. It is said that bull markets climb a wall of worry. That fact that investors are glum about $1,980/oz gold is a great sign that the bull market is intact and is gathering the energy to launch past previous all time highs. The result on the struggling miners will be electric.

1 Smith’s words are true only because of legal tender laws. Those who buy government bonds generally do not worry about creditworthiness because the proceeds on maturity may always be used to pay debts and taxes.

Daniel Oliver Jr. is the founder and managing member of Myrmikan Capital, an investment firm specializing in micro-capitalized gold and silver mining ...

www.myrmikan.com

|