The Next Stage: Financializing Nature

Dr. Joseph P. Farrell

You will want to pay attention to this article that was shared by K.M., because it represents the next step in crony crapitalism, and because it’s by one of my favorite researchers, F. William Engdahl: You will want to pay attention to this article that was shared by K.M., because it represents the next step in crony crapitalism, and because it’s by one of my favorite researchers, F. William Engdahl:

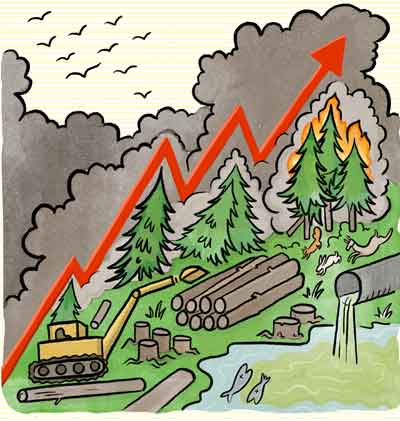

Wall Street’s Diabolical Plan to Financialize all of Nature

Before diving into this article, I want to bring something to the reader’s attention, something that I hope he will bear in mind as he reads this article because it bears directly on it. That something is “weather manipulation,” including that weather manipulation that occurs via financial instruments such as weather derivatives. With that in mind, let’s extract a few paragraphs seriatim from Engdahl’s article that explain what the next financial jackboot to drop will be:

It’s called a Natural Asset Company. With it the New York Stock Exchange has unveiled the most radical and potentially most destructive plan yet to make literally trillions of dollars on something that is the natural right and heritage of the entire human race—nature itself, all nature, from air, fresh water to rainforests to even farmland. It is being promoted as a way to incentivize the preservation of nature. In fact it is a diabolical scheme to financialize potentially trillions of dollars of nature, ultimately allowing a globalist financial elite to control even this. And the Rockefeller Foundation is a founding partner. The combination of the NYSE and that foundation ought to sound loud alarm bells .

The term financialize refers to the act of converting intangible value into financial instruments. Now hiding behind the fake facade of the Green Agenda that the UN and Davos WEF are promoting along with major OECD governments, Wall Street and the world’s largest financial institutions are promoting a scheme to financialize virtually all of nature. They even hired McKinsey and others to put a dollar value on it. They claim it all is worth 4 Quadrillion dollars or 4000 trillion dollars. Yet how can we put a dollar price on something given by nature?

Let’s stop right there before we go on. Ever since the 2008-2009 financial crisis and bailouts, I’ve been more or less trying to get across the idea that the financial crisis is to a large extent unresolved and papered over, for the simple reason that the amount of derivates sloshing around in the system is still there, as estimates of the amount of those derivatives vary from 14 quadrillion to about 17 quadrillion dollars. Or to make that point more bluntly, from $14,000,000,000,000,000.00 to $17,000,000,000,000,000.00. Faced with such (reckless) numbers, I’ve argued on occasion that if Mr. Globaloney central bankster is still concerned with maintaining any semblance of financial sanity, all that bad paper will have to be made good, and the one way in the past that I’ve suggested that it might be done is to utilize or incorporate space assets into the system. Lo and behold, a few months after the disclosure of the derivatives numbers, “they” announced the discovery of an asteroid whose mineral wealth was coincidentally estimated to be around 14 quadrillion dollars. All one needs to do is go out there, grab it, and mine it (or at least, say that one has… and there’s the rub. Does anyone really trust these people?)

What a coincidence, huh?

The other way to do it is to financialize those assets not yet financialized on Earth, like water, and even weather systems (which they’ve already done through weather derivatives, and let’s not forget those pandemic bonds). And of course, one can also do all of this in combinations of such instruments (and then bundle them into bundles of such instruments, and bundles of bundles, and so on. Sound familiar?)

Now back to Mr. Engdahl’s article:

The NYSE project to create a new class of stocks—NACs or Natural Asset Companies, to be traded alongside stocks like Apple or Boeing or Chevron—was developed in a collaboration by the Rockefeller Foundation and something they founded known as the IEG group or Intrinsic Exchange Group.

What is the IEG? To quote from their website, IEG was created by the Rockefeller Foundation together with World Bank affiliate IDB of Latin America. Two years ago IEG began work on the NYSE project. Their “Strategic Advisor”, Robert Herz, was Chairman of the Financial Accounting Standards Board (FASB) from 2002 to 2010. That says volumes about the thinking behind the IEG project. Herz today sits on the boards of many corporations including Morgan Stanley bank and US Government-sponsored real estate enterprise, Fannie Mae.

As they state on their website, IEG has created “a new asset class based on nature and the benefits that nature provides (termed ecosystem services). These services include carbon capture, soil fertility and water purification, amongst others.” They plan to bring this about by creation of the NYSE-recognized “new form of corporation called a ‘Natural Asset Company’ (NAC). The NYSE agreement will serve as their “platform to list these companies for trading, enabling the conversion of natural assets into financial capital. The NAC’s equity captures the intrinsic and productive value of nature and provides a store of value based on the vital assets that underpin our entire economy and make life on earth possible.” They further state, “IEG is proposing a transformational solution whereby natural ecosystems are not simply a cost to manage, but rather, an investible productive asset which provides financial capital and a source of wealth for governments and its citizens.” Note the “source of wealth for governments and it’s citizens.”

…

How it Works

The NAC is to be created through an IPO like any new stock listing. The NAC then publicly sells shares to investors who could include Institutional Investors such as BlackRock–the $9.5 trillion asset manager, the world’s largest–or Vanguard Group or, say, the Norwegian or Chinese Sovereign Wealth funds. BlackRock CEO Larry Fink conveniently sits on the board of Klaus Schwab’s World Economic Forum, promoters of UN Agenda 2030 and of the Great Reset of the global financial system to a “sustainable” one.

The IEG describes the possibilities: “…as the natural asset prospers, providing a steady or increasing flow of ecosystem services, the company’s equity should appreciate accordingly providing investment returns. Shareholders and investors in the company through secondary offers, can take profit by selling shares. These sales can be gauged to reflect the increase in capital value of the stock, roughly in-line with its profitability, creating cash-flow based on the health of the company and its assets.”

Where the Money Goes

Shares in the NAC can be bought by others but it will clearly be dominated by big financial actors as are all important stocks. The new company, say one which claims ownership of a part of the Amazon Rain Forest, will then be subject to accounting standards including a new IEG-created “Statement of Ecological Performance: The financial value of the flow of ecosystem services and the assets that produce them.” The value placed on the flow of ecosystem services is the key, and that is being controlled by people like IEG’s Robert Herz, a board member of Morgan Stanley bank.

As IEG states, via the NYSE platform, “IEG converts natural asset value to financial capital in order to provide owners a way to financially benefit from the value of their natural assets.” But the rewards would also go to the shareholders like BlackRock or others by creating “financial transactions valuing natural assets that allow institutional investors to recognize, participate in and preserve nature’s value.” That means to make a profit on their stocks. Here the door is wide open to manipulation. (Boldface emphasis added)

Now if you read that carefully, you’ll note that this is largely a scheme simply to create more financial paper and manipulate its trading value. Notably, in Engdahl’s summary, nothing is actually being produced other than a “valuation” of nature, which valuation is then collateralized and sold as shares in a natural asset company. Eventually, such a system will engulf other intangibles, such as the “energy” produced by a storm system, which will then be “valuated” and traded. If that sounds completely nutty, that’s because it is completely nutty, but that is where this ultimately leads.

I’m reminded of a video I saw years ago, in the early 1990s, that was produced by an accountant who was invited to attend the World Wilderness Congress during a meeting in southern Colorado. Volunteering to work during a gathering, which he assumed was simply about helping the environment and so on, he soon found himself shuttling important dignitaries from Denver to the conference location in southern Colorado, people like Maurice Strong and even a Rothschild, and he also discovered that what the congress was really about was about financializing the world’s wilderness land as a new backing for currency.

My point in mentioning this episode is simply to point out how these people do plan ahead. In short, it's a scheme to seize and assert ownership over the planet.

The problem is ownership, and the dangers that Mr. Globaloney might be asserting a claim to ownership of something where there is a prior claim, something like, oh, I don't know, Psalm 24:1 maybe? "The Earth is the LORD's, and the fulness thereof; the world, and they that dwell therein."

One wonders how, should the occasion arise, they might answer a writ quo warranto in the local celestial Crown court.

But that's a speculation for another day.

See you on the flip side...

Born and raised in Sioux Falls, South Dakota, Joseph P. Farrell has a doctorate in patristics from the University of Oxford, and pursues research in physics, alternative history and science, and "strange stuff". His book The Giza DeathStar was published in the spring of 2002, and was his first venture into "alternative history and science". Following a paradigm of researching the relationship between alternative history and science, Farrell has followed with a stunning series of books, each conceived to stand alone, but each also conceived in a pre-arranged sequence:

- The Giza Death Star

- The Giza Death Star Deployed

- Reich of the Black Sun

- The Giza Death Star Destroyed

- The SS Brotherhood of the Bell

- The Cosmic War

- Secrets of the Unified Field

- The Philosophers' Stone

- The Nazi International

- Babylon's Banksters

- Roswell and the Reich

- LBJ and the Conspiracy to Kill Kennedy

- Genes, Giants, Monsters and Men

- The Grid of the Gods, with Dr. Scott D. de Hart

- Saucers Swastikas and Psyops

- Yahweh the Two-Faced God: Theology, Terrorism, and Topology, with Dr. Scott D. de Hart (Amazon Kindle e-book)

- Transhumanism: A Grimoire of Alchemical Altars and Agendas for the Transformation of Man (with Dr. Scott D de Hart, 2012)

- Yahweh the Two-Faced God: Theology,Terrorism, and Topology (Lulu Print-on-demand book, 2012)

- Covert Wars and Breakaway Civilizations: The Secret Space Program, Celestial Psyops, and Hidden Conflicts (2012)

- The Financial Vipers of Venice: Alchemical Money, Magical Physics, and Banking in the Middle Ages and Renaissance (2013)

- Covert Wars and the Clash of Civilizations: UFOs, Oligarchs, and Space Secrey (2013)

- Talk Radio for the Eyes: Transhumanism in Dialogue; with Dr. Scott D. de Hart (2013)

- Thrice Great Hermetica and the Janus Age: Hermetic Cosmology, Finance, Politics and Culture in the Middle Ages through the Late Renaissance(2014)

- The Third Way: The Nazi International, The European Union, and Corporate Fascism (2015)

- Rotten to the (Common) Core: Public Schooling, Standardized Tests, and the Surveillance State (2o16)

- Hidden Finance, Rogue Networks, and Secret Sorcery: the Fascist International, 9/11, and Penetrated Operations

- Hess and the Penguins: The Holocaust, Antarctica, and the Strange Case of Rudolf Hess

gizadeathstar.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)