New 2x Levered Energy ETFs Launched As Investors Scramble For Upside Amid Relentless AI Power Demand

Tyler Durden

In pursuit of the seemingly relentless retail bid, Tradr ETFs has launched four new single-stock levered ETFs today, adding fresh instruments to a market incessantly infatuated with leverage-focused products. Notably, these new products land squarely in the middle of the energy sector - and includes names that stand to profit generously once what we dubbed the "Next AI Trade" (i.e., powering up the armada of newly-built data centers) takes off - at a time when power demand has never been greater thanks to AI. In pursuit of the seemingly relentless retail bid, Tradr ETFs has launched four new single-stock levered ETFs today, adding fresh instruments to a market incessantly infatuated with leverage-focused products. Notably, these new products land squarely in the middle of the energy sector - and includes names that stand to profit generously once what we dubbed the "Next AI Trade" (i.e., powering up the armada of newly-built data centers) takes off - at a time when power demand has never been greater thanks to AI.

The new offerings track Bloom Energy, Celestica, Nano Nuclear, and Synopsys and trade under BEX, CSEX, NNEX and SNPX respectively.

As noted above, what makes this offering notable is that several underlying companies sit at the intersection of energy, computing, and the rapidly accelerating AI build-out. Bloom Energy and Nano Nuclear are direct plays on emerging power technologies, while Celestica provides critical hardware integration for data-center infrastructure. Even Synopsys, not an energy company itself, enables the semiconductor designs that underpin the compute side of AI’s energy-hungry expansion.

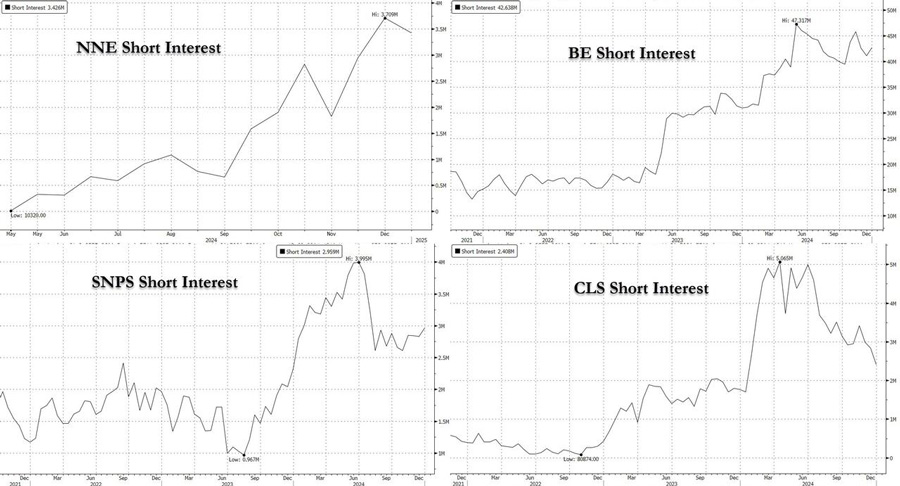

As a result of their disruptive nature, all 4 stocks have seen their short interest surge recently, with the short pile up in the names at or near all time highs, prompting some to speculate that the Tradr ETFs may have been launched to facilitate a levered squeeze.

The increasingly granular nature of these products creates abundant choice for traders but also underscores how saturated and niche the ETF landscape has become.

Leveraged ETFs have grown so prolific that the number of such products now rivals, and in some categories exceeds, the number of public companies they reference. The overall US ETF ecosystem has ballooned into thousands of funds, and leveraged equity ETFs alone have climbed into the hundreds, doubling their footprint over just a few years.

It's clear why Tradr has decided to focus on energy: global data-center electricity consumption is projected to soar over the next decade, with U.S. and international forecasts all pointing to steep increases driven by AI workloads. As we noted overnight, some $5 trillion is expected to be spent over the next 5 years on the rollout of the AI cycle. As power demand rises, grid constraints tighten, and energy prices trend higher, companies providing generation, efficiency, or data-center hardware become more tightly linked to the broader energy narrative.

The combination of swelling energy demand, a strained grid, and AI’s relentless need for compute has created a backdrop where volatility in energy-adjacent names is likely to remain elevated. The rapid growth in artificial intelligence and cloud computing is testing America’s electric grid and exposing the urgent need for new, always-available power.

The most recent example highlighted by Bloomberg was a case where Amazon has accused PacifiCorp, a Berkshire Hathaway–owned utility, of failing to deliver enough electricity for four planned data-center campuses in Oregon.

Another recent example highlighted by Bloomberg: First American Nuclear Co. plans to build self-sustaining reactors in Indiana to power data centers. The plant will begin with natural gas in 2028, then shift to a 240-megawatt liquid-metal fast reactor by 2032 that can reprocess its own spent fuel.

“Data centers are driving the demand for power,” said CEO Mike Reinboth.

As President Donald Trump pushes to accelerate AI infrastructure, power demand from computing is forecast to more than double in the US by 2035, according to BloombergNEF. Utilities and tech giants now depend on each other — but utilities worry about straining the grid and raising bills if the AI boom falters.

For traders who seek to capitalize on short-term swings in these areas, whether in emerging nuclear concepts, distributed generation, or data-center supply chains, single-stock leveraged ETFs offer a direct, amplified tool. But their daily reset mechanics and sensitivity to volatility mean the risks scale just as quickly as the potential reward, so use them sparingly and ideally during bursts of activity to leverage the momentum.

Either way, we predict they won't be the last of their kind...

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|