Send this article to a friend:

November

18

2023

Send this article to a friend: November |

The Government Just Lost Its Biggest Financial Supporter

When there are lots of buyers, and competitive bidding, the cost of financing government debt is low (as it has been for the last 20 years). But what if the government held an IOU auction and nobody came? This has never happened before. However, considering the truly astonishing quantity of debts the federal government has racked up over the last couple years, we’ve been getting dangerously close to that point. The Wall Street Journal summarized business-as-usual over the last few decades:

The problem is simply that the dollar’s “global standing” is in jeopardy. This is partially due to BRICS countries actively de-dollarizing, creating their own digital currency as an alternative to the U.S. dollar. (I don’t want to spend a lot of time on the geopolitical calculations at play here – suffice to say, BRICS nations are tired of paying for the stick that’s used to beat them.) So back to our question: What if they held an auction and nobody came? Fortunately for the U.S. Treasury, they have a special relationship with a number of global banks called primary dealers. Their job is to participate in the auction no matter what. So even if nobody shows up at the auction, the IOUs still get sold. That’s what happened last week: Remember, the U.S. dollar has no intrinsic value. That means its price is established in the market, based on just two forces:

Since we’re talking about IOUs, supply is NOT a problem! The federal government issues nearly unimaginable quantities of IOUs. In fact, if we look at three fiscal quarters (July 2023 to March 2024), the government plans to peddle another $3 trillion in IOUs. For context, this is the financial equivalent of fighting World War II all over again – every nine months! And that’s on top of the $30-plus-trillion already owed… And when I say “nearly unimaginable quantities,” that’s exactly what I mean! Take a stack of a trillion $1 bills and it would stretch out 67,866 miles – a little less than three complete trips around the Earth’s equator. By March 2024, the total U.S. debt pile would wrap around the planet more than 100 times! Now, when you start discussing debt in terms of how many times it would encircle the entire planet, you might start getting a little anxious. Maybe it’s time to start paying off the bills, you might say to yourself. If so, you wouldn’t make a good politician… Our federal government has absolutely no plan (and maybe no intention) to ever settle this ridiculous sum. We’ve seen, over and over, how discussions about spending just a little bit less are bringing the bureaucracy to a grinding halt. So don’t worry about supply! But what about demand? Well, thank goodness for the primary dealers who really saved the day recently when an auction “received far less demand from investors than the government is used to.”

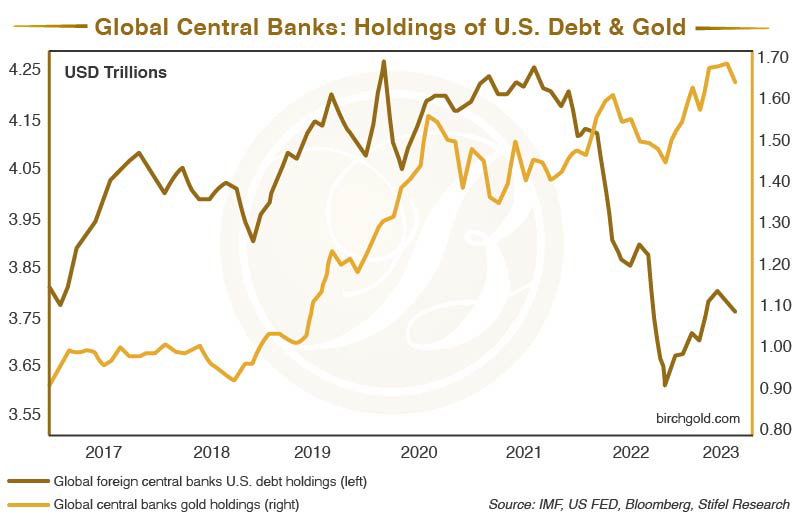

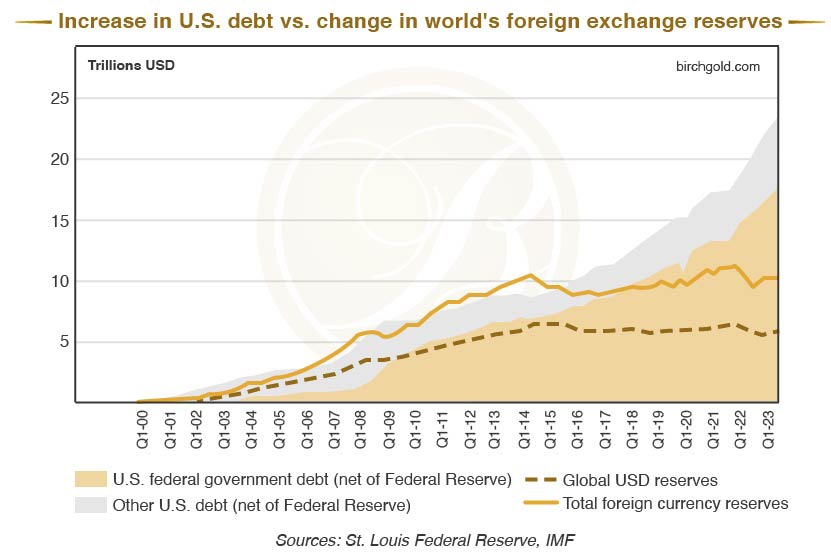

If supply is “to the moon” (actually, to the moon and back nearly 5 times) and demand is waning? Well, that’s a recipe for trouble. When the U.S. government is counting on the whole world to finance its addiction to spending, but the whole world can’t or won’t keep loaning money, we’re in trouble. Here’s why the rest of the world can’t keep up with the federal government’s greed for much longer… Tidal wave of supply meets waning demand Back when a massive surge in deficit spending devalued the dollar, the world’s central banks started to buy gold instead of more U.S. debt:  World central banks are increasingly using their dollars to buy gold Clearly, the world’s central banks are “voting with their dollars” by not buying dollars, but buying record quantities of gold instead. We can’t fault them for that! After all, the dollar has lost 16% of its purchasing power since January 2020. That’s not exactly what I’d call a store of value… Furthermore, the next chart makes clear that the federal government needs more money than the world can provide to maintain its spending levels:  The U.S. government’s demand for financing is rapidly outgrowing the rest of the world’s savings… With this in mind, you might think that the people who caused this mess would be terrified. Or at the very least, mildly concerned. But for some strange reason, they don’t appear to think it’s a problem… Government reaction to its own debt-fueled calamity: “Yawn”So far, the Biden administration has doubled down on its incoherent strategy to spend the nation into prosperity. The debt pile grew by $2.8 trillion in 2021, $1.4 trillion in 2022 and $1.7 trillion in 2023 ($5.9 trillion total in just three years!), I don’t even need to ask you how that’s working out. “Bidenomics” has become a dirty word even among the left. Janet Yellen was recently asked in an interview how rising interest payments stemming from this insane amount of debt would affect the government. Her response left a lot to be desired:

That’s not particularly reassuring. Keep in mind, though, most bureaucrats see dollars as line items on a spreadsheet. They have no idea how hard most of us work to get those dollars, or how enraging it is to watch their purchasing power dwindle month to month. Government debt isn’t something that’s going to just magically go away. Whether or not Yellen and Biden realize this, the rest of the world does. After Moody’s put the government’s credit rating on negative outlook, a lot of professional investors yawned. Like Michael Reynolds, vice president of investment strategy at Glenmede Investment Management:

To sum up his response, “So what?” Nonsense. The bottom line is: Anyone in the government or anyone who invests for the long term who honestly believes that a credit downgrade is a “non-event” is blowing smoke. Credit rating agencies exist in the first place because we simply can’t believe the claims of cash-hungry borrowers. If you’re desperate enough for money, you’ll say anything to get the loan you need. Borrowers are eager to make promises – before they get the loan. We can’t take their claims at face value. Credit rating agencies evaluate borrowers not on their promises, but on their ability to repay. In fact, the only reason the U.S. government still has a credit rating over “junk” levels is because they can print new money to pay old debts. Lenders can always expect to be repaid, more or less. The only problem with that is there’s a cost to money-printing. And guess who pays for it? Our dollars are paying the bill (not just once, but twice) Over and over again, the federal government keep racking up debt and passing the impacts to you without a second thought. What’s ahead doesn’t look promising:

Some believe the “endgame” of the government’s free-money spending-spree is in sight:

Here’s why I keep talking about the federal government’s debts: Deficit spending devalues the dollar. We taxpayers aren’t just “footing the bill” for this irresponsible behavior. We’re paying twice: Higher inflation from increased dollars in circulation up front, and the dollar devaluation resulting from borrowing or printing new money to pay old debts that inevitably results. Is it any wonder that central banks around the world are swapping their dollars for a real store of value, physical gold? They’re diversifying their national savings with a safe haven asset that protects against inflation. Shouldn’t you be doing the same with your long-term savings? Physical precious metals like gold and silver historically acted as reliable safe havens, for example, during the 1970s stagflationary period caused mainly by government mismanagement. Don’t wait until it’s too late. If global dollar demand continues to decline, hand in hand with a massive supply surge, your purchasing power will plummet. In other words, if your financial future is depending on the dollar’s future, you may have no future… Don’t delay – get the information you need to learn more about physical precious metals in our free kit. .

|

Send this article to a friend:

|

|

|