Gold Breaks Another Record – But the Real Story Isn’t the Price

Peter Reagan

Gold’s record-setting rise over $4,000 isn’t about tariffs or shutdowns – it’s about trust. With U.S. debt near $38 trillion and persistent inflation still eroding our savings, the world is starting to realize how valuable a safe haven really is… Gold’s record-setting rise over $4,000 isn’t about tariffs or shutdowns – it’s about trust. With U.S. debt near $38 trillion and persistent inflation still eroding our savings, the world is starting to realize how valuable a safe haven really is…

Gold's best week ever?

Ty Roush for Forbes reported last Tuesday that the gold price climbed past $4,000 for the first time ever. That was six days ago, so you're probably wondering what happened in the meantime.

We'll get there soon. But for now, I'll mention that it hasn't fallen notably since.

So what happened on Tuesday? Believe it or not, it was yet another episode of "whodunnit."

Roush gives us an outline of what that means, saying gold hit $3,000 due to “Trump tariffs” and $3,900 on the government shutdown. I call this a gross simplification. But people, even sophisticated people, often prefer simple stories to reality.

If you’re one of those, skip down to the next story – the rest of you, read on…

First, all due respect to Roush, but we’ve seen government shutdowns before. How many of them sent gold up 6% in less than two weeks? Zero.

You see, when we get a government shutdown, it's usually over budget, specifically because the debt ceiling has been reached.

This sounds scary, but it isn't, since the government simply just raises the debt ceiling again and everyone is happy. Crisis is averted, no default.

Just one tiny problem: raising the debt ceiling is exactly why gold has gone up, as we are in what I have often referred to as a hidden crisis.

I have watched our national debt nearly double in a decade, going from a "maybe payable" $20 trillion to today’s "this is a disaster" $37.88 trillion as of this morning, via the Treasury Department’s incredibly informative “Debt to the Penny” website.1

Do these numbers mean anything? Yes, they do. Every dollar of debt is a dollar – and as debt rises, so does the supply of dollars. Since the dollar has no intrinsic value other than scarcity, more dollars means weaker dollars. In other words, as debt grows, the dollar declines.

Can the debt go to $80 trillion in a decade? Sure, it certainly could – if the Treasury Department can find lenders (or the Fed steps in to “monetize” the debt). Forget about that, though – even at $37.88 trillion, who believes that debt mountain is ever going to be made good?

I took a look at the top 100 wealthiest people in the world – guess how much they’re worth, all in? A measly $6.5 trillion.2 That’s just barely enough to cover one year of the federal government’s budget!

The combined economic might of the U.S. creates about $30 trillion per year. So if the federal government simply confiscated all profits and revenues for about 15 months, if we survived the process, that would settle the bill.

We all know that’s not going to happen – so what will happen instead is new dollars will be printed to pay old debts. Yes, that devalues the dollar. It’s a devil’s bargain, to be sure, and it’s not inevitable – it’s simply the most likely outcome.

Inflation is how our government deals with debt, as it makes the humungous interest payments easier and cushions both further indebtedness and the dip into the negative of the federal budget. The side-effect of that is that the citizen suffers very much – but I guess it’s for a good cause…

Perhaps the most sensible call from analysts last week regarding gold’s price we discussed in detail last week. It’s not so much about the price of gold, and much more a global repricing of risk itself.

Investors have finally caught up to what I’ve been saying since 2020 – debt has consequences. Inflation risk is much higher than anyone truly believes. Biden’s weaponization of the dollar against Russia broke the world’s trust in the dollar – and our ongoing debt ceiling circuses are just icing on the cake.

Gold is one of the few beneficiaries of the ominous groans coming from a financial system that’s mostly built on promises. Lots of investors are slowly waking up to the realization that promises can be broken. Even (especially?) government promises.

Gold’s price surge shows no signs of slowing, and major banks are rapidly revising their forecasts.

Goldman Sachs is an example, as their team recently rose their Q2 2026 forecast to $4,900, up from $4,300 (via Reuters).

French megabank Société Générale thinks we’ll hit “$5000/oz by the end of 2026.”3

Bank of America agrees, predicting $5,000 by the end of next year.4

That would mean we are in for 14 more months of gains, which will leave us just short from 3x gold's price in mid-2023.

But what I want to get across here is that $1,650 gold wasn't that low to begin with. It was less than $300 off its 2011 high of $1,910, and I will remind you that many pundits over the 2010s wondered if gold can ever get back there.

David Neuhauser, CIO of Livermore Partners, is the third high-profile source I've come across in a month forecasting $6,000 gold in the near future, which he did recently on CNBC.

Doesn’t seem like quite so much a jump from $5,000, does it?

Goldman Sachs, Saxo Bank predict imminent silver correction

Business Insider reported on what looks like a joint effort by Goldman Sachs and Saxo Bank to soften us up for shenanigans in the silver market.5

Not a coordinated attempt to talk down silver’s price, not exactly. More like setting the stage for some extreme price dislocations.

First, Goldman Sachs explains that silver's surge past $50 probably only happened because of a surprise squeeze in the LBMA market, one that will be abated by big physical inflows from the U.S. or China in a week or two. Nothing to see here, move along folks. After which, silver can finally go back to its actual price of $34, where Goldman says it belongs. Can't wait.

Ole Hanson, Head of Commodity Strategy at Saxo Bank, said the same thing, and there has even been a sort of crisis in India with silver traders as if to beat this idea in.

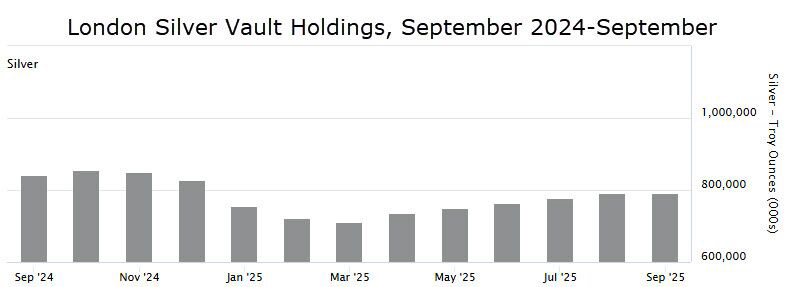

So of course I checked the latest London vault data…

Via LBMA London Vault Data

790 million troy ounces of silver – that’s a lot, 80 million more than recent lows back in March. Yet back in March we didn’t hear about a surprise squeeze, did we?

Yet this very morning, Bloomberg lead with a headline Silver Roars Higher as Short Squeeze Rocks the London Market. There’s something about arbitrageurs renting cargo planes to ship silver bullion from New York to London or back – and even an aside mentioning the reclassifying of silver as a critical mineral.

Everyone here is neglecting to mention one point that I've been raising for years: silver should have been $50, if not $100 ages ago based on gold price, commodity prices and currency strength.

I still think I’m right – and maybe Bank of America agrees with me? Again from Bloomberg:

On Monday analysts at Bank of America Corp. hiked their end-of-2026 price target for silver from around $44 an ounce to $65, citing persistent market deficits, elevated fiscal gaps and lower interest rates.

That’s what I’ve been saying!

I’ll give them credit for coming clean sooner rather than trying to jawbone silver’s price down like Goldman and Saxo.

Remember the last time silver was near $50? 2011. Gold was $1,910 then.

Gold is $4,155 now…

You do the math. And read up on the supply and demand mismatch at The Silver Institute. Afterward, I’m pretty sure you won’t believe Goldman’s story either.

Gold’s real value might be well over spot ($5,200 or more – if you can get it at all)

I take a lot of things for granted every day. That’s one of the privileges of living in a modern, developed nation. I assume the local grocery store will have food on the shelves. The corner gas station will have fuel so I can fill up my tank – and swipe my credit card to pay at the pump.

I assume that, if I want to buy a 1 oz American gold eagle, I can get one. Oh, I might have to wait a few days for shipping and I’ll pay a few points over spot. But I can get one any time I want. Even though I know for a fact that it isn’t always true! Twice over the last five years we’ve seen complete sellouts on gold and silver (during the pandemic panic, and again after the SVB collapse). Those are the exceptions, not the rule.

Not everyone has that privilege.

Via Euro News, today I learned that Iranian citizens must pay at least 30% over spot for gold coins. If they can get them at all…

For background, Iranian citizens want to buy gold coins for the same reason you and I do – as an inflation-resistant safe haven asset. Inflation in Iran is pretty severe – about 32% last year (after six consecutive years averaging 42%!), according to the World Bank. You don’t need a calculator to know that level of inflation destroys purchasing power at a breathtaking pace.

And the Central Bank of Iran isn’t exactly an independent institution… So instead of prioritizing a stable currency, instead they enable the government to run massive deficits:

“Abdolnaser Hemmati, Iran's Minister of Economy, also said last week that the government's budget deficit in the current solar year has reached 8.5 quadrillion rials…”

I don’t know about you, but that word “quadrillion” in a financial context gives me a chill.

A savvy citizen might attempt to hoard foreign currency, perhaps? In Iran, that’ll get you arrested for “smuggling.” Foreign currency is virtually impossible to come by anyway, considering Iran’s 50-year history of being sanctioned by virtually everyone.

And, in a rare show of hypocrisy, the same central bank behind the dizzying devaluation of the rial has offered a cure for the very problem they created: They’re selling gold coins.

Specifically, these seem to be Bahar Azadi (“Spring of Freedom”) coins, minted by Iran's central bank. Each is 22k pure and has 0.2354 troy oz of gold – oddly, identical to the British sovereign.

Here’s the truly upsetting part, though: The Central Bank of Iran auctions these coins. The Euro News report tells us that Iranians are paying as much as 30% over each coin’s intrinsic value. Yet they’re willing to do it.

Surprising? Perhaps when you consider that he Iranian rial lost 30% of its value against the U.S. dollar over the last 12 months, it makes more sense. But it’s also truly surprising, considering the dollar tumbled some 10% year-to-date on its own.

There are additional economic factors on top of that weighing on the average Iranian – a recession in both the economy and the housing market, insecurity caused by the looming threat of war with Israel…

You can start to see how a “perfect storm” of dreadful economic forces would make a gold coin at any price worth buying! So the central bank lets bidders fight it out, and sits back collecting half a million dollars worth of profits every day.

While I have covered the Iran situation to a reasonable extent, I have made it clear that this isn't just a local story. Things like this are happening all over the world – few are as cynical as the Iran story, though.

I do wonder, though, whether you’ve realized just how fortunate you are. We’re blessed to live in a nation where the government doesn’t seek to profit off our economic misery. When I see stories about gold demand like this, it makes me wonder, though. If you’ve been sitting on the sidelines hoping for gold to correct down to $3,300 or so, well, good luck to you. I won’t be holding my breath.

Peter Reagan is a financial market strategist at Birch Gold Group. As the Precious Metal IRA Specialists, Birch Gold helps Americans protect their retirement savings with physical gold and silver.

www.birchgold.com

|