The Silver Denarius and the Fall of Rome

Brandon Smith

As we conclude our Silver September Series, we delve into a chapter of history that holds a mirror to our present times – the fall of the Roman Empire and the role of silver in it. As we conclude our Silver September Series, we delve into a chapter of history that holds a mirror to our present times – the fall of the Roman Empire and the role of silver in it.

The tale of the Roman Denarius offers not just a glimpse into the past but also a warning for the future.

But before we get into that, here are some silver tidbits you might find interesting...

Sterling Silver Is Stronger Than Pure Silver — Pure silver, with its .999 fineness (99.9% silver), is a bit too soft for crafting jewelry. That’s where sterling silver comes in! By adding harder metals like copper, we get a more durable alloy that’s 92.5% silver and 7.5% copper.

Silver’s Ancient Origins — The first silver mines sprung up around 3,200 BCE in what is now Turkey. This precious metal played a crucial role in the prosperity of early civilizations in the Near East and Ancient Greece.

Some India Dishes Comes With A Silver Lining — Ever seen a dish shimmering with a thin layer of silver? That’s 'varak' – a delicate foil of pure silver, sometimes gold, used to adorn various South Asian sweets and dishes.

Silver: A Literal Measure of Wealth — Back in the Middle Ages, a pound of currency wasn’t just a unit – it was quite literally a pound of silver in weight.

Silver Coins Have Been Handmade For Thousands of Years — In Greece, designs were carved into a metal block. Then, a blank disk of metal was placed between them and struck with a hammer, imprinting the designs on the coin.

Silver And The Fall Of Rome

While highly valuable as a component in many electronics today, silver's biggest legacy may be its long history as money throughout human history... and no example stands out more than the Roman Denarius.

The Roman Denarius, a silver coin, was introduced in 211 BC and served as the backbone of the Roman economy for several centuries. Silver was the metal of choice when it came to Roman money. T he silver Denarius was widely used across the vast Roman Empire for trade, wages, and everyday transactions. For several centuries, the Roman Republic thrived, enjoying a long period of practically no inflation because they used sound money – pure gold and silver.

However, this stability was not to last...

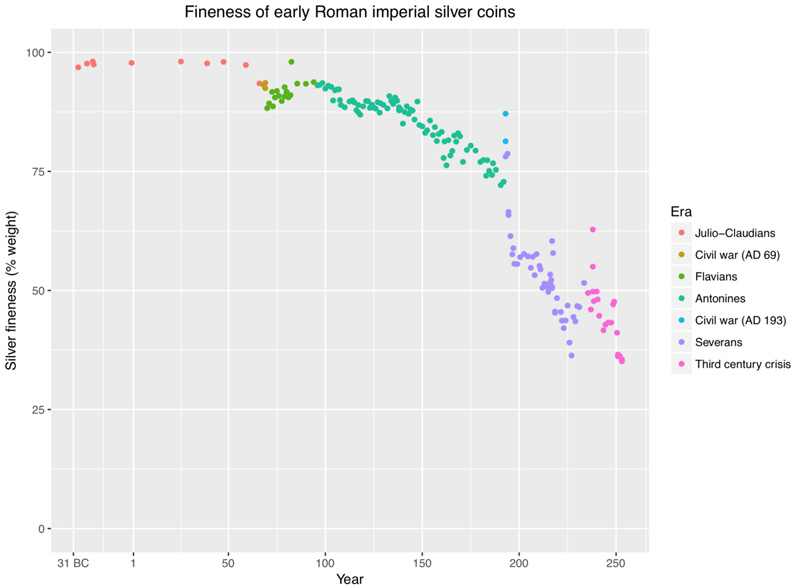

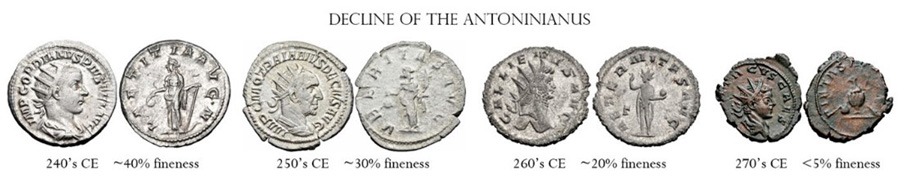

Assuming the mantle of Roman Emperor in 284, Diocletian made the decision to split the Roman Empire into four territories. As the empire expanded, facing escalating debts and military expenses, Diocletian started the debasement of the Denarius. They diluted its silver content with less valuable metals, aiming to extend the empire's silver reserves. Initially subtle, this debasement seemed effective, but it escalated as the financial strain on the empire worsened. The Denarius, once 90-95% pure during Caesar Augustus's time, plummeting to as low as 30% by the 3rd century AD.

Data from Walker, D.R. (1976-78), The Metrology of the Roman Silver Coinage. Parts I to III.

This drastic debasement led to rampant inflation, eroding the Denarius’s purchasing power and causing prices everywhere to soar. The Roman populace lost faith in the currency, and the once-thriving Roman economy began to falter.

The debasement of the Denarius was not the sole cause of the fall of the Roman Empire, but it played a significant role in its decline. The erosion of the Denarius’ value, the once high purity coin became essentially a token, undermined the economic stability of the empire, leading to social unrest, a decline in trade, and a weakened military. The story of the Denarius serves as a stark reminder of the consequences of fiscal mismanagement and the importance of maintaining the integrity of a currency.

Where We Stand Today

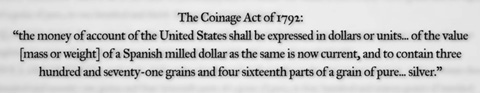

History has a way of repeating itself, and we see echoes of the past in today's currency debasement. The U.S. Dollar, once backed by gold and silver, enjoyed price stability and minimal inflation until a pivotal shift in 1971.

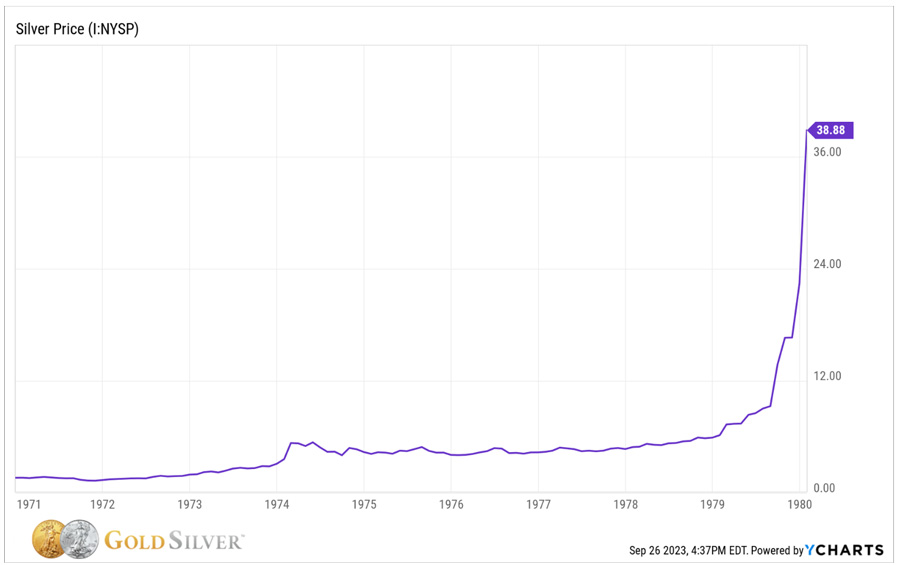

For nearly 200 years, the country saw almost zero inflation. Then on August 15, 1971, President Nixon changed everything when he ended the Bretton Wood system. The Bretton Woods system tied all the world’s currencies to gold through the US dollar. When Nixon ended the Bretton Woods system, the US dollar transitioned from sound money to a fiat currency, leading to unprecedented fluctuations in gold and silver prices as metals began freely trading on the market.

By the end of the decade, silver rose as high as 4,000%, eventually peaking at $52.50/oz in 1980.

Anyone holding silver during the 1970s would have made a fortune. A modest $1,000 investment could have returned as much as $40,000 (had you timed it perfectly). With silver prices ranging in the single digits for most of the 1970s, you hardly had to buy right at the bottom. You just had to accumulate and wait.

This historical parallel serves as a reminder of the protective value of owning silver (and gold) amidst currency debasement and economic uncertainty.

For serious investors, this lesson highlights the value of diversifying one's portfolio with precious metals like silver and gold, which have stood the test of time as reliable stores of value.

That’ll wrap up Silver September series. Until next time!

Best,

Brandon S.

GoldSilver

Brandon is the founder and chief strategist behind the Alternative Market Project. His goal is to create a barter networking hub and educational gathering place for every American across the country who wishes to decouple from our current collapsing financial system and build something better. Getting people out of their homes and meeting face to face to organize meaningful relationships, and eventually, entire free market communities designed to shield cities and states from economic and political danger; this is the mission of the Alternative Market Project.

www.alt-market.us

|