Nvidia’s Dog-Day Disaster

Greg Guenthner

Summer trading is sometimes a slow, tedious affair — especially toward the end of August. Summer trading is sometimes a slow, tedious affair — especially toward the end of August.

Luckily, NVIDIA Corp. (NVDA) earnings gave investors something to talk about late last week.

The semiconductor superstar was one of the only interesting mega-cap earnings announcements left on the Q2 docket. And since most of the chip stocks lost their first-half momentum weeks ago, the buy-and-hold crowd was hoping strong results would help encourage a decent bounce heading into fall trading.

Valuation concerns also thrust this particular earnings announcement into the spotlight. It’s clear that NVDA shares are expensive by just about every imaginable metric. Shares have soared more than 220% year-to-date – and it was becoming clear NVDA management would need to report a huge beat and strong guidance to keep the party going.

Somehow, that’s exactly what happened.

Not only did NVDA smash top- and bottom-line expectations, it also raised guidance for the third quarter due to strong chip demand.

Analysts tripped over each other to raise price targets, while speculators swooped in to bid the stock higher after-hours. The circus continued through early Thursday morning as NVDA shares broke above $500, posting an 8% gain from the previous day’s close. The financial media was already running victory laps, proclaiming NVDA shares would open at all-time highs and ignite a fresh rally that would spread throughout the tech sector.

This is where the situation takes a turn. Almost immediately after Thursday’s opening bell, NVDA began to wobble. Shares quickly retreated back below $500. Then, they dropped some more. By midday, there wasn’t much left of the huge after-hours gain. Unfortunately, the also-rans in the semiconductor space fared much worse. Semiconductors not named NVDA began to break down, dragging the rest of the tech space lower.

A Tired Trend

This is the type of action you see when a rally is getting a little long in the tooth. Typically, these exhaustion moves are preceded by good news. In this case, strong earnings were first regarded as a bullish catalyst. The only trouble was there were no sidelined buyers left to take the plunge.

NVDA’s year-to-date dominance was no secret. It leads its mega-cap peers (and the entire tech space) by a wide margin. Jim Cramer’s pumping the stock on TV and social media on a daily basis. When the dust cleared Thursday afternoon, we were left with some ugly exhaustion moves – big reversal candles that opened above the previous session’s highs that gave up most or all of their gains before the end of the day.

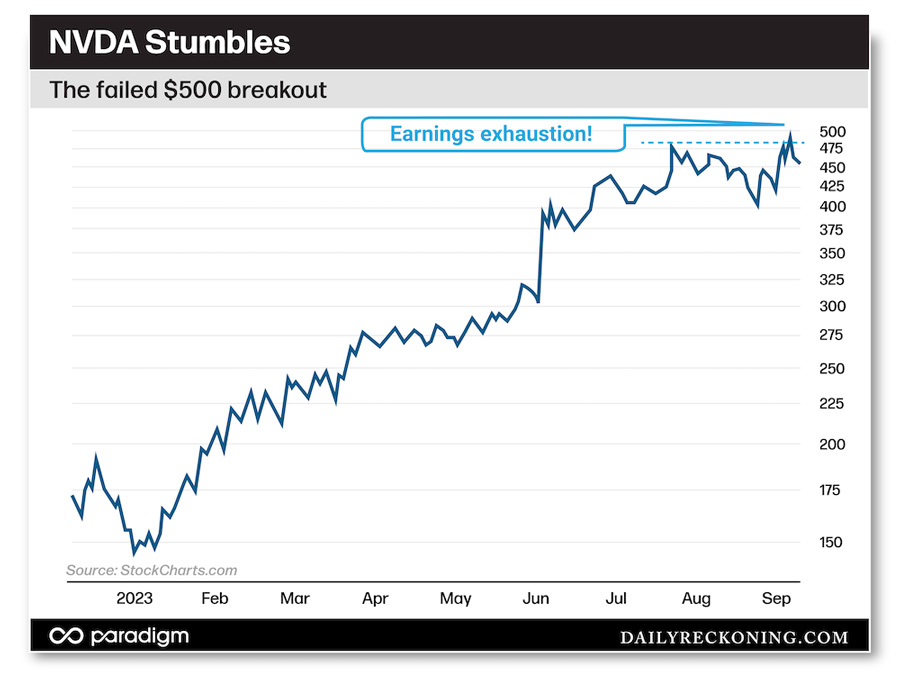

You can clearly see the attempted move above the July consolidation highs toward $500 and subsequent flameout. NVDA continues to retreat from these highs, closing lower on Friday and trapping any late bulls who piled in following the strong earnings announcement.

While I don’t believe this is a death blow to NVDA, it will probably take some time before it gets back on its feet again. In fact, it could easily drop back to $375 and retest the gap from May.

More importantly, the NVDA debacle is telling us that the tech bulls are a little too eager to get the party started again.

Don’t Anticipate — React!

Outsized rallies usually need adequate time to digest the gains before posting a new leg higher.

As evidenced by today’s chart, NVDA marched higher with virtually no interruption until the stock dipped in early August.

The timing of this consolidation makes perfect sense. Remember, we’re still experiencing the dog days of summer trading. Choppy, sideways action could stick around for weeks — or even into the fourth quarter. Only a total lunatic (or Wall Street analyst) would believe NVDA could post another uninterrupted 200% gain into 2024, especially without a hard reset or lengthy consolidation.

Putting the move into context with the market, NVDA could also be acting as a tech bellwether. The entire sector could require more consolidation or downside action heading into the fall. This would also line up with seasonal trends and rotation plays we’ve been tracking this summer (energy and industrials, for example).

Speculators will likely try to force long-side tech trades and front run any potential bounce over the next several weeks. I don’t think that’s a viable strategy. Attempting to anticipate bounces in these tech names is a great way to get stopped out and chopped up in a sideways market.

From a swing-trading perspective, you’re probably better off shorting these tech rallies. Save your longs for other sectors that could begin to stand out heading into September.

Greg Guenthner, CMT, is chief strategist at Forge Research Group. He has spent the better part of the past two decades developing long-term and short-term strategies with a single goal in mind: to help everyday investors generate outstanding returns and control their financial futures. Greg’s charts, analysis, and insights have appeared in Marketwatch, Forbes, Yahoo Finance, and many other financial publications.

dailyreckoning.com

|