Fitch Warns Big Banks Face Downgrades

Tyler Durden

At the start of August, Fitch Ratings downgraded the US government's top credit rating. Last week, Moody's cut the credit ratings of small and midsized US banks because of higher funding costs, potential regulatory capital weaknesses, and rising risks tied to commercial real estate loans. Now, another week, another possible downgrade, this time of major banks. At the start of August, Fitch Ratings downgraded the US government's top credit rating. Last week, Moody's cut the credit ratings of small and midsized US banks because of higher funding costs, potential regulatory capital weaknesses, and rising risks tied to commercial real estate loans. Now, another week, another possible downgrade, this time of major banks.

Fitch analyst Chris Wolfe told CNBC another round of turmoil could be nearing for the banking industry. He said the ratings agency is mulling over sweeping rating downgrades for dozens of banks, including ones as big as JPMorgan Chase.

"Another one-notch downgrade of the industry's score, to A+ from AA-, would force Fitch to reevaluate ratings on each of the more than 70 US banks it covers," Wolfe told CNBC at the firm's New York headquarters.

He continued, "If we were to move it to A+, then that would recalibrate all our financial measures and would probably translate into negative rating actions."

Wolfe said lowering of the operating environment score for US banks to 'aa-'from 'aa,' reflecting downward pressure on the US sovereign rating, gaps in the regulatory framework and structural uncertainty around the normalization of monetary policy, went "largely unnoticed because it didn't trigger downgrades on banks."

This comes one week after a triple whammy of factors of regional banks: Higher funding costs, potential regulatory capital weaknesses, and rising risks tied to CRE loans prompted Moody's to lower credit ratings for ten small and midsize US banks; and noted in a slew of notes that it may downgrade major banks.

"Collectively, these three developments have lowered the credit profile of a number of US banks, though not all banks equally," the ratings agency wrote in some of the assessments.

Perhaps Fitch is sending out trial balloons for Wall Street to inform them that the potential for another round of bank downgrades is a real risk for the market.

More from CNBC on the conversation with Wolfe:

The problem created by another downgrade to A+ is that the industry's score would then be lower than some of its top-rated lenders. The country's two largest banks by assets, JPMorgan and Bank of America , would likely be cut to A+ from AA- in this scenario, since banks can't be rated higher than the environment in which they operate.

And if top institutions like JPMorgan are cut, then Fitch would be forced to at least consider downgrades on all their peers' ratings, according to Wolfe. That could potentially push some weaker lenders closer to non-investment grade status.

The timing of the next round of bank downgrades wasn't disclosed but serves as a warning for more banking turmoil as the Federal Reserve has hiked interest rates to 22-year highs.

"What we don't know is, where does the Fed stop? Because that is going to be a very important input into what it means for the banking system," he said.

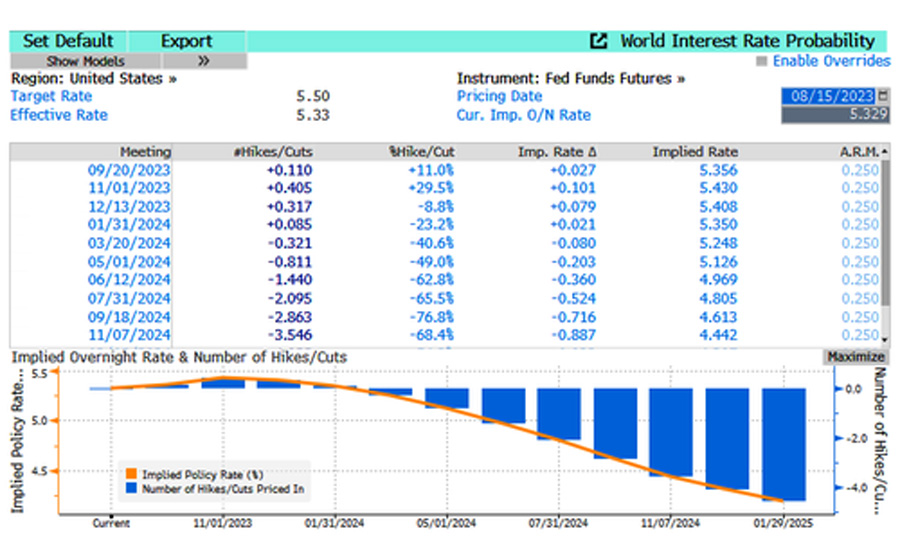

Rates on swap contracts referencing future Fed policy meetings suggest the rate hikes might be peaking with the potential for cuts to begin in the second half of 2024.

The interview continued:

A related issue is if the industry's loan defaults rise beyond what Fitch considers a historically normal level of losses, said Wolfe. Defaults tend to rise in a rate-hiking environment, and Fitch has expressed concern on the impact of office loan defaults on smaller banks.

"That shouldn't be shocking or alarming," he said. "But if we're exceeding [normalized losses], that's what maybe tips us over."

Meanwhile, days ago, we quoted a note from Vishwanath Tirupattur, a strategist at Morgan Stanley, who said, "We are skeptical that the turmoil in the regional banking sector which came to the fore in March is behind us."

... and this all comes after Fitch downgraded the US credit rating from AAA to AA+ earlier this month. Of course, the Biden administration blamed Trump.

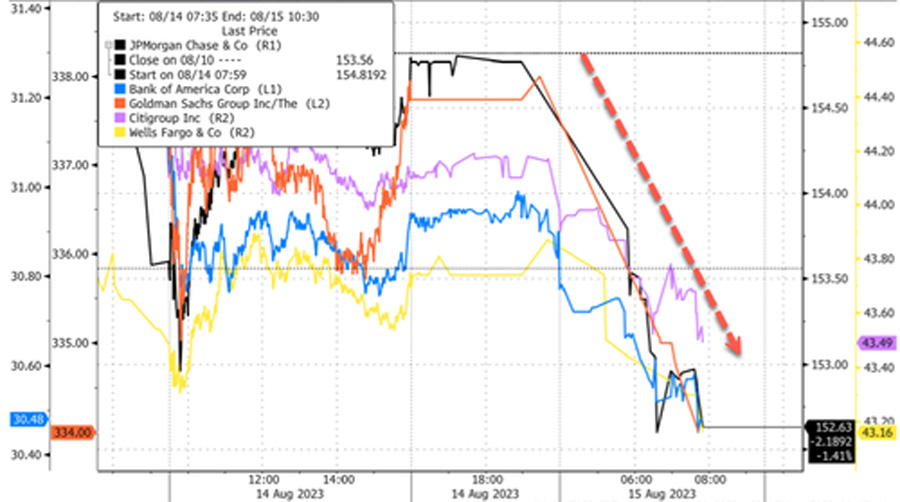

Shares of big banks are already sliding premarket on the CNBC report.

Clearly banking turmoil is not over.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

| ![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)