How the US Economy Will Crack, and More on the BRICS Big Bust

David Haggith

Xi did not even show up to his own keynote speech, and everyone downplayed Brazil's notion of a BRICS currency ... even Brazil! Xi did not even show up to his own keynote speech, and everyone downplayed Brazil's notion of a BRICS currency ... even Brazil!

First let’s talk about the US economy because financial writers are still misunderstanding where the true fault lines are, even as the pressures keep building for “the big one” — the big financial shakedown. Then we’ll talk about how even Brazil just took the idea it floated of a new BRICS currency completely off the table. You can forget about it. The BRICS just told the world it’s not happening.

Labor will break the economy before the Fed breaks labor

Perhaps more accurately, it might be said that everyone’s obsession with labor as a sign of economic strength will break the economy because it leaves them not paying attention to the critical fault line. In summary: By the time labor starts to crack up in unemployment fractures, the US economy will have already busted wide open at its financial core. It’ll be a case of …

Get the joke at Counterpoint.

In this morning’s headlines, UPS just paved the way for the trend in rising labor costs to ramp upward. UPS workers approved a “massive new labor deal with big raises.” Labor is chewing a chunk out executive management’s butt because UPS will struggle to raise prices to offset labor if USPS and Fedex and Amazon’s own delivery service and the myriad smaller companies do not face similar contract changes in the future. UPS will be constrained in what it can do with prices by stiff competition.

However, it is likely labor costs in other delivery services will be rising over time, and the move to online purchases over brick-and-mortar stores continues to mean high demand for delivery services. In fact, in other news today, the brick-and-mortar bust made another milestone as Macy’s announced it will take its experiment in stripping down the size of its stores to move from major malls to strip malls further as the smaller stores have proven to be much more profitable than the old-world big major anchor stores.

Labor is strengthened by a lack of competition right now, but labor’s unwillingness to slide into greater unemployment is still being seen by the establishment financial news as a sign of “economic resilience,” albeit one that imperils Fed Chair Powell’s fight against inflation. Labor is seen that way even though economic data is sinking.

A year ago, Chair Jerome Powell delivered a stark warning: To fight persistently high inflation, the Federal Reserve would continue to sharply raise interest rates, bringing “some pain” in the form of job losses and weaker economic growth.

Powell’s belief that he must bring down jobs to chill the US economy in order to rain down on the fires of inflation pervades. The fact that jobs are not coming down are seen by Powell — and the media that parrots the Fed — as meaning the economy is not slowing to the point where it will completely wipe out inflation. So, interest rates stay high longer and likely even go higher until jobs are crushed down … or, at least, tamped down; but that is a difficult thing to do when the jobs are hard to fill mostly because workers are more scarce.

The scarcity of labor is helping labor get a bigger piece of the corporate profit pie and that will add to inflation wherever there is not enough competition in supply of goods or services to keep a lid on a company’s ability to increase prices, especially where cost increases do not yet affect competitors, such as the UPS contract.

The attempt to see unemployment rise, however, squeezes down on everything, even though unemployment so far is stubbornly (in terms of Powell’s perceived objective) staying near a half-century low and even though labor costs may now be rising faster … if the huge sweep of the UPS contract is any indication:

Since Powell spoke at last summer’s annual conference of central bankers in Jackson Hole, Wyoming, the Fed has followed through, raising its benchmark rate to 5.4%, its highest level in 22 years. Substantially higher loan rates have followed, making it harder for Americans to afford a home or a car or for businesses to finance expansions….

As Powell and other central bankers return to Jackson Hole this week, the economy’s resilience has thrust a new set of questions at the Fed: Is its key rate high enough to slow growth and cool inflation? And will it need to keep its rate elevated for longer than expected to slow growth and tame inflation?…

Even if the Fed imposes no further hikes, it may feel compelled to keep its benchmark rate elevated well into future to try to contain inflation. This would introduce a new threat: Keeping interest rates at high levels indefinitely would risk weakening the economy so much as to trigger a downturn.

Oh, it will be much worse than a “downturn.” Those high rates are causing all kinds of financial and economic destruction that is not being seen in the form of rising unemployment, one of the key gauges Powell is watching, or suppressed retail spending (yet). We see that reality playing out in the housing market in today’s headlines where mortgage interest rates have soared to 7.3% now, which has sent mortgage demand down to a 28-year low … as in worse than it was during the housing crisis of the Great Recession.

Sales of previously owned homes (houses, condos, and co-ops) fell further, by 2.2% in July from June, to a deep-dismal seasonally adjusted annual rate of sales of 4.07 million, the lowest since January, which had matched the March 2020 lockdown low, which had been the lowest since the Housing Bust in 2010, even as the median price fell, as days on the market rose, and as supply rose to match the highs in 2022, and beyond that to the most supply since June 2020, according to the National Association of Realtors today….

What we’re seeing is that demand has vanished, and supply has vanished in equal measure because the homeowners who have a 3% mortgage are not buying a new home, and so they have vanished as buyers; and are therefore not putting their current home on the market, and so have they vanished as sellers. I estimated that the entire housing market – buyers and sellers – shrank by 20% because these homeowners vanished as buyers and sellers at the same time.

That is economic destruction since housing drives the US economy; but, even more critical, we see the reality of financial destruction building up at banks, which, as noted yesterday, are being downgraded by credit agencies as the rising interest adds to their costs because they need to raise interest paid to their depositors but, even more, because rising bond yields degrade the value of all the existing bonds banks hold in reserves, taking us back toward the troubles seen in March if people start demanding their deposits back.

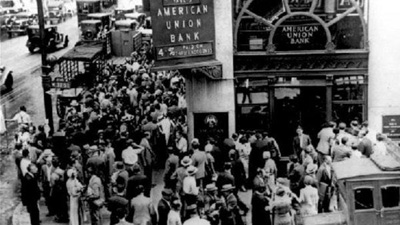

Keep in mind, the Great Depression was not caused by a housing bust, which was the epicenter of the Great Recession; it was caused by a banking bust. While today’s banks will be getting pressure from housing, they will be busting over internal financial stresses:

It could also endanger many banks by reducing the value of bonds they own, a dynamic that helped cause the collapse of Silicon Valley Bank and two other large lenders last spring.

So, economic and financial destruction are working as planned, but job destruction is holding out, as I said would be the case. That, I also warned, would cause Powell to tighten harder into a recession as he keeps trying to drive jobs down, not realizing the resilience in apparent labor strength is not economic strength but actual labor weakness — short supply. It is important to understand these nuances that are about as subtle and nuanced as a barn or a freight train. It is hard to understand how the difference between what labor tightness usually means and what it means today can still be missed, but it continues to be.

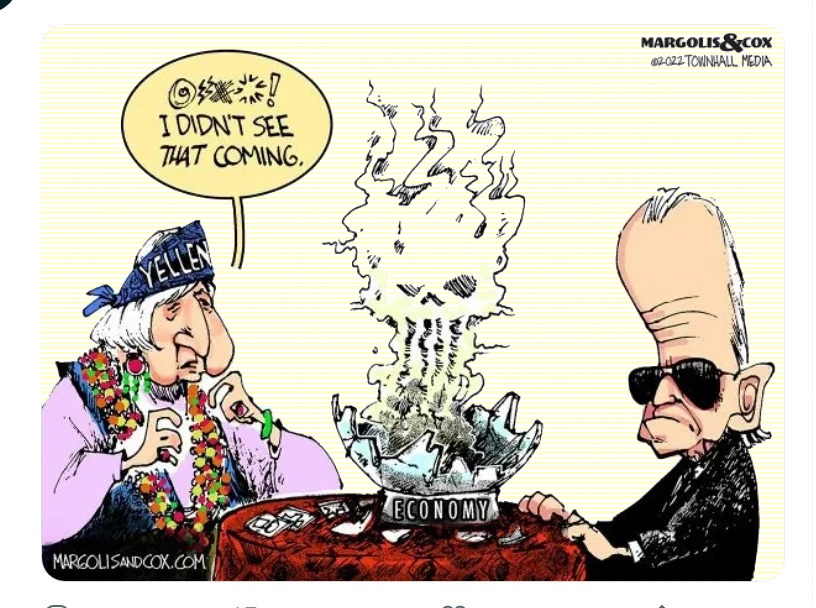

Lack of competition always strengthens the hands of those who remain in the game, and that is true for labor, too. The funny thing here is that Yellen used to yowl about how she wanted to see the gains in the economy shared more equitably by labor, but I think we all knew that was party chat and not policy because the Fed would work hard to stop that from happening the second wage gains got serious enough mean anything of value to labor. So long as the Fed could keep the gains to a tidy handful of peanuts to appease the children and elephants at the zoo, wage gains were their goal. Let the gains get significant enough to threaten the steaks eaten by the corporate heads, and the story would become much different.

Let me state again at this point that it won’t be the various forms of economic decline we see in manufacturing or even the loss of trade with China due to its own death of demand that bring the US economy down. It will be the suffocation of the financial sector under rising interest rates. Bank failures due to commercial real-estate defaults and residential mortgage defaults and corporate defaults will bring the economy back to its knees; but the real critical destruction is happening at the very core of banking (as I’ll come to).

Other factors, such as consumers reaching their maximum, as struck the morning news from Macy’s with its information about customer credit cards, will, of course, also weigh down on the economy as will inflation, itself:

On Tuesday, Macy's … said its second quarter credit card sales tanked 36% from the prior year to $150 million. The culprit: Bloated balances on Macy's Citibank-powered credit card have been met with a rising interest rate environment.

In turn, cash-strapped consumers — enduring an almost 32% annual percentage interest rate on the Macy's card — haven't been able to pay off their bills. Macy's has opted to write off those balances.

"While we have seen an increase in revenues as interest rates have risen, that has been more than offset by higher bad debt assumptions and write-offs," Macy's CFO Adrian Mitchell said on a call with Wall Street. "These bad debt assumptions and write-offs are the result of rising delinquencies, which leads to higher net credit losses over time and contributes to increased bad debt within the portfolio."

Macy’s troubles, however, come not just from the fact that deliquencies are offsetting sales strength (as the sales become meaningless if never paid for), but that they are now also starting to drive down sales because delinquent customers can no longer use their cards and many of those who know they cannot pay their bill would not want to use their credit card for more purchases even if they could:

Year to date, Macy's credit card sales are down about 24% from a year ago.

The big crack in the US economy will be the financial wreckage that comes from the bond market as the US Treasury keeps flooding the market with new government debt, the Fed keeps refusing to roll over old US debt, and the Fed raises interest rates some more, even if only once or twice because the lag time for past interest hikes is still catching up, and the bond market prices up interest faster than the Fed can keep up.

The jump in Treasury yields has likely been driven, in part, by the government’s ramped-up sale of bonds to finance gaping budget deficits. At the same time, the Fed is no longer buying bonds as it did during and after the pandemic recession to drive down borrowing rates. Many central banks overseas have also stopped or reduced their bond purchases. Banks and some investors are wary, too, given the potential for rates to rise further and reduce the value of their existing bonds.

All of that should sound familiar because it is the very path I laid out months back for the cause and effect of our national economic collapse. It is the financial tear-down that is building up behind the system that will be cataclysmic when it breaks through. And it can be self-perpetuating: (In fact, it WILL be.)

“Where is the demand for these bonds going to come from?” Rajan asked. Weak demand could force bond yields even higher to try to attract buyers.

The financial destruction among banks should, however, be a boon for Jamie Dimon, whose banking model is based on sucking up dying banks in specially priced sales arranged just for him by the FDIC, the Fed and the Treasury — the triumvirate of banking destruction — where the banking Dimon gets to feast on the wreckage for a mere ten cents on the dollar … just so that we can make sure to keep making the banks that are “too big to fail” vastly bigger. These special arrangements even somehow let him get away with pretending he is nobly taking one for the team by sweeping in to the rescue. It seems to create that ignorant response among some financial writers of “Thank God we have big banks that are strong enough to save us from the crash of these lessor institutions.”

At least, that is how Dimon and his colleagues bill it each time it happens, and they seem to get away with that. The alternative, of course, would be to part the failing banks out only to smaller or mid-sized banks in digestible pieces, rather than making the behemoths even more dangerously bloated and powerful. That never happens!

The BRICS, of course, are on course exactly as laid out

Interesting turns at the BRICS summit in this morning’s news confirm what I have been writing regarding the total lack of effort we would see from the BRICS to create a dollar replacement AND the discord among the BRICS that will always be far more problematic for a BRICS currency than the fractures in Europe are for the euro.

Today’s articles remind us that talk of a BRICS currency, which largely came out of Brazil initially has been taken off the agenda, and participants even emphasized they have no interest in creating such a currency.

Xi did not even bring up the notion of a new global currency, and he did not even attend his own talk! He skipped the event he was supposed to speak at and had an underling read his written key speech which was full of the usual high-minded vagaries anyone can agree with but no actions:

“Right now, changes in the world, in our times, and in history are unfolding in ways like never before, bringing human society to a critical juncture…. The course of history will be shaped by the choices we make….” [blah, blah, blah]

His remarks were delivered by Chinese Commerce Minister Wang Wentao, and it was not immediately clear why Xi, who had a meeting with host Ramaphosa earlier in the day, did not attend.

Mostly the speech that Xi did not find important enough to attend attempted to boast about China’s greatness:

“The Chinese economy has strong resilience, tremendous potential and great vitality. The fundamentals sustaining China’s long-term growth will remain unchanged,” according to the remarks read by Wang. “The giant ship of the Chinese economy will continue to cleave waves and sail ahead.” [strong youth labor market, blah, blah, blah]

However, the need to reassure the small congregation about China’s greatness comes directly out of China’s diminishing economic results, which the whole world is solidly aware of, just as all nations are aware that China has recently done a lot to try to hide is economic results.

China and Russia, of course, are pressing to strengthen the BRICS by enlarging its membership because of the sanctions over the Ukraine war:

Heightened tensions in the wake of the Ukraine war and Beijing's growing rivalry with the United States have pushed China and Russia - whose President Vladimir Putin will attend the meeting virtually - to seek to strengthen BRICS.

The mistake of many on the right in alternative media has been to be too quick to assume any of the rest of the BRICS members share that interest. Other nations are actually leery of expanding the membership and strengthening China’s power. Discord is, in fact, the main reason there will not be a BRICS currency, backed by gold or anything else anytime soon … if ever.

Comments from Brazil's Lula pointed to a divergence of vision within the bloc, which political analysts say has long struggled to form a coherent view of its role in the global order.

"We do not want to be a counterpoint to the G7, G20 or the United States," Brazil's Lula said during a social media broadcast from Johannesburg. "We just want to organise ourselves." Beyond the enlargement question, boosting the use of member states' local currencies in trade and financial transactions to lessen dependency of the U.S. dollar is also on the summit agenda.

So, this summit will present no new bloc-busting entrance of a dollar-busting global trade currency at all — just an effort to find ways to make trading in their own local currencies more efficient to limit always using the dollar in trade, which mandates holding US bonds for trade. They are not even going to talk about it!

Putin hit the note a little harder, of course, in his televised talk (because he cannot attend due to warrants for his arrest by The Hague).

"The objective, irreversible process of de-dollarization of our economic ties is gaining momentum," Russia's Putin said in a pre-recorded statement.

Even there, NO talk of a new currency at all. Nada word.

South African organisers say there will be no discussions however of a common BRICS currency, an idea floated by Brazil.

So, let’s put a pin in that hot-air balloon and pop it now because even the founding members are saying it is not happening.

The BRICS lack any of the kind of cohesion necessary to form an international currency and many are not as anti-West as some assume because they happen to still value trade with the West, and they fear growing Chinese hegemony as much or more than US hegemony. The agenda of Russia are not the agenda of many other BRICS nations:

BRICS remains a disparate group, ranging from China, the world's second biggest economy, to South Africa, a relative minnow which is nonetheless Africa's most developed economy.

Russia is keen to show the West it still has friends but India has increasingly reached out to the West, as has Brazil under its new leader.

Brazil and India have profited immensely from trade with the US and the rest of the West, and they are not prone to damage the very thing that has been their core strength. China, however, has grown large enough that it thinks it can profit by taking over that role, but the others don’t want that. They want solid trade with China AND with the West.

India and China have also periodically clashed along their disputed border, adding to the challenge of decision-making in a group that relies on consensus….

"This is a very diverse collection of countries ... with differences of view on critical issues…."

India, which is wary of Chinese dominance and has warned against rushing expansion….

No new members were expected to be admitted to the bloc during the summit….

The BRICS are less of a threat to the dollar than the euro ever was. Gradually (as in over a longer more tortuous time than the euro), they may build some cohesion and strength and nibble away the dollar around the edges, but there is no dollar collapse to be found there, and the US will create its own economic collapse long before that happens anyway.

Share

The Daily Doom is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

(Note: I no longer give references with each quote because I have found for years that only one or two people out of thousands of readers for an article are likely to ever chase down a quote anyway. So, to save time, I put the sources quoted or referred to in the editorial in boldface among the headlines below as this makes it easier to organize quotes based on the narrative of the editorial without having to constantly write the reference out in the limited morning time for each editorial, and the few who want to chase it down can still do so by doing a word search in the boldface articles that are there for you to read if you want.)

Keep reading with a 7-day free trial

Subscribe to

The Daily Doom

to keep reading this post and get 7 days of free access to the full post archives.

Seeing the Great Recession Before it Hit

My path to writing this blog began as a personal journey. Prior to the start of this so-called “Great Recession,” my ex-wife had a family home that was an inheritance from her mother. I worked as a property manger at the time, and near the end of 2007, I could tell from rumblings in the industry that the U.S. housing market was on the verge of catastrophic collapse. I urged her to press her brothers to sell the family home before prices dropped. The house went on the market and sold right away — and just three months before Bear-Stearns and others crashed, taking the U.S. housing market down for the tumble. Her family sold at the peak of the market.

www.thedailydoom.com

| ![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)