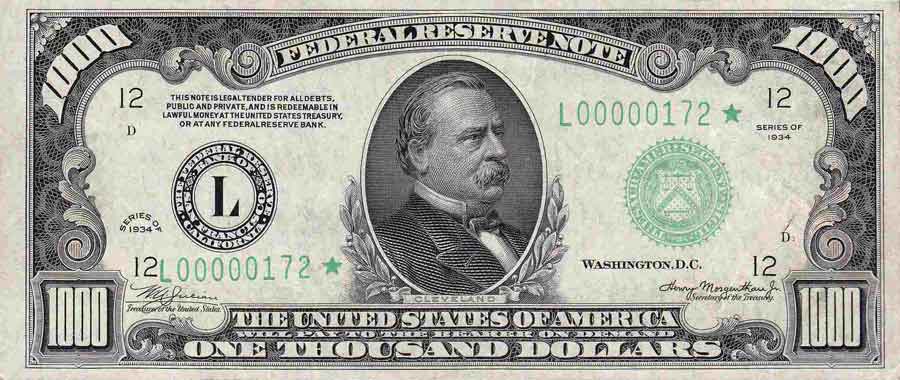

It's Time to Bring Back the $1,000 Bill...

Joseph P. Farrell

If you’ve been following the central banksters at the B.I.S. (Bank for International Swag) or the Old Lady of Threadneedle Street and her calls to end the use of 20 and 50 pound notes, you’ll know that the Klaus von Blohschwabs of the world are in earnest when they say they want to move everyone to a cashless society. Their reasons for doing so are effectively reducible to two basic points: (1) cashlessness puts all their activities and transactions behind a one-way mirror, as Catherine Fitts likes to say, i.e., the central banksters get to continue their financial tricks, insider trading, skimming frauds, robo-mortgages, and so on, without any possibility of exposure. They will even continue to conduct their transactions by the exchange of real physical instruments like bonds and stock certificates and gold bars and so one, while the rest of us are forced to rely on electronic blips, because (2) they get to control those blips at the push of a button, and to “regulate”, i.e., determine, the value thereof. In short, a cashless society is a one-way road to corporate coupons, and to “you’ll do and think as we say, or no food or heating for you.” It’s a one-way ticket to Ms. Antichrist (note my gender inclusivity). If you’ve been following the central banksters at the B.I.S. (Bank for International Swag) or the Old Lady of Threadneedle Street and her calls to end the use of 20 and 50 pound notes, you’ll know that the Klaus von Blohschwabs of the world are in earnest when they say they want to move everyone to a cashless society. Their reasons for doing so are effectively reducible to two basic points: (1) cashlessness puts all their activities and transactions behind a one-way mirror, as Catherine Fitts likes to say, i.e., the central banksters get to continue their financial tricks, insider trading, skimming frauds, robo-mortgages, and so on, without any possibility of exposure. They will even continue to conduct their transactions by the exchange of real physical instruments like bonds and stock certificates and gold bars and so one, while the rest of us are forced to rely on electronic blips, because (2) they get to control those blips at the push of a button, and to “regulate”, i.e., determine, the value thereof. In short, a cashless society is a one-way road to corporate coupons, and to “you’ll do and think as we say, or no food or heating for you.” It’s a one-way ticket to Ms. Antichrist (note my gender inclusivity).

According to this article from Zero Hedge and shared by K.J., however, some Britons appear to be taking the advice of Catherine Fitts, and are using more and more cash:

“Anything But A Cashless Society”: Physical Money Makes Comeback As UK Households Battle Inflation

Now, I’m going to crawl way out on a twig not only of high octane speculation, but of utter lunacy: the inflation that the world is experiencing under alleged President Bidenenko might not be because they’re running the printing presses, but because they’re dialing up more blips on the computer. The article itself suggests this strange phenomenon, that physical cash seems to be acting in a fashion similar to gold and silver when the printing presses of money are being run, i.e., it is acting as a relatively more stable store of value:

The report pointed out that increasing physical cash demand was primarily due to more people managing their budgets via notes and coins on a “day-by-day basis.” It said some withdrawals were from vacationers needing cash for “staycations” in the UK. About 600,000 cash payouts totaling £90mln were from people who received power bill support from the government, the Post Office noted.

Britain is “anything but a cashless society,” according to the Post Office’s banking director Martin Kearsley.

“We’re seeing more and more people increasingly reliant on cash as the tried and tested way to manage a budget. Whether that’s for a staycation in the UK or if it’s to help prepare for financial pressures expected in the autumn, cash access in every community is critical,” Kearsley said.

We noted in February 2021, UK’s largest ATM network saw plummeting demand as consumers reduced cash usage. At the time, we asked this question: “How long will the desire for good old-fashioned bank notes last?

… and the answer is not long per the Post Office’s new report as The Guardian explains: “inflation going up and many bills expected to rise further – has led a growing numbers of people to turn once again to cash to help them plan their spending.”

But why should cash and coins act as stable stores of value?

Note that my original statement was that it is acting as a relatively more stable store of value. By this I mean when banks are running the printing presses and printing paper notes, the more stable store of value is bullion, because bullion cannot be processed as quickly; when paper notes in circulation do not vastly fluctuate over a unit of time, they can be relatively stable stores of value. The trouble is, it’s much easier to print notes, than to mine bullion. Similarly, it’s much easier to manufacture electronic blips as money, than it is to print paper notes. To use an old conception, the seigneuriage (the difference between the value of money and the cost to produce it) is low in the case of paper notes when compared to bullion, and much lower for electronic blips on a computer compared to paper notes. This means stability of a store of value of any physical medium of exchange is a function of the seignueriage, i.e., a function of the time and cost of production and the amount of units of value produced per unit of time. Store of value as a concept is thus relative, and has nothing to do with some magical or inherent property of bullion per se, but is intimately linked to the idea of seigneuriage. By the nature of this case, then, even though the risks of hyper-inflation are inherent in any system of paper currency, they are even greater by orders of magnitude in any digital system of “cashlessness.” And by the very same processes of reasoning, one can also see that the risks of deflationary periods are magnitudes greater in a “digital” system than in an “analogue” system of paper, coins, and/or bullion.

This is the reason for the odd phenomenon being reported in Great Britain of people using cash and coins as a means of budgeting: relative to the creation of electronic “money”, the value of the actual physical media of exchange is more stable. Or to put this problem with more bluntness: suppose one wanted deliberately to inflate or hyper-inflate the economy. Would it be more effective to “run the presses”, or to create more electronic blips? Answer: create more electronic blips. Which of the two becomes a more stable store of value? Answer: Cash and coins.

We can go further of course, and note that the seigneuriage of printing, say, 1,000 thousand dollar bills will be less than printing 1,ooo,ooo one dollar bills.

Maybe it’s time to revitalize the printing of large denomination notes… it would make buying a car with cash so much easier.

But in any case, save your privacy, and your freedom, use cash as much as possible...

See you on the flip side..

Born and raised in Sioux Falls, South Dakota, Joseph P. Farrell has a doctorate in patristics from the University of Oxford, and pursues research in physics, alternative history and science, and "strange stuff". His book The Giza DeathStar was published in the spring of 2002, and was his first venture into "alternative history and science". Following a paradigm of researching the relationship between alternative history and science, Farrell has followed with a stunning series of books, each conceived to stand alone, but each also conceived in a pre-arranged sequence:

- The Giza Death Star

- The Giza Death Star Deployed

- Reich of the Black Sun

- The Giza Death Star Destroyed

- The SS Brotherhood of the Bell

- The Cosmic War

- Secrets of the Unified Field

- The Philosophers' Stone

- The Nazi International

- Babylon's Banksters

- Roswell and the Reich

- LBJ and the Conspiracy to Kill Kennedy

- Genes, Giants, Monsters and Men

- The Grid of the Gods, with Dr. Scott D. de Hart

- Saucers Swastikas and Psyops

- Yahweh the Two-Faced God: Theology, Terrorism, and Topology, with Dr. Scott D. de Hart (Amazon Kindle e-book)

- Transhumanism: A Grimoire of Alchemical Altars and Agendas for the Transformation of Man (with Dr. Scott D de Hart, 2012)

- Yahweh the Two-Faced God: Theology,Terrorism, and Topology (Lulu Print-on-demand book, 2012)

- Covert Wars and Breakaway Civilizations: The Secret Space Program, Celestial Psyops, and Hidden Conflicts (2012)

- The Financial Vipers of Venice: Alchemical Money, Magical Physics, and Banking in the Middle Ages and Renaissance (2013)

- Covert Wars and the Clash of Civilizations: UFOs, Oligarchs, and Space Secrey (2013)

- Talk Radio for the Eyes: Transhumanism in Dialogue; with Dr. Scott D. de Hart (2013)

- Thrice Great Hermetica and the Janus Age: Hermetic Cosmology, Finance, Politics and Culture in the Middle Ages through the Late Renaissance(2014)

- The Third Way: The Nazi International, The European Union, and Corporate Fascism (2015)

- Rotten to the (Common) Core: Public Schooling, Standardized Tests, and the Surveillance State (2o16)

- Hidden Finance, Rogue Networks, and Secret Sorcery: the Fascist International, 9/11, and Penetrated Operations

- Hess and the Penguins: The Holocaust, Antarctica, and the Strange Case of Rudolf Hess

gizadeathstar.com

|