Send this article to a friend:

July

10

2025

Send this article to a friend: July |

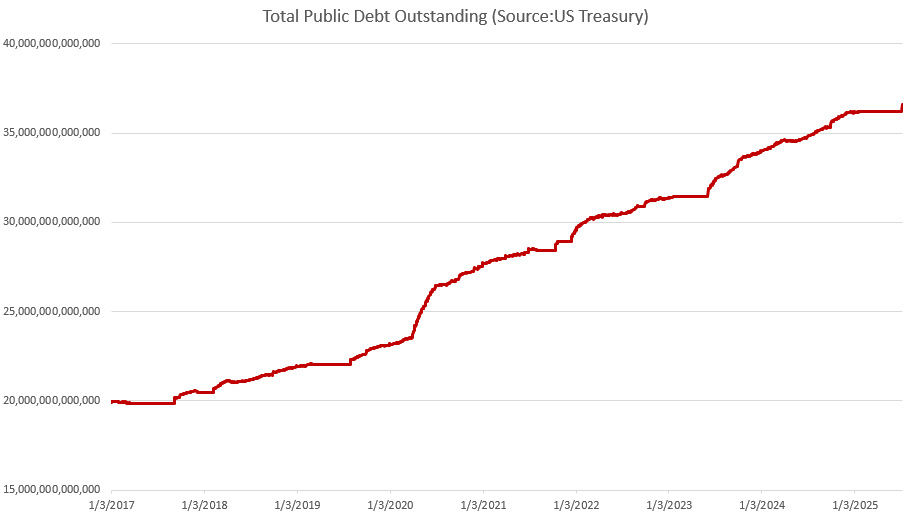

The Federal Debt Just Jumped $366 Billion in a Single Day

The enormous surge in the national debt comes as Congress and President Trump approved the latest omnibus spending bill which included an increase to the debt limit of $5 trillion. (That’s the largest increase to the debt limit ever.)

Although the federal government had been running large deficits under the previous debt limit, the Treasury had been using a variety of budget tricks to borrow funds from various Federal accounts in order to keep spending while not exceeding the debt limit. Thanks to the increase in the debt limit, the Treasury can now issue new debt, pay off its internal debts, and get back to running up the official debt total. In part, the surge in debt is to ensure the Treasury is flush with cash. Bloomberg provides some additional details:

Naturally, the Treasury can’t use the entirety of new debt to replenish its cash balance because hundreds of billions of dollars are being spent monthly to fund the welfare-warfare state. As we noted here at Power& Market yesterday, the federal government is on track for a $2 trillion deficit this fiscal year, making it the biggest year for new debt since 2021.

Ryan McMaken (@ryanmcmaken) is executive editor at the Mises Institute. Send him your article submissions for the Mises Wire and Power and Market, but read article guidelines first. Ryan has a bachelor's degree in economics and a master's degree in public policy and international relations from the University of Colorado. He is the author of Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities and Commie Cowboys: The Bourgeoisie and the Nation-State in the Western Genre. He was a housing economist for the State of Colorado. Ryan is a cohost of the Radio Rothbard podcast and the War, Economy, and State podcast, has appeared on Fox News and Fox Business, and has been featured in a number of national print publications including Politico, The Hill, Bloomberg, and The Washington Post.

|

Send this article to a friend:

|

|

|