Distressed Commercial Real Estate Properties Top $64 Billion

As "Full-Blown Trouble" Ahead

Tyler Durden

In yet another sign that a commercial real estate crisis has arrived, a new report from MSCI Real Asset reveals that distressed properties are piling up as some building owners of malls and office spaces have no choice in a high-interest rate environment but to default. In yet another sign that a commercial real estate crisis has arrived, a new report from MSCI Real Asset reveals that distressed properties are piling up as some building owners of malls and office spaces have no choice in a high-interest rate environment but to default.

The report, which Bloomberg first reported, shows the number of distressed assets increased by 10% in the first quarter to nearly $64 billion. The report notes distressed CRE assets could balloon to as much as $155 billion.

These distressed assets are unable to refinance while regional banks are tightening credit standards amid a period of high borrowing costs -- and couple that with sliding CRE prices and some properties, such as office space and malls, where vacancy rates are soaring.

"Should this potential distress be upgraded to full-blown trouble, an increase in distressed asset sales and declining prices would be inevitable," MSCI Real Assets analysts Jim Costello and Alexis Maltin wrote in the report.

At the end of the first quarter, there were about $23 billion in distressed CRE retail properties and $18 billion in office buildings. The report highlighted another $43 billion of potential distress emerging in the office space segment as companies shrink corporate footprints.

The analysts found Manhattan had the most distressed CRE asset sales with $2.6 billion of deals — or 19% of US transactions in the 12 months through May. Los Angeles was second with $746 million of distressed asset sales, followed by Houston with $465 million.

None of this should be surprising to readers, as we outlined months ago "CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans."

And have shown CRE prices have slid for the first time in more than a decade.

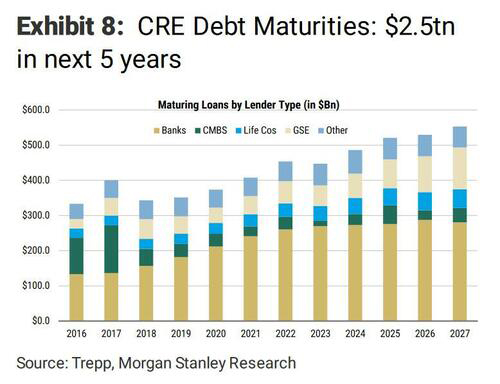

And what's worse is a multi-trillion-dollar CRE debt maturity wall over the next five years.

We suspect when MSCI Real Assets releases the second quarter report, the CRE space will have deteriorated even further as just recently:

The CRE dominos are falling.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|