Michael "Big Short" Burry: This Is The Greatest Bubble Of All Time In All Things

"By Two Orders Of Magnitude"

Tyler Durden

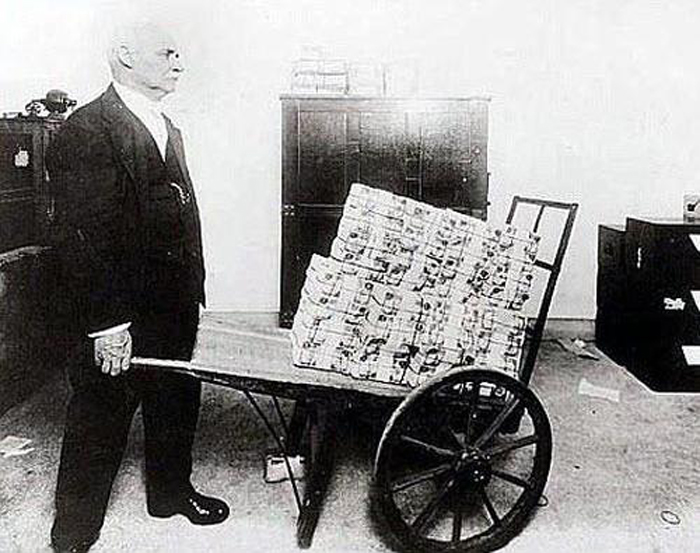

Earlier this year, none other than Michael 'Big Short' Burry confirmed BofA's greatest fears, as he picked up on the theme of Weimar Germany and specifically its hyperinflation, as the blueprint for what comes next in a lengthy tweetstorm cribbing generously from Parsson's seminal work, warning that: Earlier this year, none other than Michael 'Big Short' Burry confirmed BofA's greatest fears, as he picked up on the theme of Weimar Germany and specifically its hyperinflation, as the blueprint for what comes next in a lengthy tweetstorm cribbing generously from Parsson's seminal work, warning that:

"The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increases while retail sales, PMI stage V recovery. Trillions more stimulus & re-opening to boost demand as employee and supply chain costs skyrocket."

#ParadigmShift

"The life of the inflation in its ripening stage was a paradox which had its own unmistakable characteristics. One was the great wealth, at least of those favored by the boom..Many great fortunes sprang up overnight...The cities, had an aimless and wanton youth"

"Prices in Germany were steady, and both business and the stock market were booming. The exchange rate of the mark against the dollar and other currencies actually rose for a time, and the mark was momentarily the strongest currency in the world" on inflation's eve.

"Side by side with the wealth were the pockets of poverty. Greater numbers of people remained on the outside of the easy money, looking in but not able to enter. The crime rate soared."

"Accounts of the time tell of a progressive demoralization which crept over the common people, compounded of their weariness with the breakneck pace, to no visible purpose, and their fears from watching their own precarious positions slip while others grew so conspicuously rich."

"Almost any kind of business could make money. Business failures and bankruptcies became few. The boom suspended the normal processes of natural selection by which the nonessential and ineffective otherwise would have been culled out."

"Speculation alone, while adding nothing to Germany's wealth, became one of its largest activities. The fever to join in turning a quick mark infected nearly all classes..Everyone from the elevator operator up was playing the market."

"The volumes of turnover in securities on the Berlin Bourse became so high that the financial industry could not keep up with the paperwork...and the Bourse was obliged to close several days a week to work off the backlog" #robinhooddown

"all the marks that existed in the world in the summer of 1922 were not worth enough, by November of 1923, to buy a single newspaper or a tram ticket. That was the spectacular part of the collapse, but most of the real loss in money wealth had been suffered much earlier."

"Throughout these years the structure was quietly building itself up for the blow. Germany's #inflationcycle ran not for a year but for nine years, representing eight years of gestation and only one year of #collapse."

His punchline: the above was "written in 1974 re: 1914-1923" and then makes the ominous extrapolation that "2010-2021: Gestation" adding that "when dollars might as well be falling from the sky...management teams get creative and ultimately take more risk.. paying out debt-financed dividends to investors or investing in risky growth opportunities has beaten a frugal mentality hands down."

And, as if reading from the same playbook, Paul Tudor Jones warned yesterday that things are "bat shit crazy" and if Jay Powell

“The idea that inflation is transitory, to me ... that one just doesn’t work the way I see the world."

All of which led to Burry's latest tweet warning this morning...

"People always ask me what is going on in the markets. It is simple. Greatest Speculative Bubble of All Time in All Things. By two orders of magnitude. #FlyingPigs360"

In other words: "Brace!"

So what are you going to do about it?

Tudor Jones had some simple advice: "buy commodities, buy crypto, buy gold."

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|