Send this article to a friend:

May

20

2023

Send this article to a friend: May |

New Debt Report Proves We’re in Uncharted Territory

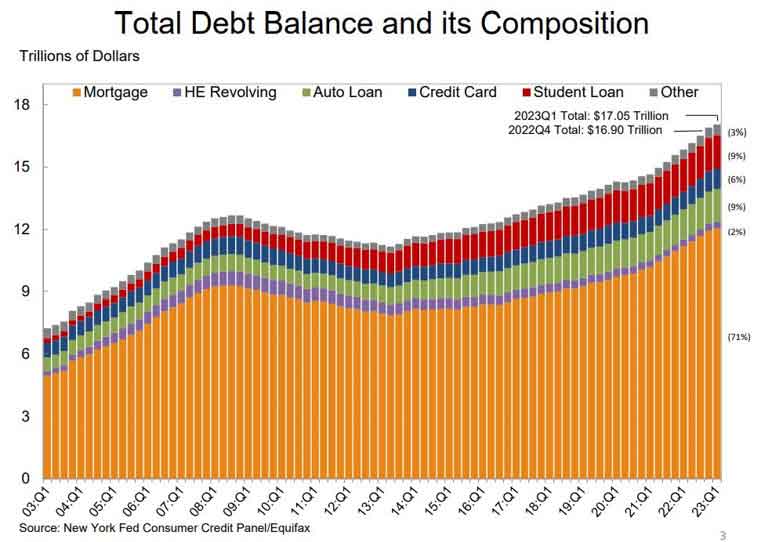

When the pandemic started, that spending slowed, thanks in part to the panicked response by government officials who shut down businesses for weeks or months in 2020. (Remember “Two weeks to stop the spread”?) But starting in 2021, consumer spending finally started picking up again (along with red-hot inflation). And that’s a big economic force! In fact, consumer spending on everything from gas and groceries to mansions and Maseratis now accounts for 68.4% or more than two-thirds of the nation’s gross national product (GDP). The next logical question to ponder is: “What is fueling this spending?” Unfortunately, part of the answer is: rapidly accumulating consumer debt. Debt-fueled economic growth simply isn’t sustainable. Once consumers are maxed out, that economic expansion turns into a sudden contraction… Today, we’ll dig into the current state of consumer debt and try to figure out how much more our credit cards can take… Alarmed economists report record consumer debt over $17 trillion According to a quarterly report made available by the New York Fed, consumer debt has been piling up rather quickly since 2019, before the pandemic started:

You can clearly see the upward trend of consumer debt accumulation, and exactly what types of debt are increasing, on the official chart below:  via Federal Reserve of New York Quarterly Report on Household Debt and Credit Upon closer examination, it looks as though the debt mountain surged back in 2013. Hmm, I wonder if artificially-low interest rates and quantitative easing had anything to do with it? In addition to increases in consumer debt, and overall mortgage balance increases of $121 billion, three other increasing debt trends from the report were also notable:

As you’d expect, people tend to buy holiday gifts on their credit cards. That’s no surprise. Usually, though, people spend less during the first quarter of the following year, paying down those credit card balances… That didn’t happen this year.

This simply doesn’t make sense… why would anyone open a HELOC now that interest rates are twenty times higher than they were a year ago? The only reasonable answer is they’re desperate for cash.

Well, that’s not good news for obvious reasons… Now, after the COVID-19 pandemic started in 2020, there was a mini mortgage refinance boom as people locked in lower, pandemic-era mortgage rates. That may have been a smart choice for some people.. Unfortunately, it seems that homeowners were mostly drawing on their home equity to try and lower rates and monthly debt payments:

Now, as my colleague Phillip Patrick has mentioned, debt isn’t necessarily a bad thing. Cashing out home equity to spend on consumption items, though? That’s a bad idea for most people… In a further development, Americans are turning to “by now pay later” (BNPL) loans not for high-ticket consumption items (leisure and travel), but for normal everyday necessities like groceries and gas:

Credit is a financial tool. Like all tools, it’s neither good nor bad. Using credit to pay down more expensive loans? To fund a valuable home renovation? That might be a great decision that increases your net worth over time. Using credit because you want a new pair of shoes? Well, that might make you happier, but it’s also likely to make you less wealthy. But using credit (especially expensive loans like credit cards or buy-now-pay-later) for basic necessities? That can create a huge problem down the road. And the road may not be that long… Here’s what we’re seeing:

Debt-fueled economic activity can only last as long as the credit does. With interest rates on the rise, not only is that credit getting more expensive, it’s getting more scarce. And considering what a gigantic portion of our nation’s economy is fueled by consumer spending, we may not even get much warning before a single declined credit cart transaction turns into a full-blown economic crisis. During dire economic times, there are a few smart things prudent families do to keep their own financial houses in order… Focus on assets that aren’t liabilities With few exceptions, incurring debt constrains your retirement savings – especially if that debt is made of expensive credit card bills. You’re smart enough to already know this. You also know that credit is only as good as the debtor’s ability to repay it. Considering the economic situation, it’s a good idea to really ponder who’s on the other end of any IOU you might own. That’s a big reason that, during times of economic uncertainty and crisis, safe-haven gold becomes so incredibly popular. Physical precious metals, primarily gold and silver, are the only assets that aren’t someone else’s liability. They’re not a promise of a stream of payments, they aren’t fractional ownership of something you’ve never seen – they’re tangible, physical, finite assets (and you know you own them because you can hold them in your hands!) Their value proposition isn’t complicated. You don’t need a Ph.D. in physics to understand gold and silver. Diversifying your savings with physical precious metals like gold and silver can offer a lot more than simplicity – our customers enjoy the peace-of-mind that comes with owning tangible assets. Want to find out whether you, too can benefit from diversifying with gold and silver? It’s easy to learn more here.

|

Send this article to a friend:

|

|

|