Bitcoin Tumbles After Treasury Unveils Stricter Crypto Reporting To IRS

Tyler Durden

(Editor's Note: Inflation is theft. A little inflation is a little theft, and a lot of inflation is a lot of theft. There is nothing natural about inflation. The Federal Reserve is the only cause of inflation in the U.S.A., and a major cause of inflation throughout the world. Everyone involved with the Federal Reserve are thieves. The IRS is the collection agency for the Federal Reserve. They, too, are thieves. Not one in a hundred working there realizes it. But that hardly matters. We are talking about thousands upon thousands of thieves. No wonder we are in such a mess. - JSB) (Editor's Note: Inflation is theft. A little inflation is a little theft, and a lot of inflation is a lot of theft. There is nothing natural about inflation. The Federal Reserve is the only cause of inflation in the U.S.A., and a major cause of inflation throughout the world. Everyone involved with the Federal Reserve are thieves. The IRS is the collection agency for the Federal Reserve. They, too, are thieves. Not one in a hundred working there realizes it. But that hardly matters. We are talking about thousands upon thousands of thieves. No wonder we are in such a mess. - JSB)

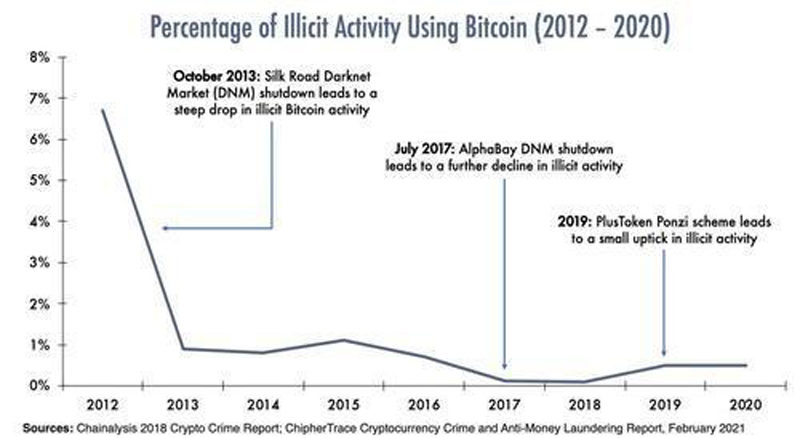

Just a month after Treasury Secretary Janet Yellen's complete fearmongering lie about Crypto being used largely for illicit finance (which has been overwhelmingly proven false,especially relative to dollars)...

The Treasury has just announced a new set of rules about reporting crypto transfers because, they claim...

“Cryptocurrency already poses a significant detection problem by facilitating illegal activity broadly including tax evasion.”

If you think the timing is coincidental with yesterday's plunge, we have a bridge in Brooklyn to sell you.

“As with cash transactions, businesses that receive cryptoassets with a fair-market value of more than $10,000 would also be reported on,” the Treasury Department said in a report on tax-enforcement proposals released Thursday.

The Treasury said that comprehensive reporting is necessary “to minimize the incentives and opportunity to shift income out of the new information reporting regime.” It noted that cryptocurrency is a small share of current business transactions.

Percentage of Illicit Activity Using Bitcoin (2012-2020)

This is all part of Yellen's Tax Reclamation Plan (and likely was accelerated by the fact that Europe basically told to her to 'f**k off' with her demands for a global tax increase to cover the Biden admin's big tax hikes.

The U.S. Treasury Department estimated that wealthy taxpayers as a group are hiding more than half their income outside of wages and salaries, a conclusion that aims to bolster the Biden administration’s call for Congress to approve expanded IRS funding and broad new financial-transaction reporting requirements.

“The IRS will be able to deploy this new information to better target enforcement activities, increasing scrutiny of wealthy evaders and decreasing the likelihood that fully compliant taxpayers will be subject to costly audits,” the Treasury said of the proposed reporting requirements.

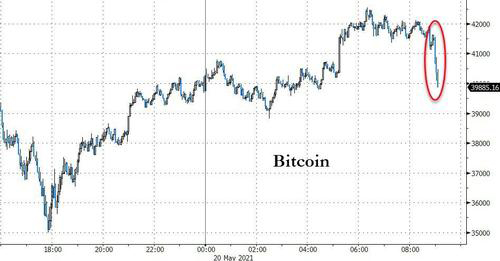

The announcement sent Bitcoin back below $40,000...

The drop, while of note, is perhaps less than some might expect. However, as several veteran crypto traders noted, this move is positive overall since it suggests 'regulation' is the way ahead for US agencies, and not a blanket ban.

Additionally, it seems odd to us that they would announce this plan now (just a week after the Colonial Pipeline ransomware payment). First, any large income transfer would, of course, already be tracked FROM the employer (and so very easy to find for the IRS on any paper trail); and if they are claiming this is to capture off-the-book income, that is a fallacy too, since the vast majority of off-the-book income is undertaken in dollar bills?

We also wonder how this question on the current tax form does not address this even more broadly by enquiring about whether you "exchanged ANY interest" in a virtual currency.

.jpg)

The Treasury said the new reporting regime would go into effect in 2023 to give financial institutions time to prepare for the new requirements. The Treasury estimates that the increased visibility into taxpayers’ accounts, on its own, would net the IRS $460 billion of the $700 billion over a decade.

Finally, putting bitcoin's "taxability" in context: the Fed monetizes more debt than bitcoin's entire market cap in 6 months.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|