Ethereum Reaches Record High $500 Billion Market Cap,

Now Bigger Than JPMorgan

Tyler Durden

Dip-buyers have charged in after Monday's flash-crash in cryptos, sending Ethereum to a new record high near $4400... Dip-buyers have charged in after Monday's flash-crash in cryptos, sending Ethereum to a new record high near $4400...

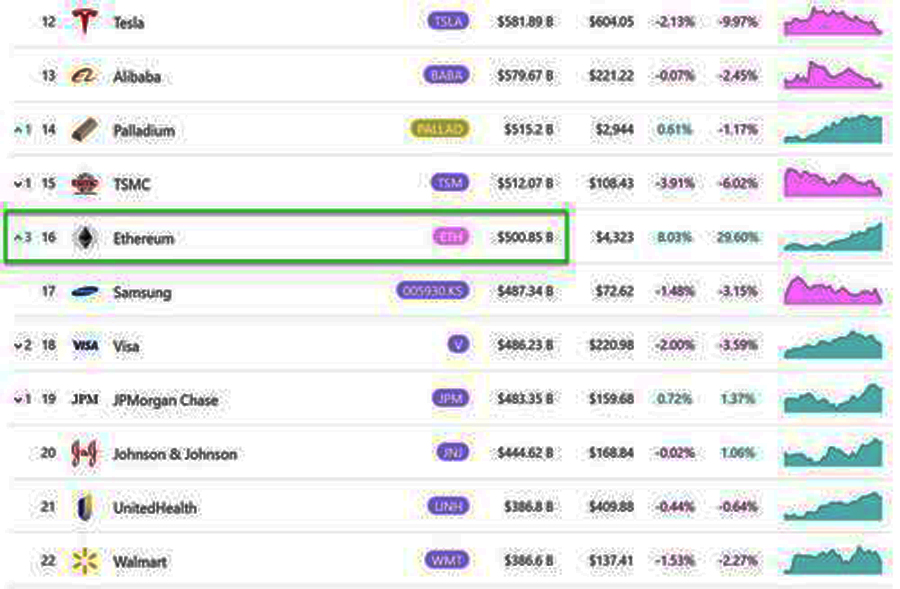

That has pushed Ethereum's market cap above $500 billion, now larger than JPMorgan...

As CoinTelegraph reports, Ether is the second cryptocurrency to hit a $500-billion market cap after Bitcoin. Ether took significantly less time to become a half-a-trillion-dollar asset.

Launched in January 2009, Bitcoin took nearly 12 years to reach a $500-billion market capitalization in December 2020 at a price above $27,000. As the first version of an Ethereum cryptocurrency protocol was launched in July 2015, Ether is now five years and 10 months old.

Source: 8marketcap.com,

As previously reported by Cointelegraph, Ethereum co-founder Vitalik Buterin became a billionaire after Ether’s price rose above $3,000 on May 3. Megan Kaspar, a crypto analyst and co-founder of digital asset investment firm Magnetic, believes that Ether is now on track to hit a price target between $8,000 and $10,000 by late 2021. The analyst previously reportedly predicted that ETH would hit $3,400 when the cryptocurrency was trading about $1,200.

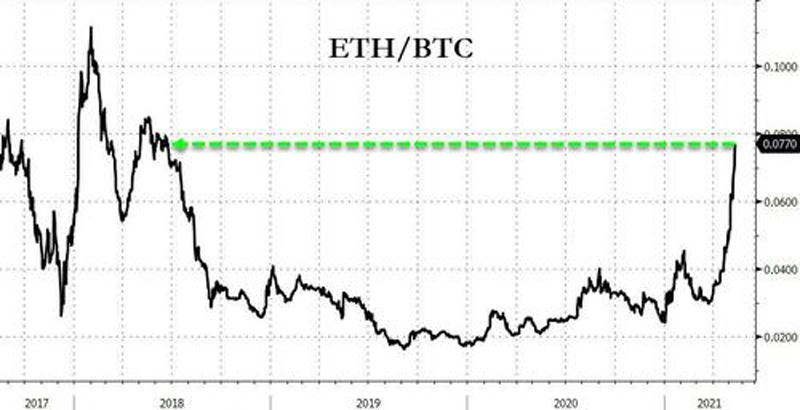

Bitcoin is lower on the day, driving the ETH/BTC ratio to its highest since June 2018...

Source: Bloomberg

It is also worth noting the sudden appearance of "Internet Computer" which was released Monday and is now in the Top 10 cryptocurrencies by market cap...

Source: CoinMarketCap.com

A quick look into the token’s issuing authority, Internet Computer, described it as a “blockchain-based cloud computing project” that proposes to build an open, public network. But the biggest takeaway for traders was the involvement of high-profile institutional players in the project. As CoinTelegraph reports, in retrospect, Dfinity aims to develop a blockchain-based infrastructure, one in which the internet itself supports software applications instead of cloud hosting providers.

Its Internet Computer protocol proposes to host online services, such as social media, messaging, search, storage and peer-to-peer digital interactions, atop its public Web 3.0 cloud-like computing protocol.

The aim involves relying more on large data centers and high-end node machines — aka validators — with a capacity much larger than that provided by the leading blockchain Ethereum.

In short, Dfinity hopes that it will offer the first truly global blockchain network that runs at the top web speed with unlimited scaling features to support any volume smart contracts computation.

“If the IC succeeds at replacing legacy IT, there would be no need for centralized DNS services, anti-virus, firewalls, database systems, cloud services, and VPNs either,” noted Mira Christanto, researcher at crypto analytics platform Messari.

Dfinity proposes decentralization by introducing a unique consensus model dubbed as Threshold Relay, coupled with its Blockchain Nervous System to ensure algorithmic governance.

Meanwhile, ICP serves as a native asset to the Internet Computer. Its role within the platform involves staking that allows users to participate in the Blockchain Nervous System and security deposits that allow private entities, including client software and cloud networks, to connect to the Internet Computer’s public network.

And all of these moves come a day after billionaire fund manager Stan Druckenmiller warned that Fed/Government policies are putting the dollar's reserve currency status at risk and cryptos could be the solution...

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|