Home Prices Soar Most On Record As Fed Continues Bubble Blowing Policies

Tyler Durden

The Federal Reserve continued to increase its holdings of mortgage-backed securities by the tune of $40 billion per month, fueling a housing bubble with record-low mortgage rates and low inventory. The Federal Reserve continued to increase its holdings of mortgage-backed securities by the tune of $40 billion per month, fueling a housing bubble with record-low mortgage rates and low inventory.

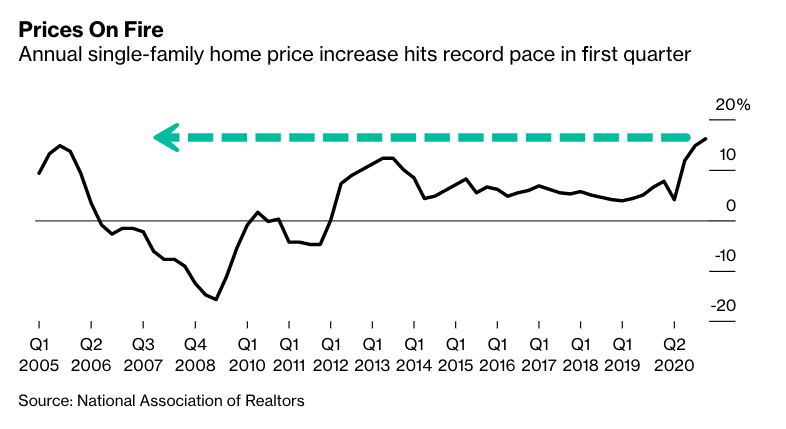

Even as the housing sector has more than recovered from the downturn, Chair Jerome Powell continues pedal to the metal with MBS purchases. According to the National Association of Realtors (NAR), this has resulted in the median price for a single-family home to soar the most on record in the first quarter.

"Nationally, the median existing-home sales price rose 16.2% on a year-over-year basis to $319,200, a record high since 1989. All regions recorded double-digit year-over-year price growth, with the Northeast seeing a 22.1% increase, followed by the West (18.0%), South (15.0%), and Midwest (14.4%)," NAR said.

As home prices surge, Powell still doesn't have a satisfactory answer for why the Fed continues its massive MBS purchases every month.

Here's Powell's quote in full from an April press conference:

"Yeah. I mean, we started buying MBS because the mortgage-backed security market was really experiencing severe dysfunction, and we've sort of articulated, you know, what our exit path is from that. It's not meant to provide direct assistance to the housing market. That was never the intent. It was really just to keep that as, it's a very close relation to the Treasury market, and a very important market on its own. And so, that's why we bought as we did during the global financial crisis. We bought MBS, too. Again, not intention to send help to the housing market, which was really not a problem this time at all. So, and, you know, it's a situation where we will taper asset purchases when the time comes to do that, and those purchases will come to zero over time. And that time is not yet."

Back to the report, Lawrence Yun, NAR chief economist, said, "record-high home prices are happening across nearly all markets, big and small, even in those metros that have long been considered off-the-radar in prior years for many home-seekers."

Of the 183 metro areas covered by NAR, 163 had double-digit price gains, up from 161 in the fourth quarter.

"The sudden price appreciation is impacting affordability, especially among first-time homebuyers," said Yun. "With low inventory already impacting the market, added skyrocketing costs have left many families facing the reality of being priced out entirely."

In a separate report, Redfin's monthly data showed that in April, homes sold at their fastest pace on record with nearly half off-market within one week.

Quantitative easing is a crapshoot, the Fed's overstimulation is fueling a housing bubble. Any taper announcement, possibly at Jackson Hole, could throw a wrench into the housing market later this year.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|