Send this article to a friend:

February

09

2023

Send this article to a friend: February |

Crash Alert

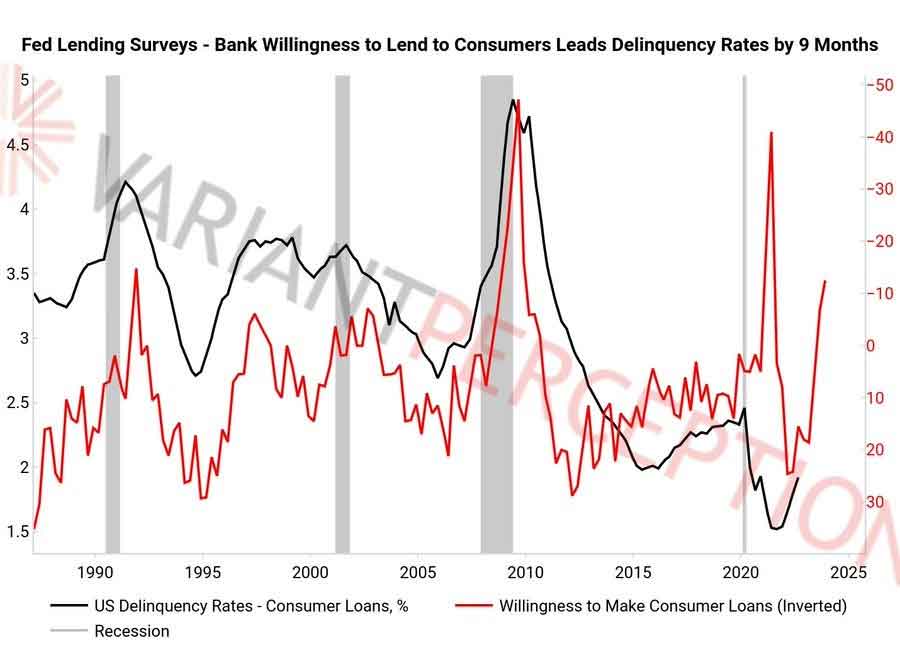

Ignore that low unemployment rate. Most forward-looking stats are screaming recession, and the epicenter of the coming quake is plastic. From CNBC:

Meanwhile, home prices, though down in some markets, remain ridiculously high. The following Seattle-area listings just appeared today. Take a close look and see if a million dollars seems reasonable for any of them. What made such prices conceivable in the recent housing bubble was record-low mortgage rates. But today’s rates are more than twice their pandemic-era lows, which nearly doubles a typical monthly mortgage payment. In a world where people are borrowing to buy groceries, the prices of homes like these have to fall dramatically to make sense. Housing, in other words, is headed for a serious contraction. Banks, which see this happening in real-time, are tightening their lending standards aggressively. So forget about personal loans or even high-quality credit cards. In the year ahead, millions of people who can’t make ends meet will have to find a way to do so.

In this Wealthion video, Jim Rickards makes a compelling case for a brutal slowdown, leading to a “crash by mid-year”. No one can predict the future with certainty, but the imbalances now building up make this seem like an obvious time to convert cyclical stocks into cash. If you own bank, auto, housing, or credit card company shares they’re vulnerable to a consumer-driven bear market and might end up being a lot cheaper at the bottom of the next cycle.

|

Send this article to a friend:

|

|

|