Send this article to a friend:

February

06

2021

Send this article to a friend: February |

|

Gold vs Bitcoin is F-ing stupid

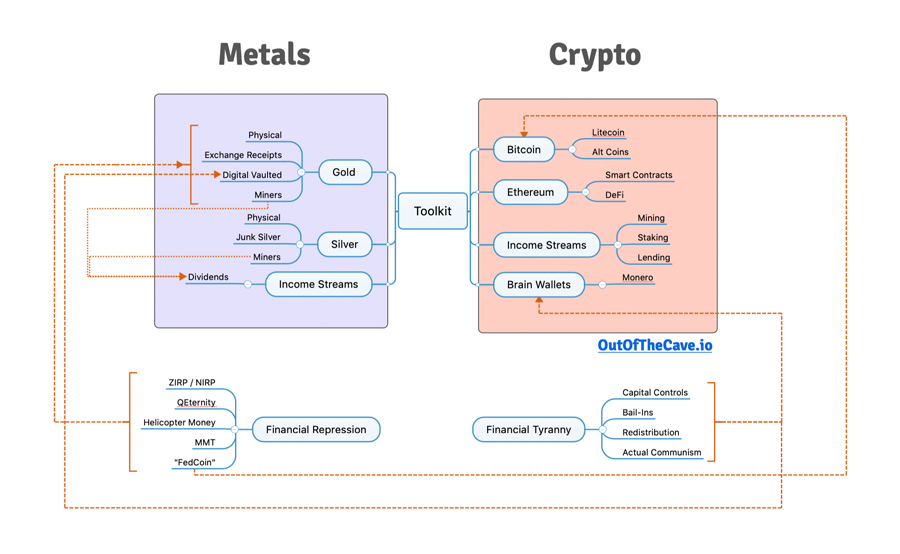

Introducing your Economic Apocalypse Toolkit With both Bitcoin and gold (and stonks, for that matter) at or recently off of all time highs the age old debate of whether gold is better than Bitcoin or vice versa is everywhere. I finally sat down and mapped out the Economic Apocalypse Toolkit after listening to Grant Williams and Bill Fleckenstein’s End Game podcast episode with Fred Hickey, who writes The High Tech Strategist. In it they hit on the perennial question of “gold vs Bitcoin” and Hickey laid out his objections to it. I’ve been a subscriber of The HTS for several years now and think it’s absolutely fantastic, and of course I also subscribe to Grant Williams TTMYGH and Fleck’s newsletter as well. All great stuff, well written, from extremely intelligent people. I do get the sense that Williams is somewhat open to Bitcoin and he wants to talk about it and explore the idea that it may be something more than the usual tropes: a ponzi, based on nothing, Tulipmania, etc, but maybe he’s hesitant at prospect of taking heat for suggesting it. I just find the entire debate pointless because people who invest in either asset class are doing so for the same reasons. They are reacting to the same threat, they see the same unsustainability, they are preparing for the same End Game, if you will. Given that many of the people who see the underlying issues are of a capital allocator, long term mindset, why is this being thought of in terms of either/or and not in terms of probabilities and scenarios? If the job at hand is to protect one’s wealth from systemically rigged and disintegrating monetary regime, arguing for one over the other feels like trying to defend against it with only half the available toolkit. Is there a mechanic who wouldn’t be caught dead with a screwdriver in his toolbox because he can give you a list of reasons why every problem can be solved with a wrench? “Screwdrivers for suckers!” The entire gold vs crypto argument goes away when one realizes that there is more overlap in the objectives of each asset than there are differences. And if you can get your own biases out of the way, then even the differences when looked at objectively seem to have uncanny parallels

I could go on…. Since the future is unknowable and certainty elusive, aligning with one aspect of the above over the other has to be a choice not a fact. It’s an act of faith. So why not embrace agnosticism and make use of both sets of tools in your financial survival toolkit? The Toolkit Let’s just step briefly through some of the items in the mindmap. We have metals on one side, cryptos on the other.

On the cryptos side, I just think Bitcoin is the crypto-reserve currency and will continue to be for the foreseeable future. My preferred way to accumulate BTC is to earn it via my businesses. easyDNS has been accepting Bitcoin since 2013 and we’re developing a payments service for clients that will be based on BTCPayserver. I put Litecoin and alts in there to trigger the maximalists. As per the Supersuckers song, “I like it all man. (All or nothin’ I’m all in even when I’m bluffin’)”. Ethereum is different animal, I think the Bitcoin vs Ethereum schism is every bit as fucking stupid as Gold vs Bitcoin. They do different things, and while they overlap in some aspects, that doesn’t mean there should only be one path forward. The way I think about it, Bitcoin is the value, Ethereum is the execution. When I hear people dismiss Bitcoin because “there is as yet no ‘killer app’ that anybody has come up with for Bitcoin” I like to ask them “what is the killer app for the money in your wallet?”. Do you want to be able to play video games on your money? Collaborate on a document with your coworkers before you spend it? Dollars or euros aren’t dismissed as useless because nobody has come up with a compelling use case for them. You just spend it. That’s the use case. Ethereum on the other hand, well that’s a whole different ball game. Smart contracts, DeFi, even Dao’s (despite early setbacks) will completely transform our lives. Ethereum, and other projects like it (Cardano, EOS, and even Ravencoin, which is actually a Bitcoin fork) are going to provide ways to code parameters and instructions around value and wealth that will be guaranteed to execute and can outrun government overreach. We’re now coming out of that “Trough of Disillusionment” I wrote about back in 2018 and we have actual companies, actual businesses and ways to derive income now in crypto. We can invest in miners, in crypto based publicly traded companies, we can stake our assets or lend them and earn a return on them. Multiple income streams available here so we actually have some ability to compound whatever wealth we’ve managed to port to the crypto-economy separate from any nominal gains garnered in fiat terms. And of course, with crypto we have the ability to move capital, in figurative terms, simply by thinking about it. If Actual Communism comes to your habitat and the best you can manage is to get out with your skin and some pass phrases you’ve remembered in your head, you can retrieve some of your assets wherever you come up for air (read “We The Living”. Take it to heart. This is the fate we seek to avoid, and large chunks of the world are barreling straight at it). On the precious metals side you have your physical metals which, if all goes well, you simply keep vaulted in various places and your currency never collapses and you teach your kids that they should preserve the hoard and only use it in extreme emergencies down the road. And to teach their kids the same. You have junk silver in case there is a currency crisis and you don’t want to have to carve off a piece of a Krugerrand in order to buy some food at the market. You have some gold tucked away in international vaults like Bullionvault and Goldmoney. My cousins run TrustableGold.comwhich rates these places. All of this stuff, especially on the crypto side, has to be set up in advance, and you have to know how to navigate these systems before TSHTF. When a mob of mostly peaceful democratic socialists are tearing through your town and burning down your homes and businesses, or when the government is hanging both goldbugs and HODL-ers from lamposts, you do not want to be learning how to set up a Monero wallet and frantically converting as much as you can into it, nor do you want to be just then opening your Goldmoney account and trying to wire in some funds. It has to be ready now, so when the inevitable Financial Repressions intensifies, or God forbid, the Financial Tyranny occurs, you can focus on executing your exit plans and coming out on the other end with enough capital and wealth to rebuild. The missing link What we really need are bridges between crypto-currencies and gold. Not metaphorical “can’t we all be friends” bridges, I mean gateways, tokenized/staked storage and transfer of precious metals. Conversion into or out of crypto from metals. This is not easy. There have been attempts in the past, Roger Ver, in Sal the Agorist’s recent “Gold vs Bitcoin” podcast mentioned e-gold. easyDNS was the only domain registrar to accept e-gold back in the day and that’s how we amassed our physical gold which remains on our balance sheet even now. But contrary to Ver’s assertion that the government’s shutdown of E-gold speaks to gold’s inferiority to Bitcoin – that’s not entirely accurate. E-gold turned a blind eye to governance and it really was a wild west of ponzi schemes and criminal activity. Contrast with other DGCs of the day, like Pecunix or Goldmoney, the latter of which still exists. Goldmoney had far more stringent KYC and governance protocols, self-enforced, and here they are – still up and running. In fact it was Goldmoney who had one of the more recent attempts at Bitcoin to vaulted gold convertability under their incarnation as Bitgold. They’ve since discontinued this precisely because of the governance hurdles. I won’t trivialize how hard this is, but for people droning on about the need for a ‘killer app’, this one would probably do well. It’s all about optionality Both metals and crypto tribes look at the financial system and our legacy institutions as entering some form of breakdown and decline. Because the future is inherently unknowable, what makes more sense?

If you’re a goldbug, would it kill you to have a fraction of your liquidity in Bitcoin, knowing that from past events crypto superspikes tend to 10X or 100X or more with stubborn repetitiveness and increasing magnitude? If you’re into Bitcoin, buying the right gold miners now with a fraction of your capital may very well set you up with an increasingly fat, cushy dividend stream in a few years that you can use for living expenses while you continue to HODL. Now there are many End Gamer luminaries out there who are invested in both even though they prefer one or the other. But there are too many out there who are not only completely dismissing the other side, they are going even further and acting under an assumption that their preferred asset will prevail so totally that it will in the fullness of time become the world reserve asset. In part 2 I’ll discuss why the odds of that happening in either case are near infinitesimal. For anybody paying attention to how governments actually function, it is not even desirable. If your thesis is one that of these assets will form the basis of a new global statist monetary system and you’re an extreme skeptic of gold or Bitcoin, you should be hoping that the other guy’s favourite asset is the one that gets used. Get on the list or follow me on Twitter if you want to know when Part 2: Careful What You Wish For, is available.

|

Send this article to a friend:

|

|

|