US Mint Warns It Can't Meet "Surging Demand" For Silver & Gold

Tyler Durden

With The Fed printing money 'out the wazoo', monetizing COVID relief package debt as fast as Congress can pass the bills, demand for bullion was already surging. However, the last week or so, on the heels of the Reddit-Raiders taking aim at Silver, demand for silver (and gold coins) has exploded... With The Fed printing money 'out the wazoo', monetizing COVID relief package debt as fast as Congress can pass the bills, demand for bullion was already surging. However, the last week or so, on the heels of the Reddit-Raiders taking aim at Silver, demand for silver (and gold coins) has exploded...

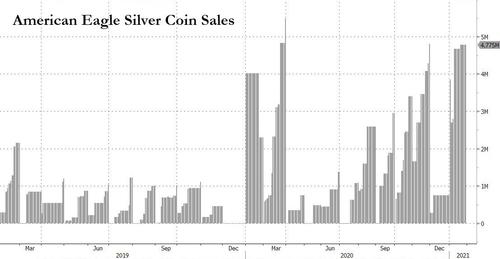

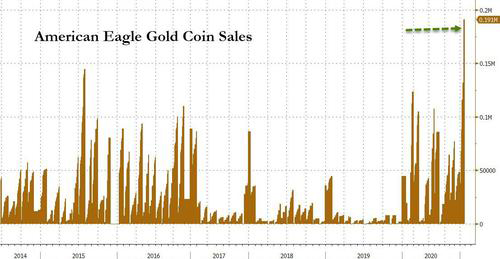

Sales of U.S. gold bullion coins rose 258% in 2020 while silver coin demand was up 28%, the U.S. Mint said Tuesday.

Which has led to bullion dealers running dry of stock and physical premium to paper silver prices soaring to record highs.

“There are massive shortages. We’ll be completely out of stock if it carries on like this - the first time since our company opened in Singapore seven years ago,” said David Mitchell, managing director at Indigo Precious Metals.

“In the short term, stocks may run out since it takes a long time for sea shipping, but overall supply is ample,” said Peter Fung, head of dealing at Hong Kong-based Wing Fung Precious Metals.

And now, courtesy of Reuters, we have an answer to the shortage.

The US Mint is limiting distribution of its gold, silver and platinum coins to specific dealers because of heavy demand, and a limited number of suppliers of metals, it said in a statement.

The United States Mint said on Tuesday it was unable to meet surging demand for its gold and silver bullion coins in 2020 and through January, due partly to pandemic-driven demand and plant capacity issues... Heavy buying has continued in 2021, it said, squeezing supplies, which had already been tight as the coronavirus affected production.

The last time the US Mint 'admitted' its inability to meet demand was in June 2010.

And the reaction in precious metals was...

Trade accordingly.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|