It is vital to understand that what we face is by no means the plain vanilla version of governments just printing into hyperinflation. These people are fighting back as is ALWAYS the case with core and major economies. The German hyperinflation took place AFTER a revolution with a unstable government that lacked credit. When there is “credit” then government FIRST tries to keep the game afoot and that means the bankers threaten they will collapse unless debt is serviced. This is why the FIRST response is all out financial war against the people.

Literally, you will PRAY for only hyperinflation. Society CAN survive that. It cannot and has NEVER survived an all out Sovereign Debt Crisis. I hope to have a book out this year on this subject covering NOT my OPINION, but uncovering every event and how do empires, nations, and city states die. There is just too much bullshit out there. There is a danger that unless we turn back, we could end up in World War III and a new Dark Age. One reader wrote:

Am following your reasoning about hyperinflation etc and very illuminating it is. I can appreciate deflation overwhelming printing and forcing the USD higher — in which case tangible asset protection becomes a chimera? As you also say the USD will be the last to plummet during a bond collapse ( inflationary?) so then tangibles rise? Separately you said earlier that any gold held had better be in coin form,I believe you were talking in the context of the underground economy. Ditto Silver coins? Am an avid daily reader of the blog and greatly indebted to you for throwing light over the darkening scene.

The USD will rise FIRST because the Sovereign Debt Crisis emerges on the peripheral of the core economy. Today that is Europe and Japan. I had a front row seat with the Euro since the commission came to us and attended our London conference taking the whole back row. As Europe and Japan implode, capital rushes from one currency to the next and that pushes the dollar higher. As the dollar soars, currency wars and trade wars always follows. The rise in the dollar will reverse the trend on the debt and it will appreciate in “real terms”. When I met with the US Treasury back during the Reagan Administration to argue against the rate hikes of Volcker, using that simple pocket calculator the debt would jump 800% by the end of the decade of the ’80s. I was told point-blank, it was ok because they would be paying back with cheaper dollars.

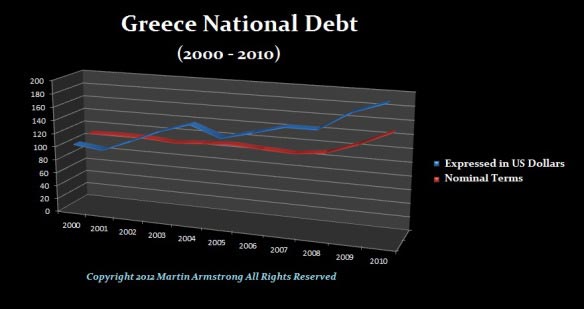

Greece cracked because the Euro rose from 80 cents to $1.60 so the past debt was NOT being paid back with cheaper currency, but DOUBLED in value. This is what a dollar rise will do to the US national debt and that will add even more pressure to raise taxes. It becomes a drunk trying to drink himself to sobriety. People are so bearish the dollar because of nonsense they CANNOT see that a rise in the dollar will be DEFLATIONARY and add to the pressure on government. Tax revenue will fall, unemployment will rise building the base for civil unrest, and protectionism will raise its head from the grave. This is NOT a good thing!!!!!

They are seeking to eliminate the underground economy. Gold and silver in storage, banks, and even bar form may fail to provide the purpose it will serve. Coin form is probably the safest bet. These people have gone nuts historically. If you are going to prepare, it better be for the worse case scenario – not the candy coated version of hyperinflation. Forget gold at $30,000 dividing the debt by the gold reserves. That all ASSUMES honest people at the top who will simply readjust everything fairly. Good one! And Santa Claus will help you sell your fortune tax free of course.

People who have known me for years, know when I research something, it is NEVER with a predetermined expectation. I go into everything with the purpose of following the breadcrumbs for history is better than anything you can imagine. Let the facts lead you to the conclusion – you might actually learn something. The one thing I have learned is the business cycle cannot be altered. However, I would “like” to think we can mitigate the VOLATILITY and thereby survive. But you cannot even do that unless you know what you are dealing with. If you constantly listen to bullshit – then the old saying – bullshit in and crap comes out.

We will try to republish the Core v Peripheral Economies soon as well as the formal proposal for The Solution. The backup support will be provided by In the Blink of an Eye how all governments die, and we will republish the Greatest Bull Market In History with charts of everything following the global economy through the Great Depression and into the Birth of Bretton Woods, but under the new title – The Global Economic Meltdown – the First Sovereign Debt Crisis of Modern Times. We will advise as these books are read. We all have opinions. But they will not cut it. It matters NOT what you “think” will happen based upon nonsense, false information, and beliefs. All that matters is HOW has such circumstances resolved themselves in the past.