Send this article to a friend:

January

13

2024

Send this article to a friend: January |

Banks Tank, Cooling Inflation Heats up,

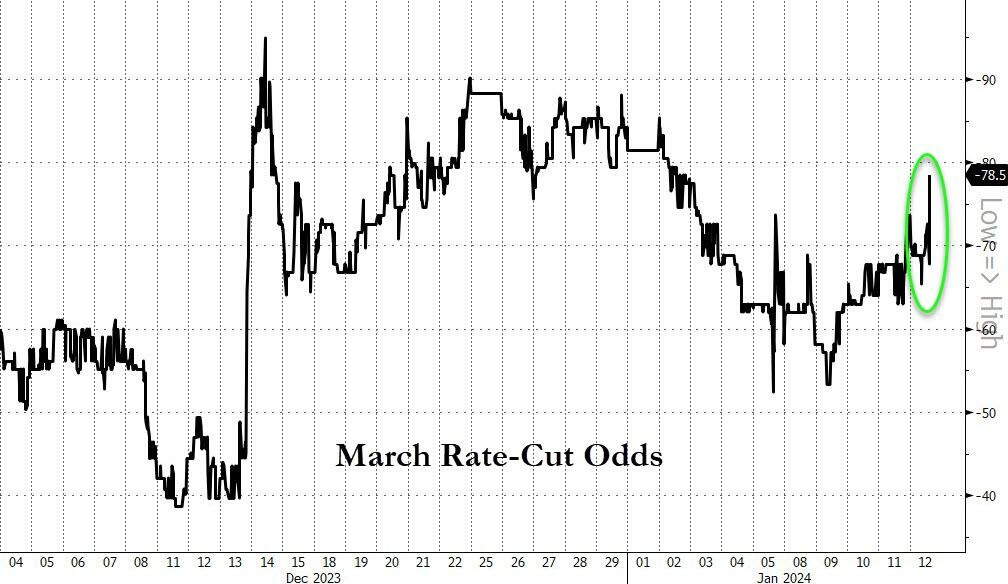

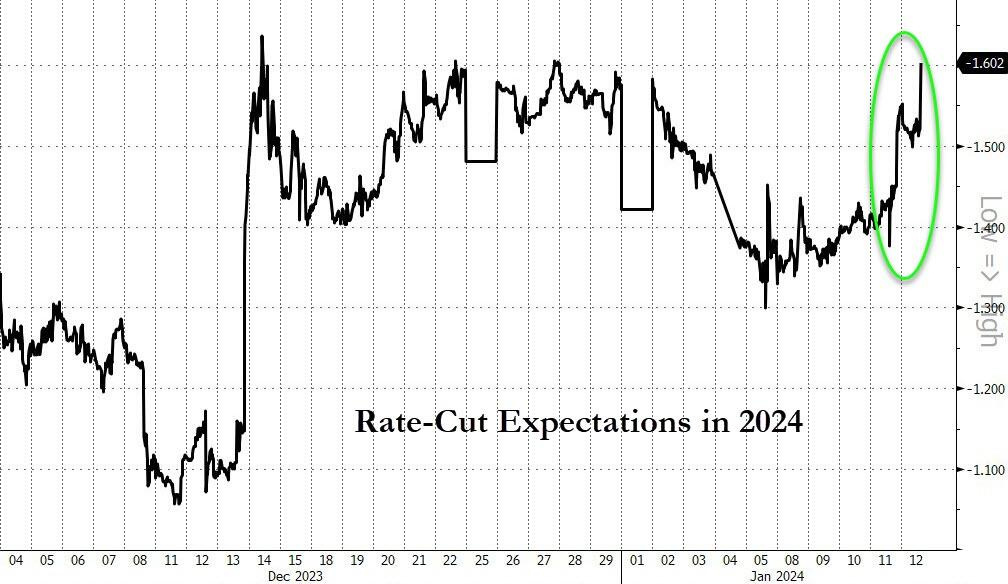

Every major bank reporting for Q4 2023 tripped over the threshold for one reason or another today—profits down, penalties up, etc.—helping stock investors find the exit. Recession risks got noted as higher than thought as the yield curve begins to un-invert. While normally that is a sign of impending recession, there are, of course, those in the news today claiming, “Not this time” in order to punch the pivot narrative again today. This time is special! Producer prices came in a little cooler than this week’s earlier CPI report, and some claimed that is proof that the pivot is still alive because it means the Fed will be cutting rates in March after all! Due to the minuscule dip in some measures of PPI, bets for March rate cuts went back on the table because the market’s greed-driven delusions know no end.

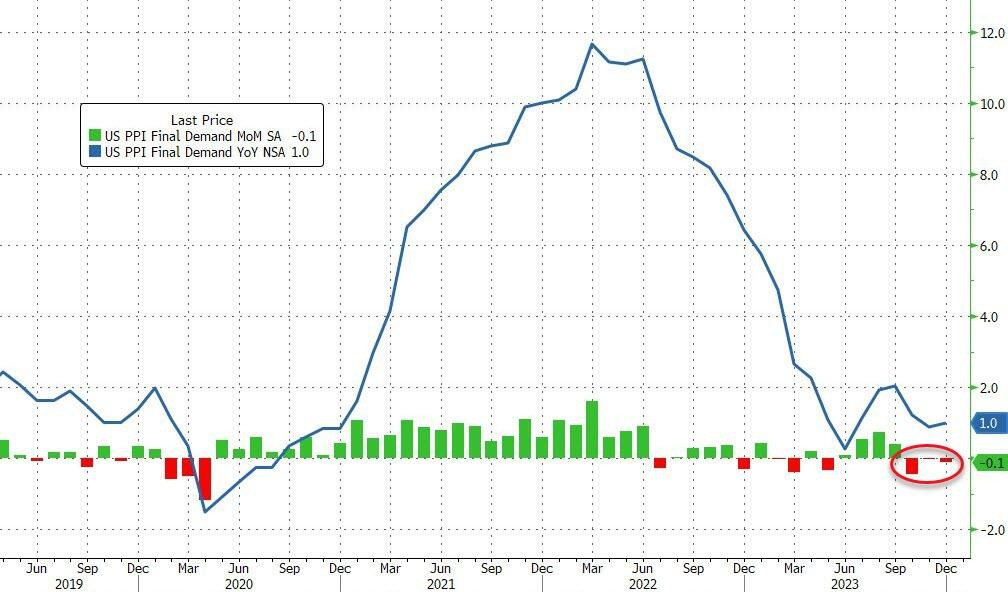

But what did the Producer Price Index really have to say? First, while month-on-month PPI inflation dipped just a little, year-on-year rose a little, holding the rising trend that began this past summer. This is hardly the thin blue line the Fed wants to see:

Secondly, even though headline inflation dipped, core inflation (minus food and energy) froze in place, and that is the inflation that the Fed watches intently. Moreover, it was goods that dipped. Services—the stickiest part—stayed sticky. That is also the biggest part, accounting for 80% of all that is tracked. Energy and food, which hit all of us hardest, went up, except diesel.

Yeah, well, it looks like that isn’t going to last. Today’s news shows energy prices busting out and looking destined to rise more, impacting all other prices down the road. Brent broke past $80 per barrel of crude today due to a serious escalation in warfare around the Red Sea as the US and its many allies attacked military facilities in and around Yemen’s capital, making the Red Sea Houthis conflict now war against a nation, not just against some wild terrorists. Many Middle Eastern nations jumped in with criticism today, but the alternative is to let the Houthis continue to effectively blockade global commerce through the Suez Canal, which is also inflationary. So, now you have shortages and slowdowns forming due to the canal blockade, which is hampering shipment of oil, and you have oil prices rising on speculation due to the intensification of war in the Middle East intended to end the blockade because that now has many nations caught up in active warfare against Yemen that appears to be spreading. This is why, in the Year of Chaos, when there are so many possibilities for trouble circling the horizon like black, rabid vultures, betting against inflation seems a fool’s bet to me; but it is apparently a bet most investors are happy to keep making as they pretend inflation is still falling! Neither of the following measures of PPI look to me like they have any good news for CPI inflation as producer prices work their way down the pipeline to consumers:

How are either of those lines seen as a sign that the Fed is making great progress? Why would they cause the Fed to cut rates in March? Almost everything is back to an upward trend since summer, which is when I started saying we had returned to rising inflation that you’d eventually start to see, even though no one was seeing it back then. I don’t see how the last six months on those lines translate into the Fed cutting rates in three months. Still, nobody wants to admit it. Thus, you even have Zero Hedge saying all-out stupid things like this:

It is a little worrying, and that is why the Fed has made clear it has zero intention of cutting rates in March. But ZH keeps ignoring what the Fed has actually said, as do all the greedy investors, and pounding the pivot fantasy like it can’t resist being proven wrong for about the eighteenth month in row. These delusional ways of looking at the world should not surprise me in a society that shivers worse very winter as it endlessly pumps the global-warming narrative. I mean let’s just gauge the truth factor in the world by all of today’s weather news. The hottest year in in history (we were just told based on the new specially calculated “heat” gauges, which they rarely tell you they are using any more, as opposed to old-fashion “temperature” readings) has given way to a winter of sweeping record cold temperature. Every state in the nation is now under some form of severe weather warning, with most of those being winter cold warnings of one form or another. So, I say, “Thank God we have some global warming! Can you imagine how hard it would be to tolerate such widespread extreme cold without it?” Share the news before it happens with your friends: Make sure you don’t miss any of the actual truth about inflation, as everyone tells you inflation is falling, by subscribing to The Daily Doom:

|

Send this article to a friend:

|

|

|