Send this article to a friend:

January

15

2024

Send this article to a friend: January |

So... About Bitcoin

Everyone on Earth wishes they’d loaded up on Bitcoin back when it was, like, $10. The fact that most investors have chosen not to ride that particular rollercoaster can be attributed to two things. First, cryptocurrencies were complicated to buy and store safely, which put them beyond the reach of most non-techies (myself included). Second, the use case for cryptos wasn’t yet clear. In other words, most people didn’t — and still don’t — know what they are and why they exist. But that may be about to change, as the Securities and Exchange Commission just solved the first problem (complexity) by approving Bitcoin exchange-traded funds (ETFs). Starting this week, anyone who can buy a stock can now diversify into Bitcoin (or something that emulates Bitcoin) with a mouse click.

Typical for this wild-west sector, the ETF announcement was preceded by a week of chaos when someone hacked the SEC’s website and tweeted a fake approval, causing Bitcoin to spike by more than $1,000. Whatever. It’s that kind of market. Here’s a list of Bitcoin ETFs that can now be traded like stocks, courtesy of the Lead-Lag Report:

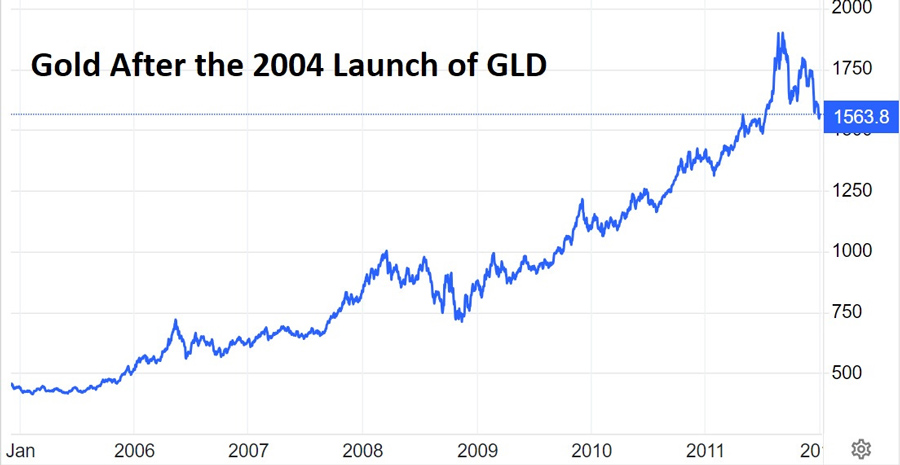

What does this mean for the price of Bitcoin? The obvious answer is that it invites in a lot of generalist money that will, other things being equal, give Bitcoin and maybe cryptos generally a nice tailwind. That’s how it worked for gold when GLD, the first physical gold ETF, went live in 2004:

Bitcoin has already had a strong run in anticipation of the ETF launch, so it’s not clear how much short-term juice is left (buy the rumor, sell the news). But longer term, bitcoin, like gold, is a tiny wave on a vast sea of investible capital that’s mostly mired in overvalued government bonds and tech stocks. Just a fraction of that capital fleeing into safe-haven assets could have a profound effect. But what is it? Bitcoin’s fans view it as next-generation money destined to replace gold and dollars as the bedrock of the global financial system. Which is another way of saying that for these ETFs to make sense, bitcoin has to become money. Specifically, it has to evolve from a “tradable asset” to a medium of exchange (i.e., we have to be able to buy stuff in Costco with it, and things have to be priced in Bitcoins a well as dollars). And it has to spawn a financial system that includes bonds, car loans, bank accounts, etc. Most of this has yet to happen. Along the way, Bitcoin has to survive an “Empire Strikes Back” scenario in which increasingly authoritarian governments introduce central bank digital currencies (CBDCs) as a means of controlling the peasants during the Great Reset. These wannabe dictators will view Bitcoin as a threat and will try to ban/regulate/co-opt it to minimize its role as sound money. Who wins this epic battle? That remains to be seen, though obviously we should be rooting against the dictators. Another big question is whether these ETFs are actually a scam for funneling cryptos into the “official” part of the financial system where they can be confiscated in a “Great Taking” scenario. I don’t have answers for any of this, but hope to acquire some as time goes on. Cryptos are in maybe the third inning of a very long game. So expect much more on this subject as the story evolves.

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) and The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

|

Send this article to a friend:

|

|

|