22

2013

January 22 2013 |

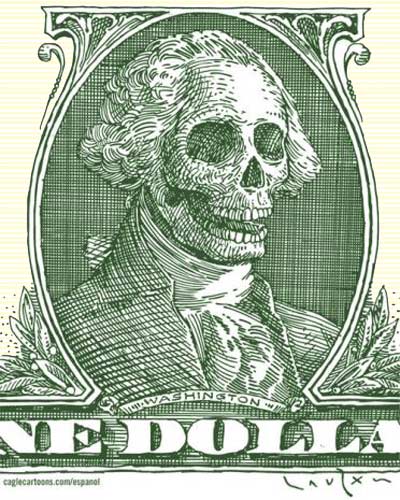

This is how money dies

Many investors are expecting a financial collapse in 2013. It's a nervy time! On Friday, I suggested that many await the collapse alongside a government bond market breakdown. And it's true – if the great bond bubble were to burst, it would be goodnight Vienna. But to my mind, it's looking increasingly like there won't be a classic bust in this market. As I argued on Friday, the central banks have got the bond market covered. In response to Friday's Right Side, some readers pointed out that the central banks can do many things – but they cannot control inflation. And inflation could be the great undoing of the bond market. This is serious stuff. And definitely worthy of a response, so in today's Right Side, I am going to look at the impact inflation could have on the fragile British economy. The scene is set for an inflation blow-upNow, I never suggested that inflation will be purged just because the bond market avoids its date with destiny. And yes, I know that in the past inflation and a bond collapse have gone hand-in-hand. But what seems to be brewing is the seemingly impossible. That is, the scene is set for inflation, yet no bond blow-up! Before we consider how this plays out, we need to consider the exact definition of 'inflation'... Some say inflation is the increase in official money supply… and by gum, we've had plenty of that! Others say inflation is the increase in retail prices – of course, that's another can of worms in itself. Which prices do you use? And crucially, which mathematical construction do you use for the index? It's a debate that's certainly raging today. Science versus faithBut there's a whole other concept to inflation. A school of thought that says inflation isn't some sort of scientific concept, or even anything that lends itself to measurement. Inflation is in the eye of the beholder and comes down to faith. Specifically the public's faith in paper currency. Needless to say, the central banks don't view inflation in this light. For them inflation falls very much into the realms of science, measurability and predictability. They run carefully crafted computer simulations that they believe model how inflation should work. They allow them to meddle endlessly with the money supply in the belief that inflation will toe the line. But I believe there'll come a point when the public simply loses faith in the currency. Some say that will be when we head into hyperinflation – and it's right to draw a distinction between the normal type of inflation (which can be corrected) and the 'lost-faith' type. However you like to define it, it's happened many times throughout ancient and modern history. It's just that, in the West, we haven't seen it for a while. Why? Because the broad public has faith in our currencies. But the public won't remain asleep forever. There will be a wake-up call. And we need to be ready for it... The four warning signsIt's hard to measure faith in currency – that's why the central banks don't bother. But there are some warning signs – I've got four of them: First, we need to keep an eye on what I call the 'inflation indicators'. Watch out as energy and precious metals prices start to move to new highs. The rich and powerful will lose faith first and they'll be tucking away real assets (if they haven't already started!). If you see gold move swiftly over $2,500, or Brent crude oil heading towards $150, then start to look out for the next signs... The second thing to keep an eye on is volatility in the markets. Now, I've already suggested that this will be met head on by the central planners. And the way they deal with markets going the wrong way is to print more money and prop them up. So we're looking out for volatility followed by an escalation in quantitative easing (QE) to pay for it all. As I said, in the West, most investors are unfamiliar with 'lost-faith' currency inflation. Some may have read about it – but there's precious little first-hand experience. What we need is a reminder. So the third thing to look out for is a rupture in a Western currency. Iceland and Hungary have come pretty close over the last few years – local residents will tell you all about the benefits of holding gold! So far, these breakdowns haven't been big enough for most investors to notice. What we need is a biggie – Japan perhaps? My colleague Simon Popple has certainly lost his faith in currency. He is so convinced of a massive financial collapse, he has already invested half of his life savings into one niche gold investment. Now, you may find that shocking, I know I did at first, but then he explained to me exactly why he didn't even consider his strategy high-risk. He is confident that his strategy could be the single most lucrative investment on the planet. You can find out more about Simon's strategy here. The fourth thing to look out for is what the economists call the 'velocity of money'. It's a rather arcane measure that attempts to quantify how quickly money races round the economy. The idea is that as inflation hots up, people spend money as soon as they get it. Why sit on cash if you believe it'll buy you fewer goods in the future? Losing faith in cash…Now clearly, if we get to the stage where the public doesn't like to hold cash, then we've got big problems. But this is actually a progression that's already started. Think about how investors have been moving cash into equities. Myself included! It's a sign that cash is no longer treated with the reverence it once deserved. How many more investors are starting to lose faith? I suspect we've still got a few years ahead of us before all faith is lost. And there is, of course, still time for a u-turn on central bank policy. I don't think it'll happen, but technically there's still time. To my mind, the bond market can be held in check. The gilt market is a rigged game, after all. Over time, I expect increasing numbers of people to lose faith. And as they do, the four indicators will come into play: commodity prices, market volatility, increasing QE, a currency crack-up and ultimately a dash out of cash. But for the moment, let's not get too excited. It'll take quite a while to destroy the faith in currency that's taken over half a century to build. For now keep calm and carry on. I will. But I'll be watching out for those four warning signs. I suggest you do too. Important Information Metals & Miners is a regulated product issued by Fleet Street Publications Ltd. Your capital is at risk when you invest in shares, never risk more than you can afford to lose. Forecasts are not a reliable indicator of future results. Please seek independent financial advice if necessary. Fleet Street Publications Ltd. 0207 633 3600. Your capital is at risk when you invest in shares - you can lose some or all of your money, so never risk more than you can afford to lose. Always seek personal advice if you are unsure about the suitability of any investment. Past performance and forecasts are not reliable indicators of future results. Commissions, fees and other charges can reduce returns from investments. Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future. Please note that there will be no follow up to recommendations in The Right Side. The Right Side is an unregulated product published by Fleet Street Publications Ltd. Fleet Street Publications Ltd is authorised and regulated by the Financial Services Authority. FSA No 115234. http://www.fsa.gov.uk/register/home.do Here at MoneyWeek, our aim is simple. To give you intelligent and enjoyable commentary on the most important financial stories of the week, and tell you how to profit from them. If you've enjoyed what you've read so far, I've got something you'll definitely be interested in. Every Monday, Wednesday and Friday, I send out our contrarian email, 'The Right Side', which cuts through market noise to deliver useful, shrewd and to the point advice straight to your inbox. And with your permission, I'd like to send you The Right Side for FREE. Good luck with your investments! Bengt Saelensminde,

|

|

|

|