Powell To Markets: "You're Wrong!"

Nicholas Colas

“Today’s prices are wrong” is the central tenet of active portfolio management. Without that belief, no manager could justify his or her role in capital markets. Systematically identifying mis-priced assets is the first line of a PM’s job description. “Today’s prices are wrong” is the central tenet of active portfolio management. Without that belief, no manager could justify his or her role in capital markets. Systematically identifying mis-priced assets is the first line of a PM’s job description.

At the same time, investors have grown accustomed to questioning the existence of rampant asset price inefficiencies. That has driven the growth of passive management, of course. But it has also made “what’s your investment edge?” the only question that matters when quizzing everyone from a junior hedge fund analyst to the most senior long-only manager.

Markets made a harsh assessment today: Fed Chair Jay Powell has no edge.To be fair, that judgment actually started in early October, when Powell offered his “far from neutral rates” comment. The S&P 500 is down 14% since then. Today’s 1.5% drop was just the equity market’s way of saying “you are missing important information”.

Six quick thoughts to expand on this, all based on Chair Powell’s answers to various questions during the post-meeting press conference:

#1. Not only did the Chair shrug off markets, he also discounted commentary from the Fed’s own business contacts. Powell mentioned that there is a “mood of angst” as he speaks to companies just now. But he brushed aside these sentiments, noting that they may not last. He also mentioned the difficulty of measuring business confidence with enough precision to incorporate it more robustly in Fed rate discussions.

#2. When questioned about still-quiescent inflation and the Fed’s consistent over-estimation of this half of their dual mandate, Powell could only say (essentially) “Well, we’re pretty close to 2%”. In the Fed’s latest Summary of Economic Projections (SEP) out today, the FOMC actually lowered its inflation expectations for next year to 1.9% from 2.0%. Against that lower comp, the Chair struggled to explain why the committee still thought 2 rate increases next year were appropriate.

#3. While Chair Powell stressed that the Fed looks at a variety of market indicators, he seemed unconvinced that recent simultaneous moves in US stocks and Treasury yields were telling a compelling story about recession probabilities. Market volatility can be transient, to be sure. The Chair said that the only valid signal will come if long term interest rates remain low, signaling a change in the bond market’s expectations for future growth and inflation. But since investors know monetary policy only works with a lag, they are rightly concerned it will be too late by then.

#4. The market’s key worry that the Fed is overly reliant on a specific (bullish) outlook got a boost from the Chair’s comments about the Fed’s balance sheet. The current $50 billion/month reduction will remain in place. In his view, that consistency helps the bond market digest the runoff. But it was another signal that the Fed thinks asset prices are too negative on the US economy.

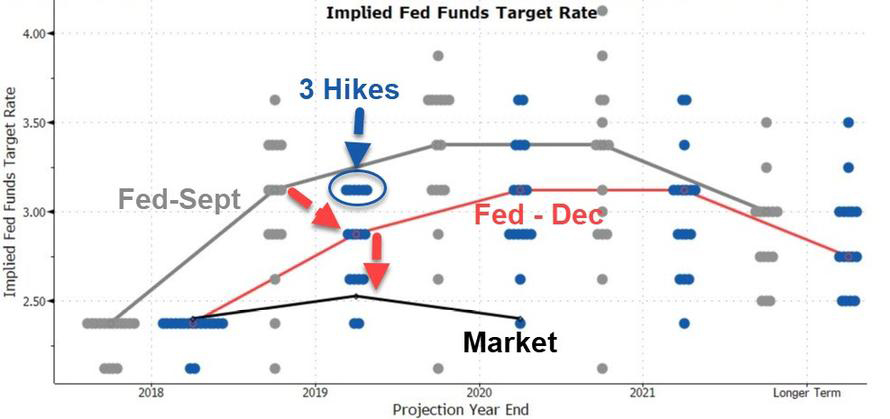

#5. The committee’s SEP contributed to confusion about the Fed’s future rate path. This was a problem we highlighted in Sunday’s note: how does the Fed reduce their guidance on future rate hikes without causing undue concern about 2019 economic growth?

Their answer was to cut GDP growth expectations to 2.3% (from 2.5%) and inflation to that 1.9% estimate (from 2.0%). But those changes caused several reporters to ask why the Fed needed to raise rates at all, and the Chair didn’t have a great answer except to offer up the “data dependent” hedge and say there was a “fair degree of uncertainty” just now.

#6. There were more questions on the “neutral” (neither stimulative nor restrictive) rate of interest than any other topic, an intellectual quagmire with no clear answer. All the Chair could say was that after today the Fed Funds rate is at the lower end of the committee’s long run estimate. Markets found that to be slim comfort since the Fed has two more rate increases penciled in for next year.

Summing up with one charitable (and important) point about Chair Powell’s performance today: no Fed Chair can ever say “Winter is coming.”

He must take the other side of the current bearish trade in stocks and bonds. To do otherwise would only hasten an economic slowdown as companies and individuals followed the Fed’s lead. Regardless, markets were looking for more signals from Chair Powell that he hears their concerns. He is now in a tough spot. How investors view his leadership is now as data-dependent as the Fed’s future rate policy. He owns the bullish case now. He needs to be right.

One of the most clear-eyed bits of Chair Powell’s commentary today was when he recounted the mixed track record of the Fed’s “Dot Plot” – the Federal Open Market Committee’s best guesses of future rate policy. Looking at year-end expectations over the last 3 years, his point to take the “Dots” with a grain of salt is sound advice:

- At the end of 2015, the median “Dot” called for a Fed Funds rate of 1.375% at year-end 2016.

The actual rate at the end of 2016: 0.66%. Instead of raising rates by 100 basis points over 2016, the Fed only managed 25 bp.

- At the end of 2016, the median “Dot” for year-end 2017 was 1.375%.

The actual rate at year-end 2017 was 1.42%, essentially the same as the FOMC’s median guess at the end of the prior year.

- At the end of 2017, the median “Dot” was 2.125%.

Fed Funds will end the year at 2.25% - 2.50%, reflecting 1 more rate increase than the FOMC thought prudent at the end of 2017.

Powell’s mention of this record – overestimating 2016, correct in 2017, and underestimating 2018 – was meant to show that the Fed’s data dependency regarding rate policy is real. The year 2016 saw only 1.5% GDP growth, so the Fed remained on the sidelines and ignored their “Dots”. The next year was more in line with their expectations, and Fed policy went to plan. This year, the Fed responded to better growth with more rate hikes than anticipated at year-end 2017.

This got us to wondering about a related point: in aggregate, how “sure” was the FOMC about its forward year expectations in these years, and what does that say about their conviction level right now? We pulled the year-forward “Dots” from year-end 2015, 2016 and 2017, ran the standard deviations for the estimates, and found this:

- Their greatest uncertainty was 12 months ago. The standard deviation of the year-end 2017 “Dots” for 2018 was 0.39, or close to 2 rate increases of 25 bp apiece. Fair enough, given that the FOMC was trying to anticipate the economic effect of soon-to-be passed tax cuts.

- Both 2015 and 2016 showed higher levels of collective FOMC forecast confidence than 2017 at standard deviations of 0.33 and 0.32 respectively, or closer to just 1 rate decision of 25 bp. When measured against what really happened, however, it shows that more FOMC certainty is no assurance of accuracy.

- Today’s “Dots” for 2019 year-end have a standard deviation of 0.26, the lowest level of collective uncertainty in the last 4 years when it comes to the FOMC’s forward-year expectations of rate policy.

Bottom line: the FOMC sees the world very similarly to Chair Powell’s own bullish take and their median estimate of 2 rate increases in 2019 is a high conviction point of view. The spread between the various forward-year “Dots” is tighter than at any similar point over the prior 3 years. Markets think they are wrong, but the committee is showing very little doubt. It will likely take more than a few more negative data points or swooning markets into year-end to change their minds.

Nick is a 30+ year veteran of Wall Street with experience in equity research, money management and investment banking.

From 1991 to 1999 he was the senior equity auto analyst at First Boston (now Credit Suisse). In addition to his duties advising clients on investments in the sector, he was also active in a range of equity offerings and M&A assignments. These included several equity underwritings for Chrysler, as well as its eventual sale to Daimler Benz, along with IPOs in the auto parts, rental car, and Chinese auto industry sectors.

From 1999 – 2001, Nick was an analyst and portfolio manager at SAC Capital reporting directly to company founder Steve Cohen.

From 2003 – 2017 he was Director of Research and Chief Market Strategist for first Rochdale Securities and then Convergex Group. In the latter role he authored the firm’s Morning Markets Briefing, which became a daily must-read for thousands of Wall Street professionals.

Nick is regularly on CNBC and Bloomberg TV/Radio and is widely quoted in the financial press.

Nick received his MBA from the University of Chicago in 1991 and his undergrad degree from Haverford College in 1986, majoring in Near Eastern Archaeology. He is a lifelong New Yorker, born and raised in Manhattan.

[email protected]

datatrekresearch.com

|