Why Speculators Should Love the Crypto Crash

Greg Wilson

On February 12, 1827, financier George Brown hosted a meeting at his Baltimore home. On February 12, 1827, financier George Brown hosted a meeting at his Baltimore home.

Joining him were 24 of the leading merchants of the day.

The topic: making Baltimore competitive on the Eastern Seaboard.

You see, New York had recently opened the Erie Canal… and it was a smashing success. Shipping prices decreased dramatically, and workers flocked to the state.

Other cities across the U.S. East Coast planned more canal construction. Baltimore merchants feared being left behind.

George Brown and Philip Thomas, a prominent local businessman, had a solution. It was a new technology called the railroad. And they would build one from the Port of Baltimore to the Ohio River.

They sold the local merchants on the idea by telling them considerable trade would flow into the state. The merchants agreed.

A month later, Brown and Thomas incorporated the Baltimore and Ohio (B&O) Railroad Company.

To finance the company, Brown and Thomas held a stock offering. They convinced the public that considerable commerce would flow to the state – and raised $3 million in just 12 days. (For reference, $3 million in 1827 is worth over $71 million today.)

It’s said that nearly every resident in Baltimore bought the stock.

Shares issued by the B&O Railroad in the 19th century

And it’s important to remember that railroads were a revolutionary technology at the time… In fact, B&O (now part of CSX Transportation) was the very first commercial railroad in the United States.

Everyone knew it would have a profound impact on business in America. But how that impact would play out was unknown.

As I’ll show you, the maturation of the railroad industry was a series of booms, busts, and narratives.

And I’ll also show you its parallels to the cryptocurrency industry today.

Everyone Loves a Boom

In 1829, the B&O Railroad became the first railroad in the United States to earn passenger and freight revenues.

By 1854, it was pulling in annual profits of $2.7 million per year. And remember, B&O started with only $3 million.

It wasn’t just B&O, either… Railways started to spring up across the United States. Between 1849 and 1857, the U.S. added over 20,000 railway miles. It was an all-out railway mania. (For comparison, the UK’s current railway system only has roughly 10,000 miles.)

Of course, everyone loved the boom.

But by 1857, it started to come crashing down. The California gold rush had ended. Britain’s war with Russia drained the Bank of England. And foreign financing for America’s railroads dried up.

It was a disaster for the U.S. economy. Railroad stocks collapsed. Many railway lines had to shut down and lay off thousands of workers. Lots of railroads declared bankruptcy.

The collapse spread to the banks that had financed the construction and land for these railroads. Several, like the Ohio Life Insurance and Trust Company, failed.

Despite an economy in tatters and falling railroad stocks, the railway didn’t die. Instead, the crash acted like a forest fire that cleared out the dead brush and allowed for new growth.

And it paved the way for the next boom.

The benefits of the railway were just too good for it to go away.

Speculators Love a Good Bust

By 1859, the Panic of 1857 had mostly passed. New entrepreneurs emerged to advance the railroad industry once again.

One of them was Jay Gould. He began speculating in small railway securities in 1859. And by 1863, he had become the manager of the Rensselaer and Saratoga Railroad.

He was always promoting railroads and the telegraph as the future, saying:

I am interested in the telegraph, for the railroad and telegraph systems go hand in hand, as it were, integral parts of a great civilization.

And:

I always bought on the future; that’s how I made my money.

He was able to sell others on the future as well. At one point in his career, Gould controlled over 10,000 miles of railway in the United States – over 10% of the entire U.S. railway system at the time.

But like the first boom, this one ended in a bust as well…

After the Civil War, the banking system grew rapidly. Railroads borrowed heavily to finance their operations. And investors rushed into the new innovative stocks of the day – railroads.

But eventually, a banking crisis in Europe found its way to the States. All told, over 100 banks failed.

Financing dried up. Investors started selling their railroad stocks en masse, resulting in the Panic of 1873.

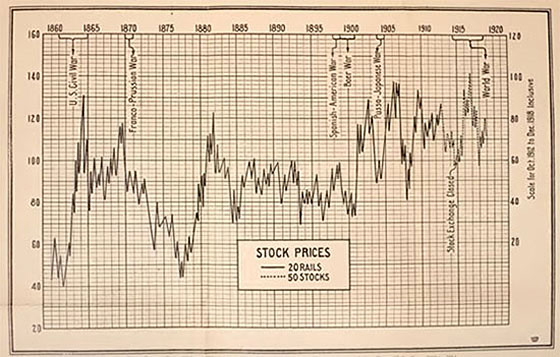

You can see the damage done to railway stocks in the chart below:

Starting in 1870, railroad stocks plummeted

None of the country was spared. Once again, like the first bust, the second paved the way for the next boom.

The railroad industry would go on to boom and bust several more times. But it was never the end of the railroad. Each time, the industry came back stronger.

In fact, if you avoided the headlines and focused on long-term growth, the success of the railroad was obvious.

How the Crypto Industry Is Like the Early Years of the Railroad

Just like with the railroad, we’ve seen the same pattern emerging in cryptocurrencies. The main difference is that it’s happening much faster.

In fact, in the decade that cryptocurrencies have been around, we’ve already seen four booms and busts:

-

2011: After rallying 10,500%, bitcoin went from $32 to $2 – down 94%.

-

2013: After rallying 11,400%, bitcoin went from $230 to $70 – down 70%.

-

2014: After rallying 1,600%, bitcoin went from $1,200 to $173 – down 86%.

-

2018: After rallying 11,450%, bitcoin went from $20,000 to $3,405 – down 83%.

As I write today, we’re at the tail end of the most recent cryptocurrency bust. And now, a new narrative is emerging that’s going to take us into the next boom.

Here are some of the big stories of the year:

-

CBOE: In July, the Chicago Board Options Exchange (CBOE) filed with the Securities and Exchange Commission (SEC) for a bitcoin ETF. Partnering with investment management firm VanEck and SolidX, CBOE added features such as insurance, which make approval more likely in the future.

-

Bakkt: The Intercontinental Exchange (ICE) – owner of the New York Stock Exchange and 22 other exchanges around the world – is launching its digital asset platform on January 24, 2019.

-

Yale Endowment: In October, David Swensen, chief investment officer of the Yale Endowment Fund, announced that the fund had invested in cryptocurrencies. (Harvard’s, Stanford’s, Dartmouth’s, and MIT’s endowments have made cryptocurrency investments as well.)

-

Nasdaq: The world’s second-largest stock exchange says it still plans to list bitcoin futures in the first quarter of 2019. Nasdaq will base its futures contracts off bitcoin’s price on numerous spot exchanges, as compiled by investment management firm VanEck.

And this is just the beginning. The Wall Street narrative is beginning to accelerate. Consider some statements made in just the last month…

Morgan Stanley hails cryptocurrency as the “new institutional investment class.”

JPMorgan told the world: “We are big believers in Ethereum.”

And crypto venture capital firm Grayscale Investments announced it’s seeing “record levels of interest among institutional investors,” despite the price slump in cryptos.

Like the railroad, the next crypto boom will open up new investment opportunities. Many investors will sit out the crypto market in 2019 until the next boom is well underway.

But if you’re a speculator, and you’re willing to invest in this fledgling asset class, today’s crypto bust is your opportunity.

Just remember that cryptos are very volatile. If you want to get exposure, don’t invest more than you can stand to lose. You only need a tiny stake for the potential to make life-changing gains.

Regards,

Greg Wilson

Analyst, Palm Beach Confidential

P.S. Not long ago, Palm Beach Confidential editor and world-renowned cryptocurrency expert Teeka Tiwari uncovered a group of crypto investors who make money every week whether the market is up, down, or sideways.

As we learned about these special situations, we put together a team to uncover 10 similar, small crypto opportunities. If you’d like to know about these opportunities, and see how you could make steady income regardless of what happens in the crypto market, go right here.

Greg Wilson is the chief analyst for The Palm Beach Letter and Palm Beach Confidential.

Originally from New York, Greg graduated from the University at Buffalo with a degree in accounting and received his MBA from Pace University, where he specialized in strategic management and finance. Read more…

www.palmbeachgroup.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)