Unthinkable!

Gary Christenson

Sometimes we must consider the unthinkable. Sometimes we must consider the unthinkable.

Official US national debt is $21.6 trillion. Unfunded liabilities are five to ten times higher. Global debt is about $250 trillion. US national debt has doubled every eight to nine years for decades.

- National debt in 2018 – $21.6 trillion

- National debt in 2026? – $40+ trillion

- National debt in 2040? – $100+ trillion

- How much will prices rise when the dollar is devalued by an additional $80 trillion in new US government debt plus more private debt?

- What interest rate will be needed to sell that debt? 5%, 10%, 15% or higher?

- Annual interest payments on current debt run about $500 billion. Both rates and debt are rising. One $ trillion per year in interest payments is coming soon. Six percent interest on $40 trillion requires $2.4 trillion per year, a large smoking hole in the federal budget!

- The government can never pay the debt with dollars of current value. Soon the interest will be difficult to pay.

THE OBVIOUS CONCLUSIONS:

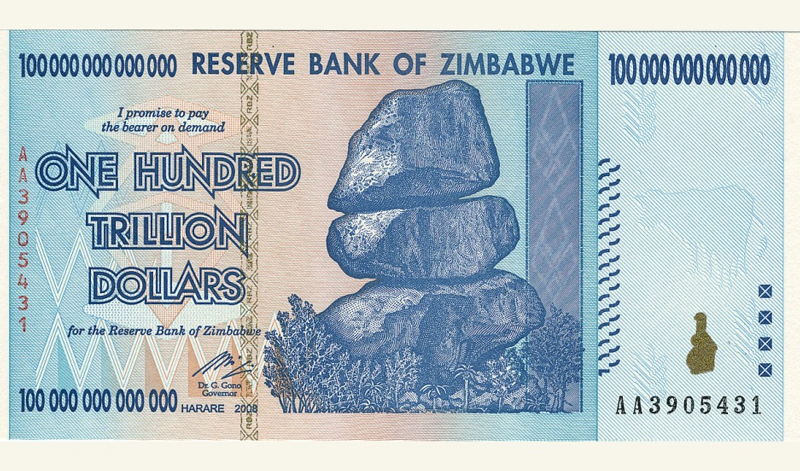

- Sovereign debt (Europe, Japan, the US and others) will default or be hyper-inflated.

- This explosion of debt is everywhere visible and understood by many.

- Nothing is working—that we see—to reverse this accelerating debt-train wreck.

- The political and financial elite know and understand the implications of massive and unpayable debt accumulation.

- Hence they WANT the system to reset, OR… they can’t stop the reset so they are extracting as much wealth in advance as possible.

IMPLICATIONS FOR HYPER-INFLATION AND DEFAULT:

Hyper-inflation destroys more than savings, businesses, retirements and hope. People abandon morality and look for strong leaders or dictators. Governments adapt to survive. They increase taxes, forfeitures, surveillance and police state tactics. Hyper-inflation has occurred many times in the past hundred years in Europe, Asia, Africa and South America. Hyper-inflation creates ugly consequences for the bottom 99%!

Default on $20+ trillion in government debt would write down the value of those bonds to pennies on the dollar, or less. Insurance companies, public and private pension funds, individual savers, hedge funds, Wall Street, many corporations and pensioners would be devastated. Social Security, Medicare, defense contractors and others dependent upon federal tax collection and government spending may be destroyed.

A society that depends upon fake money—unbacked debt based Federal Reserve Notes—could implode when they devalue fake money to near-zero purchasing power. The powers-that-be want to delay the inevitable.

THE UNTHINKABLE SCENARIO – SPECULATION:

If the system can’t continue, and it must implode or hyper-inflate someday, then today seems like a good day to default.

- Declare on a Friday afternoon that the US government will no longer pay interest on debt. Bonds and notes will not be redeemed. The reset will be disastrous for almost everyone. Expect blood in the streets and huge riots within days or weeks. Governments will implement martial Law. Stock and bond markets and Wall Street might take years or decades to recover.

- The titanic pools of fake money – $trillions in debt and levitated stock values – will reset with much lower purchasing power.

- The US economy runs on credit, and most credit will vanish. Cash machines, credit cards and EBT cards might cease working in hours or days. Expect supply disruptions, massive lay-offs, unpaid wages, bank failures, power outages, empty stores… and then it turns worse. People will be desperate and angry.

- The Federal Reserve and politicians will blame anyone and everyone, except themselves, for the devastation, loss of life, imploded economy, market crashes, collapsed pension funds and coast-to-coast misery.

- Digital dollars might purchase little or nothing. Paper dollars will buy a few goods, but food and gasoline might not be available.

- The powers-that-be may declare war, lock-down the economy, expand their control over the media, establish martial law, issue a new paper currency and incarcerate those who resist. (What constitution?)

- From the ashes of an economic disaster might come a new and better world, or another dark age.

- Silver and gold will have tremendous value, but few individuals will physically own either.

The above in not an appealing scenario and it might be optimistic. The consequences of a hyper-inflation are similar, but take longer to manifest. Almost everyone wants to avoid both hyper-inflation and default…

Conclusions:

- The unthinkable scenario is this: Default now, default later or hyper-inflate later!

- The government and Federal Reserve policy of “extend and pretend” is attractive compared to the above “unthinkable” scenario which results from sudden federal debt default.

- The hyper-inflation scenario is equally destructive but extends over several years.

- The 99% want to believe such devastation can’t happen in the United States. That belief is politically correct, comforting, and potentially catastrophic.

- The “Four G’s” are important in either scenario: God, Gold, Guns and Grub. Add silver coins to the “Four G’s” and trust divine intervention.

- Nothing lasts forever, and that includes “reserve currency status,” the credibility of central banks, fiat currency purchasing power, corporate buybacks, unsustainable pension plans, ever-increasing debt and bull markets.

- Silver bullion and coins may not be available except at sky-high prices.

Silver coins are available at Miles Franklin in exchange for fiat dollars. They will recycle Federal Reserve Notes (debts of the Federal Reserve) for silver coins and bars. Call 1-800-822-8080. Email me if you have questions: deviantinvestor “at” gmail.com.

Gary Christenson, hoping “extend and pretend” will survive a long time because few want to face the ugly reality of either hyper-inflation or federal debt defaults.

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of several books, including “Fort Knox Down!” and “Gold Value and Gold Prices 1971 – 2021.” He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy, and central banking. His articles are published on Deviant Investor as well as other popular sites such as 321gold.com, peakprosperity.com, goldseek.com, dollarcollapse.com, brotherjohnf.com, and many others.

deviantinvestor.com

|