Bank of America Is Now Warning Of Full-On Economic Collapse

Tyler Durden

Having predicted back in July that the "most dangerous moment for markets will come in 3 or 4 months", i.e., now, BofA's Michael Hartnett was - in retrospect - wrong (unless of course the S&P plunges in the next few days). However, having stuck to his underlying logic - which was as sound then as it is now - Hartnett has not given up on his "bad cop" forecast (not to be mistaken with the S&P target to be unveiled shortly by BofA's equity team and which will probably be around 2,800), and in a note released overnight, the Chief Investment Strategist not only once again dares to time his market peak forecast, which he now thinks will take place in the first half of 2018, but goes so far as to predict that there will be a flash crash "a la 1987/1994/1998" in just a few months. Having predicted back in July that the "most dangerous moment for markets will come in 3 or 4 months", i.e., now, BofA's Michael Hartnett was - in retrospect - wrong (unless of course the S&P plunges in the next few days). However, having stuck to his underlying logic - which was as sound then as it is now - Hartnett has not given up on his "bad cop" forecast (not to be mistaken with the S&P target to be unveiled shortly by BofA's equity team and which will probably be around 2,800), and in a note released overnight, the Chief Investment Strategist not only once again dares to time his market peak forecast, which he now thinks will take place in the first half of 2018, but goes so far as to predict that there will be a flash crash "a la 1987/1994/1998" in just a few months.

Contrasting his preview of 2018 with the almost concluded 2017, Hartnett sets the sour mood with his very first words, stating that he believes "2018 risk asset catalysts are much less bullish than in 2017" for the simple reason that the bearish positioning going into 2017 has been completely flipped: "positioning now long, not short; profit expectations high, not low; policy close to max stimulus; peak positioning, peak profits, peak policy stimulus means peak asset returns in 2018." He also goes on to point out that the historical omens are poor:

- Bull market in S&P500 would become the longest ever on August 22, 2018 (and the second biggest ever at 2863 on S&P500).

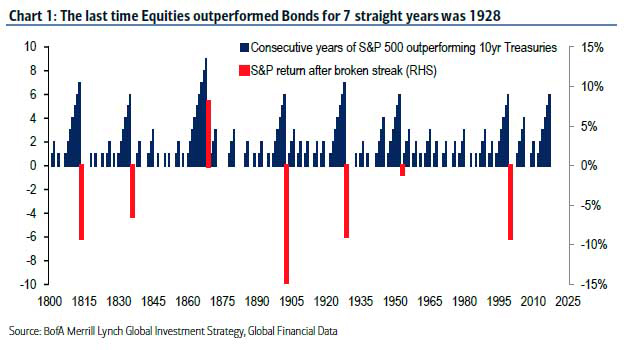

- Equities have only outperformed bonds for seven consecutive years on three occasions in the past 220 years (the last time was 1928 - Chart 1).

Having read Hartnett for many years, we can sense an almost tangible undertone of anger and frustration at central banks for making his bearish forecasts for 2 years in a row go up in a puff of smoke. Which probably explains why one of BofA's best strategists has decided to double down, and raise the stakes beyond a simple market crash, and to a flash crash, if only for dramatic impact.

But before we get there, here is Hartnett's explanation why the market will peak in the first half of 2018:

The Big H1 Top

We forecast a H1 top in risk assets as the last vestiges of QE, the passage of US tax reform and robust early year EPS revisions incite full investor capitulation into risk assets. Potential targets are SPX 2863, CCMP 8000, with US government bond yields moving >2.75%.

We start 2018 with a pro-risk asset allocation of equities>bonds, EAFE>US, gold>oil, bullish US dollar.

We believe the air in risk assets is getting thinner and thinner, but the Big Top in price is still ahead of us. We will downgrade risk aggressively once we see excess positioning, profits and policy.

Peak positioning would be signaled by…

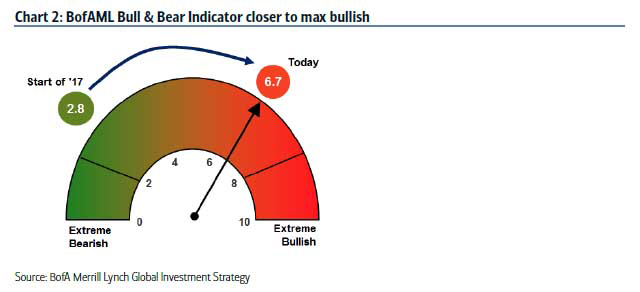

- BofAML Bull & Bear Indicator exceeds “sell signal” of 8 (Chart 2);

- Active mutual equity funds start to see inflows;

- BofAML GWIM equity allocation exceeds 63%, an all-time high (currently 61%).

How to know if/when peak profits arrived?

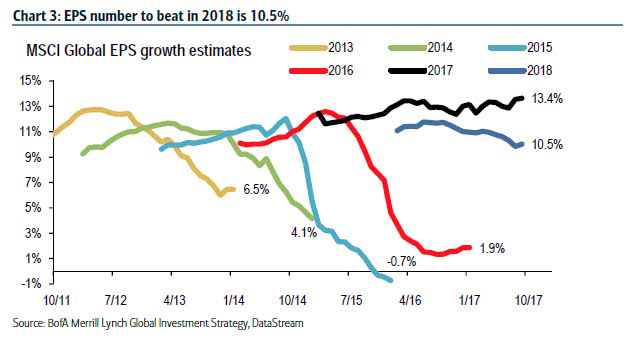

US ISM dips below 55: needs to end 2018 >55 to beat consensus global EPS estimate of 10.5% (Chart 3); Inverted yield curve, which in seven out of seven occasions in the last 50 years has been the prelude to recession.

More to the point, how to know that peak central bank policy has arrived?

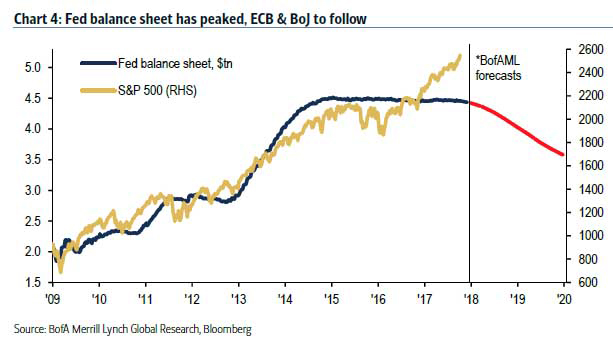

- Q2 peak in G4 central bank liquidity of $15.3tn: net central bank buying of financial assets drops from $1.5tn in 2016 and $2.0tn in 2017 to nearly zero in 2018;

- US tax reform passed, after which investors must discount tighter, not earlier economic policies.

Which brings us to Bank of America's "big long" trade: volatility, and the stark prediction that in just a few months, a 1987-type flash crash which will wipe out trillions in market cap, is imminent.

The Big Long: volatility

Second, we believe that peak positioning, profits, and policy in 2018 will engender peak asset price returns and trough volatility. In 2017, stock market volatility fell to 50-year lows, bond volatility fell to 30-year lows, ETFs accounted for 70% of daily average global equity volume, the AUM of quant hedge funds is now $432bn (up $271bn since 2009).

A flash crash (à la ’87/’94/’98) in H1 2018 seems quite likely, in our view, as the major sedative of volatility, the central banks, start to withdraw liquidity.

According to Hartnett, the right way to to trade the upcoming flash cash and the "Big Long is throguh a combination of long 2yr/short 10yr Treasuries, long TIPS steepener vs flattener in OATei, long SPX put ratio calendar, long Russian equities.

As an added "bonus", in addition to a "big long", the BofA strategist also has a "big short" trade, which perhaps not surprisingly, is in credit.

The Big Short: credit

Third, we believe that higher inflation, higher corporate debt levels, higher bond volatility and the end of the QE era will be most damaging for corporate bonds.

The big 3 consensus assumptions are: Goldilocks, no Fear of Fed/ECB, and no Mean Reversion. The game-changer is wage inflation, which on our forecasts is likely to become more visible. Wage inflation would shatter consensus via higher credit spreads. 3½% US wage growth, 2½% US CPI, and 2% Eurozone CPI are all inflation levels likely to increase volatility and credit spreads.

For those looking to trade in advance of the bursting of the credit bubble, BofA's advice: go long CDX HY & iTraxx XOVER.

* * *

Finally, if that wasn't bad enough, in addition to the combined bursting of the short-vol and long credit bubbles, BofA has one final prophecy: "the biggest risk of all is that the structural “Deflationary D’s” (excess Debt, aging Demographics, tech Disruption) cause wage inflation to again surprise to the downside." Here's why:

The Big Risk: tech bubble

Finally, we believe the biggest risk of all is that the structural “Deflationary D’s” (excess Debt, aging Demographics, tech Disruption) cause wage inflation to again surprise to the downside. The era of excess liquidity, bond yields fall, and the Nasdaq goes exponential. 2018 calls for the big top, big volatility long, big credit short, all once again prove to be way too early. An “Icarus unleashed” bubble nonetheless could end in 2019 with a bear market on hostile Fed hiking, Occupy Silicon Valley and War on Inequality politics.

Translation: the Fed - having created the record wealth, income and class divide that resulted in Brexit, Trump and a wave of nationalism across Europe - is unable to stop, and unleashes civil, and perhaps world war as its final act.

How to hedge against "the biggest risk of all"? Hartnett has two words of advice: buy gold.

our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|