There Are Decades When Nothing Happens, And Weeks Where Decades Happen

Tad Rivelle

In real estate there is a saying that time kills all deals. Hopeful forecasts for a V-shaped recovery following in the wake of 45- or 60-day “lockdowns” have ceded to a different reality: notwithstanding monstrous QE, titanic Federal deficits, stimulus checks, CARES Act, tightening credit spreads, and a booming stock market, unemployment and business conditions for many remain sobering. Bizarrely, this has been the one, the only recession where, at least initially, disposable incomes rose, and net worths have grown. This has encouraged many to gain comfort with the possibility that a sustainable recovery has taken, or shortly will take hold, relegating the pain and suffering of 2020 to the history books. In real estate there is a saying that time kills all deals. Hopeful forecasts for a V-shaped recovery following in the wake of 45- or 60-day “lockdowns” have ceded to a different reality: notwithstanding monstrous QE, titanic Federal deficits, stimulus checks, CARES Act, tightening credit spreads, and a booming stock market, unemployment and business conditions for many remain sobering. Bizarrely, this has been the one, the only recession where, at least initially, disposable incomes rose, and net worths have grown. This has encouraged many to gain comfort with the possibility that a sustainable recovery has taken, or shortly will take hold, relegating the pain and suffering of 2020 to the history books.

Is it realistic to believe we stand on the precipice of prosperity? Perhaps given that nothing that has happened this year could have, from the perspective of one short year ago, appeared plausible, maybe we should revert to Voltaire’s advice to just “tend our own gardens.” But, no, we will offer our perspective, if for no other reason than giving us all the opportunity, one years’ hence, to wonder how we missed what we will inevitably have missed during these uncertain times.

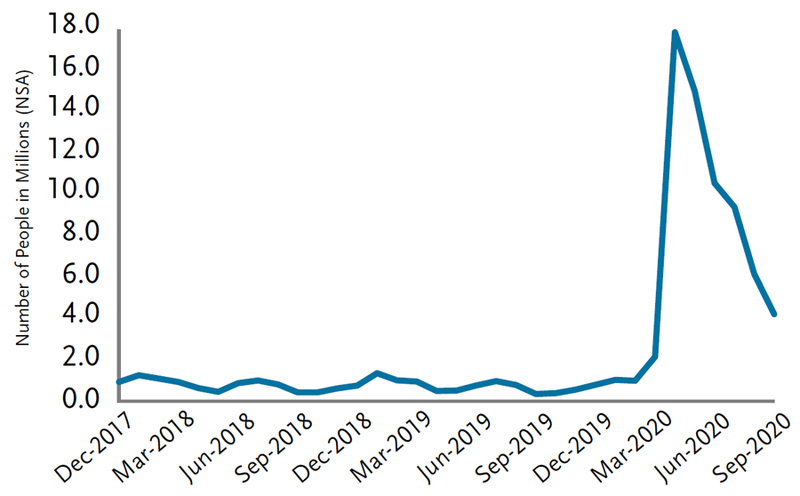

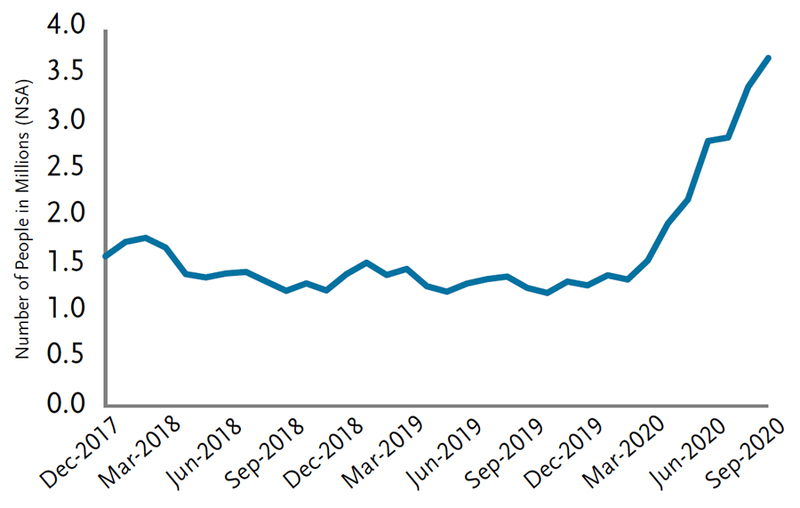

Let’s begin at the beginning: the pandemic was – and remains – a shock, a catalyst. But recessions are not so much shortfalls in demand, as they are transformations of demand. And, since producers are continually dancing to the tune of demand side realities, businesses re-position and re-size accordingly. But since capital and labor does not reposition on a dime, frictions result. It takes time for producers to figure out what their new markets might be and what the earnings power of theirs, and others, assets will be. Unemployment is the inevitable result. True, the massive spike in the “temporarily” out of work category has fallen in sync with the hope of the V-shaped crowd. Yet, more ominously, many companies are beginning to confront the changed realities of their businesses, and this is forcing an expansion in the ranks of those permanently unemployed:

Unemployed: On Temporary Layoff

Source: Bureau of Labor Statistics, Bloomberg, TCW

Unemployed: Permanent Job Losers

Source: Bureau of Labor Statistics, Bloomberg, TCW

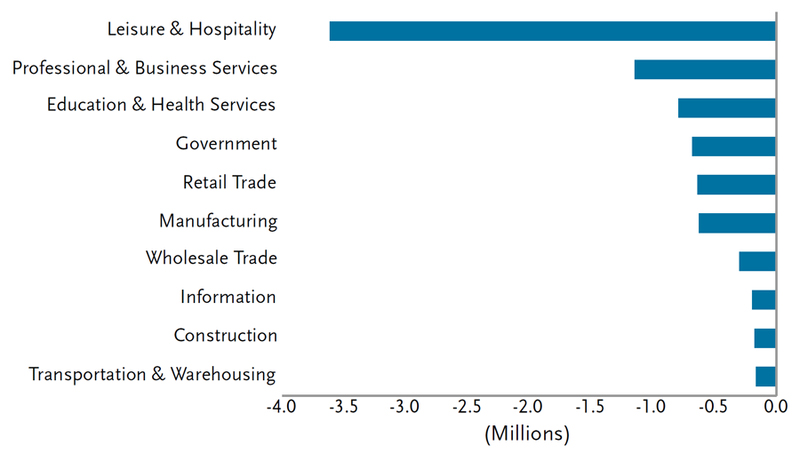

As we all recognize, the pain of the economic adjustment has disproportionately fallen on the industries in the eye of the social distancing storm:

Net Change In Jobs Since February 2020

Source: Bureau of Labor Statistics, TCW

Yet, if recessions are periods of transformation, there can be no going back to the pre-COVID economy. But what then will take its place? While it is perhaps just a bit glib to say it this way, I believe we are witnessing the birth of the economy of 2030 before our very eyes. Businesses that blithely, and perhaps habitually assumed that professional office work meant retaining the physical layouts of say the past two decades have been woken from their slumber. Perhaps the writing has been on the wall for some time already: after all, such itinerant professional workers as management consultants have lived and worked on the road for years, demonstrating that headquarters can be more of a hub and less of a second home. Now, how many tech, finance, legal, accounting, public relations, and advertising workers may follow in their wake? Surely not 100%. And surely not none. On this subject as in so many issues of our day, arguments on both sides abound while the future facts remain unformed and in dispute.

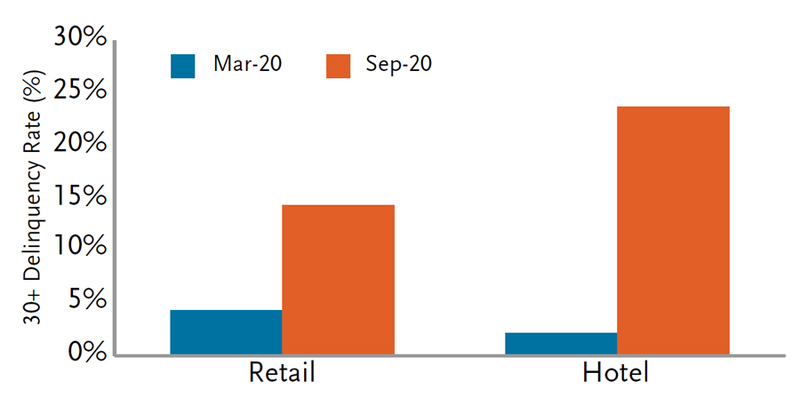

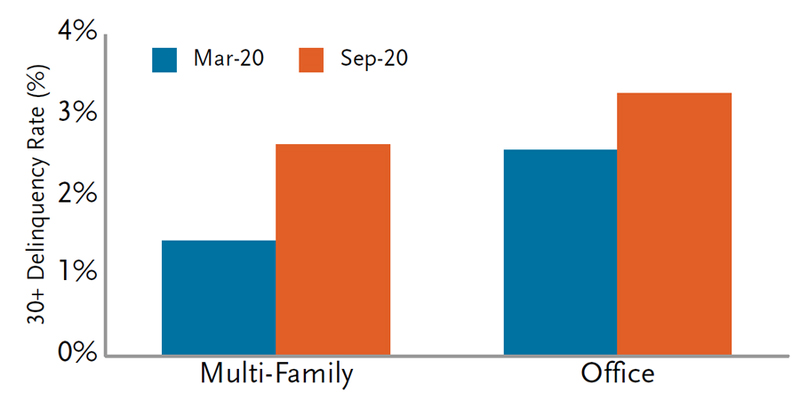

Delinquency Rates: Retail and Hotels

Source: Bank of America, TCW

Delinquency Rates: Multi-Family and Office

Source: Bank of America, TCW

John Lennon famously sang that life is what happens when you’re busy making other plans. While governments plan their next stimulus and executives update their strategic plans, the grass root choices of employees, consumers, and competitors will largely determine how the next decade’s worth of changes take place over the next 12-months.

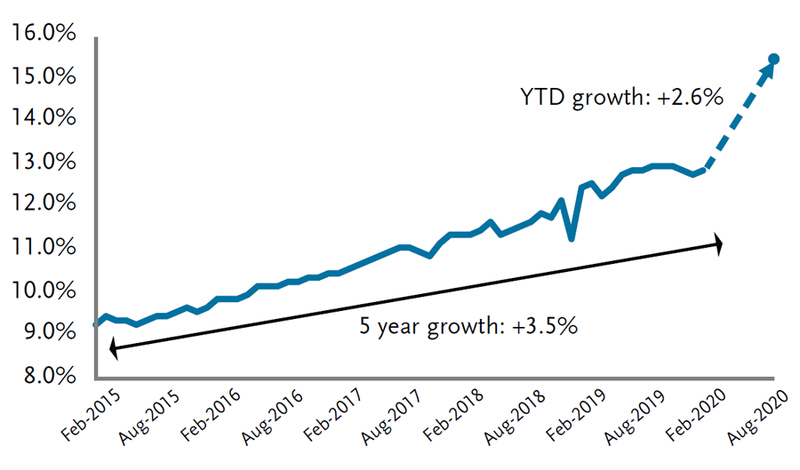

U.S. E-Commerce Penetration (% of all retail sales)

Source: Census Bureau, Bloomberg, TCW

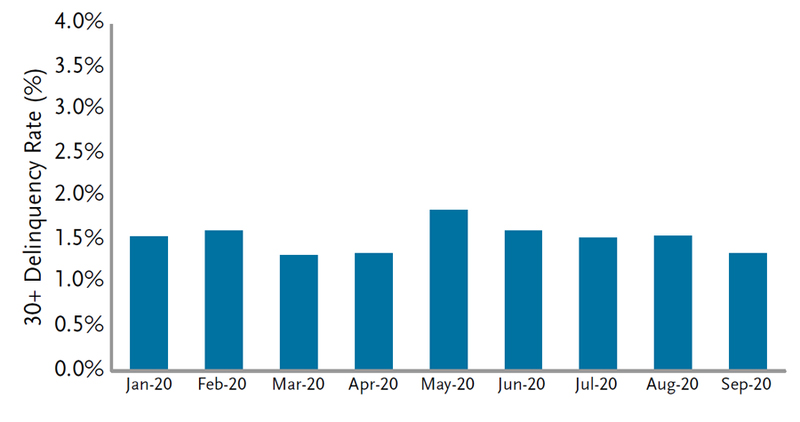

Industrial CRE Delinquency Rate

Source: Bank of America, TCW

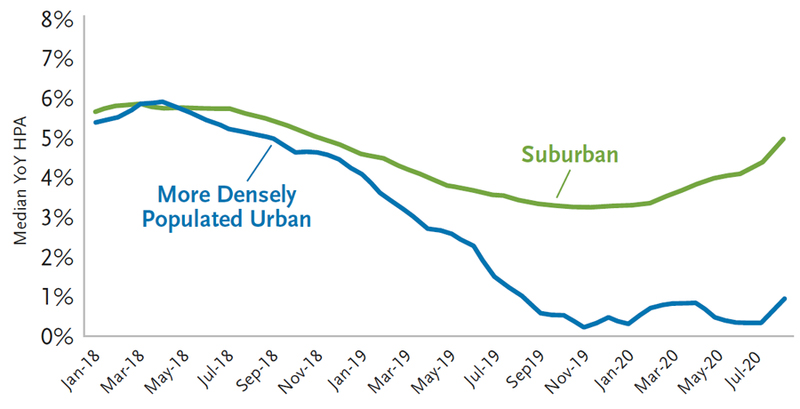

These choices are very much evident in the growth of e-commerce (where roughly what had been one years’ worth of penetration is happening every month), in the rising delinquencies of CRE loans, and in the apparent migration out of the hip and high growth urban centers to the placid and more affordable suburbs.

Home Prices

Source: Zillow, Dpt. of Defense, U.S. Census Bureau, Morgan Stanley

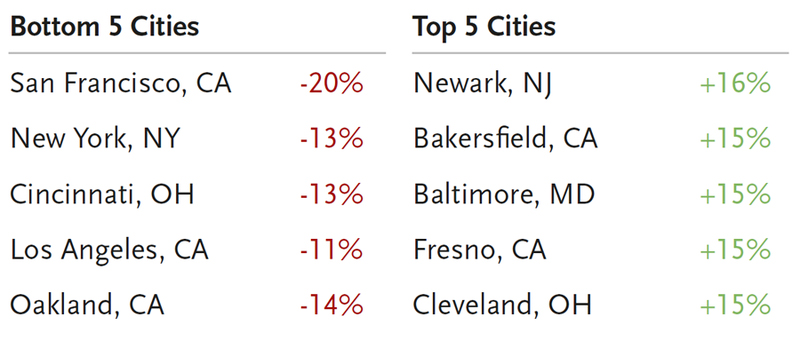

Two Bedroom Apartment Median Rent Price YoY Changes as of October 2020

Source: Zumper National Rent Report

Historically, with every recession, this question emerges: what will we do with all the production facilities that are no longer needed and with all the workers who once worked there? In the ’70s, it was aerospace. In 1982, the plight of the steel industry was front and center. In 1990, it was S&Ls and the many white elephants they financed. Whatever the challenge, human ingenuity eventually works out a solution that gives rise to a better, if initially unfamiliar future. While it is still too early to call out what that future will be, we share the following observations and conclusions from the capital markets:

-

Massive and continuing stimulus cannot be sustained without ultimately severe and unpalatable consequences.

-

The Fed will, nonetheless, suppress rates – especially front end rates – and volatility with all its might.

-

The ongoing economic transformation serves to make many assets obsolete and to devalue the debt held against those assets.

-

COVID is the catalyst, but the changes set in motion will prove to outlast the pandemic. As such a full V-shaped recovery is a dubious proposition.

Strategically, this suggests a fixed-income investment strategy that is supported by these pillars:

- Risk based assets, such as credit, that have largely returned to pre-COVID pricing levels should be downsized.

- Agency mortgage assets that benefit from the Fed’s big bear hug should be embraced as a means to add yield and carry.

- Non-agency mortgages will continue to provide idiosyncratic opportunities, in both the non-QM as well as legacy space.

- Value destruction in CRE and CMBS has yet to be realized. The “fat” pitches will be coming, but probably not until banks inevitably initiate a round of foreclosures.

- Maintain liquidity as a means to opportunistically invest when surprises inevitably happen during this time of opacity.

Tad Rivelle is Chief Investment Officer, Fixed Income, overseeing over $200 billion in fixed income assets, including $106 billion of fixed income mutual fund assets under the TCW Funds and MetWest Funds brands. ... Rivelle was also the co-director of fixed income at Hotchkis & Wiley and a portfolio manager at PIMCO.

www.tcw.com

|