UN Report Cites Central Bank Liquidity Bubbles, Loose Money, Debt Expansion

Mike "Mish" Shedlock

A UN report has everything wrong as to the cause of current problems. Yet, the report mentions central bank liquidity. A UN report has everything wrong as to the cause of current problems. Yet, the report mentions central bank liquidity.

Seldom does one see a report that "debt is the problem" while being 180 degrees wrong as to the cause of the buildup in debt.

The United Nations' Trade and Development Report for 2018 blames the "Free Trade Delusion" for what ails the word.

International trade in the late nineteenth century was managed through an unholy mixture of colonial controls in the periphery and rising tariffs in the emerging core, often, as in the case of the United States, pushed to very high levels. But like today, talk of free trade provided a useful cover for the unhindered movement of capital and an accompanying set of rules – the gold standard, repressive labour laws, balanced budgets – that disciplined government spending and kept the costs of doing business in check.

Wow. There's more:

But if there is one lesson to take from the interwar years, it is that talking up free trade against a backdrop of austerity and widespread political mistrust will not hold the centre as things fall apart. And simply pledging to leave no one behind while appealing to the goodwill of corporations or the better angels of the super-rich are, at best, hopeful pleas for a more civic world and, at worst, willful attempts to deflect from serious discussion of the real factors driving growing inequality, indebtedness and insecurity.

With such an ass-backward premise, one might expect the entire report to be wrong. Far from it.

Liquidity Driven Bubbles

Unlike their progressive MMT brethren, the authors understand some things:

- There's an unsustainable buildup of debt

- There are huge asset bubbles

- Cheap liquidity stretched valuations to extreme levels

Explosion of Debt

Private debt has exploded, especially in emerging markets and developing countries, whose share of global debt stock increased from 7 per cent in 2007 to 26 per cent in 2017, while the ratio of credit to non-financial corporations to GDP in emerging market economies increased from 56 per cent in 2008 to 105 per cent in 2017.

Global Policy Tightrope

Vulnerability is reflected in cross-border capital flows, which have not just become more volatile but turned negative for emerging and developing countries as a group since late 2014, with outflows especially large in the second quarter of 2018. Clearly, markets turned unstable as soon as the central banks in advanced economies announced their intention to draw back on the monetary lever. This leaves the global economy on a policy tightrope: reversing the past loose monetary policy (in the absence of countervailing fiscal policy) could abort the halting global recovery; but not doing so simply kicks the policy risks down the road while fueling further uncertainty and instability.

Contagion

What is more, the implications of monetary policy tightening, whether now or later, could be severe because of the various asset bubbles that have emerged, even as the chances of global contagion from problems in any one region or segment now seem greater than ever.

Synchronized Property Bubbles

The synchronized movement of equity markets across the globe is one indicator of this. While property price movements in different countries have been less synchronized, they have also turned buoyant once again after some years of decline or stagnation after the Great Recession.

Cheap Liquidity and Carry Trades

The cheap liquidity made available in developed country markets led to overheating in asset markets in both advanced and developing economies, as investors engaged in various forms of carry trade. The impact of the liquidity surge on equity markets has been marked, as valuations have touched levels not warranted by potential earnings. This has resulted in a fundamental disconnect between asset prices and real economic forces. With no support from fiscal policy, monetary measures failed to spur robust recovery of the real economy.

Unsustainable Levels

While asset prices have exploded to unsustainable levels, nominal wages increased by much less, and stagnated in many countries. This has led to further increases in income inequality, which implied that sluggish household demand could only be boosted through renewed debt bubbles.

Investment Dives

Meanwhile, debt expansion has not financed increased new investment.In advanced economies, the investment ratio dropped from 23 per cent on average in 2008 to 21 per cent in 2017. Even in emerging markets and developing countries, the ratio of investment to GDP was 32.3 per cent in 2017, only marginally higher than the 30.4 per cent achieved in the crisis year 2008, with some larger economies registering a drop over this period.

After those brilliantly-written paragraphs the report then launches into a tirade on the "wretched spirit of monopoly", hyperglobalization, the need for new regulatory policy, and the need to breakup companies like Google (not mentioned explicitly).

Tariffs

The report then switches back to reality with a blast at tariffs.

There should be little doubt that using tariffs to mitigate the problems of hyperglobalization will not only fail, but also runs the danger of adding to them, through a damaging cycle of retaliatory actions, heightened economic uncertainty, added pressure on wage earners and consumers, and eventually slower growth.

Cause and Effect

Analyzing the ping-pong nature of the report is simple.

The authors look at symptoms of problems as if they are in fact the problems.

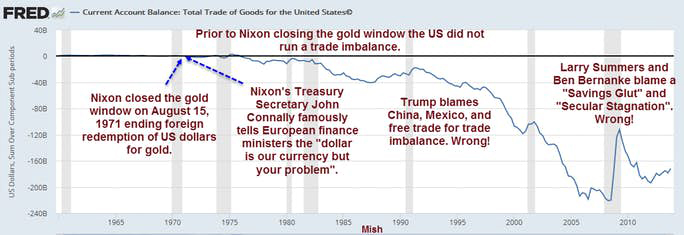

Instead of blaming central banks and the lack of a gold standard to enforce trade, the authors blame "hyperglobalization" a symptom of the problem that escalated the moment Nixon closed the gold window.

Shortly after Nixon ended gold convertibility , global credit exploded as did deficit spending, and monstrous never-ending trade deficits.

Trade Imbalance Cause

Damning Blast of Central Banks

The report ought to be a wake-up call against the extremely counterproductive policies of central banks.

Instead, the report blames a free market that ought to exist, but doesn't.

For further discussion, please see Disputing Trump’s NAFTA “Catastrophe” with Pictures: What’s the True Source of Trade Imbalances?

Mike "Mish" Shedlock

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management.

Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

You are currently viewing my global economics blog which typically has commentary every day of the week.

mishtalk.com

|