Gold Gains Nearly 1% On Week As Global Stock Markets Fall Sharply

Gold Core

Key Gold and Precious Metals News, Commentary and Charts This Week Key Gold and Precious Metals News, Commentary and Charts This Week

Here is our Friday digest of the important news, commentary, charts and videos we were informed of this week.

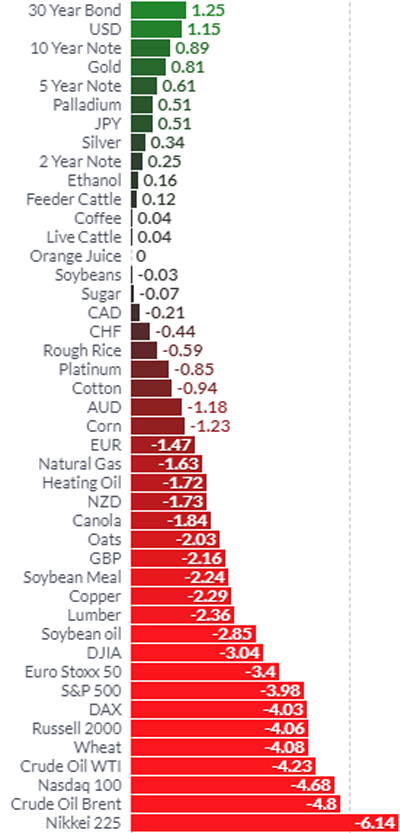

The old Wall Street adage is that they "never ring a bell at the top" but there was a real sense this week that we may have seen a turning point. U.S. stocks including both the NASDAQ and the S&P 500 have seen sharp falls already this week of 4% and nearly 5% respectively.

Weekly Relative Performance (Source: Finviz.com) Weekly Relative Performance (Source: Finviz.com)

Asian and European markets did not fare much better with the Euro Stoxx 50 down 3.4% and Nikkei down 6.1% for the week.

This resulted in a rotation out of risk assets and into safe haven assets which saw certain government bonds, the dollar, gold and silver catch a bid.

Gold is 0.8% higher for the week and 3.5% higher month to date. Safe haven gold is again acting as a hedge and safe haven asset, exactly when investors need one.

Much of the news flow and price action this week was bearish for risk assets and quiet bullish for the precious metals. The world's central banks, already the biggest holders of gold, are again looking at gold as a safer reserve asset than the U.S. dollar. Hungary increased its gold reserves by a massive 1,000% due to increasing “safety concerns.”

Large banks such BofAML and Goldman Sachs are again recommending gold to their clients as a diversification. This week BofAML (Bank of America Merrill Lynch) recommended as an "asset hedge" and "value play.”

Property markets around the world are seeing price falls - some sharply. This is being seen in London, Sydney, Vancouver and in other overvalued housing markets.

Prudent investors are positioning themselves in physical gold due to the increasing risks of sharp market corrections or indeed a crashes.

The 'market bells' rang a little bit louder this week ...

► GoldCore.com was founded in 2003 and has become one of the leading bullion brokers in the world for both delivery and storage. ► GoldCore.com was founded in 2003 and has become one of the leading bullion brokers in the world for both delivery and storage.

► GoldCore are international bullion dealers and have over 4,000 clients in over 40 countries, with over $205 million in assets under management and storage.

► We help investors, individual to institutional, to protect and grow their wealth with the provision of the safest forms of precious metals ownership - allocated physical gold, silver, platinum and palladium bullion coins and bars. We offer mass affluent, pension owners, HNW, UHNW and institutional investors including family offices, gold, silver, platinum and palladium bullion in London, Zurich, Singapore, Hong Kong and Perth.

► Our bullion trading platform is one of the most sophisticated and safest in the industry. The bullion bars are individually allocated & segregated under direct client control and ownership of the client. Bullion is owned in ultra-safe vaults strictly outside the global banking system, greatly reducing counter party risk.

IRL +353 (0)1 632 5010

UK +44 (0)203 086 9200

US +1 (302)635 1160

www.goldcore.com

|