Federal Reserve President Kashkari’s Masterful Distractions

MN Gordon

The True Believer The True Believer

How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard.

Minneapolis Fed president Neel Kashkari attacking a block of wood with great zeal. [PT]

Photo credit: Linda Davidson / The Washington Post

Minneapolis Federal Reserve President Neel Kashkari is a man with strong convictions. He is what the late Eric Hoffer would have classified as “the true believer.” According to Hoffer:

“It is the true believer’s ability to ‘shut his eyes and stop his ears’ to facts that do not deserve to be either seen or heard which is the source of his unequaled fortitude and constancy. He cannot be frightened by danger nor disheartened by obstacle nor baffled by contradictions because he denies their existence.”

For starters, Kashkari believes the Federal Reserve, an unelected board of bureaucrats, can crunch economic data into pie graphs and bar charts and draw conclusions as to what they should fix the price of credit at. Moreover, he believes that by fixing credit at the “correct” price, the Fed can somehow “optimize” the economy.

This idea is patently false. Remember, the economy is comprised of billions of people with ever changing interactions. Activities and exchanges are always adapting.

What may be the correct price of credit at one time is precisely the wrong price of credit at another. Only a free market for credit, where rates are agreed to by willing borrowers and lenders, and unobstructed by government decree, can self-correct in real time to properly meet changing supply and demand.

Well Considered Conclusions

But even if it were true that economic data could be used by the Fed to properly fix the price of credit, there is an even greater leap of faith that Kashkari takes with unequaled fortitude. Specifically, Kashkari wholeheartedly accepts data contrived by federal bureaucrats as if it were the gospel truth.

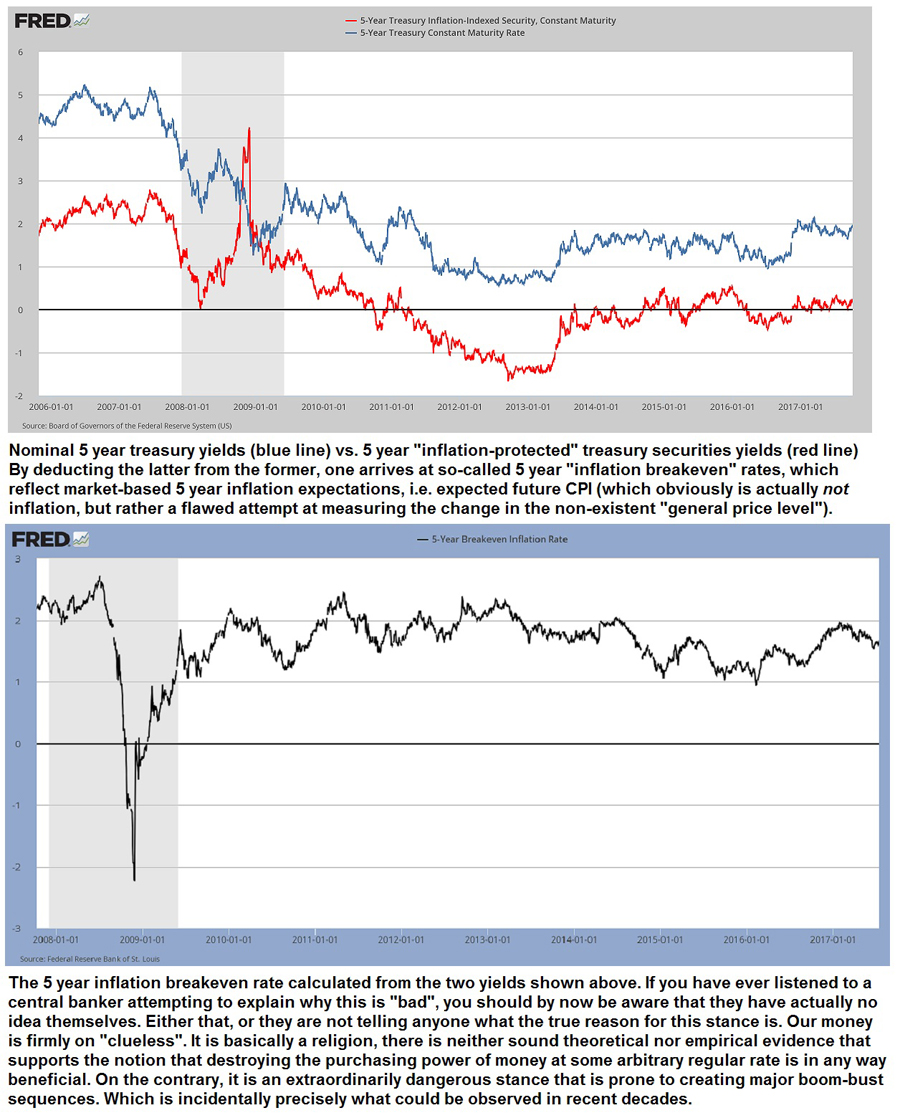

“Inflation breakeven rates” are an attempt to measure the inflation expectations of market participants by comparing two sets of market-derived bond yields (see explanation in the annotation above). As you can see, the market tends to change its mind frequently, and occasionally to a very large extent. As we point out in the annotation, the idea that it is “bad” for the economy if the central bank fails to constantly debase the money it issues has no basis in fact. No other shibboleth held as sacrosanct by the central planners is as utterly bereft of theoretical and empirical evidence as this one. One could essentially call the Fed a faith-based printing company. [PT].

These fabricated abstractions are what Kashkari and his cohorts use as the basis for fixing the price of credit to their liking. No doubt, the methodology of using economic data to identify apparent aggregate demand insufficiencies and perceived supply gluts is flawed.

Unemployment. Gross domestic product. Price inflation. These data points are all fabricated and fudged by people with their own biases and prejudices. For each headline number, there are a list of footnotes and qualifiers. Hedonic price adjustments. Price deflators. Seasonal adjustments. Discouraged worker disappearances. These subjective adjustments greatly affect the results. So, what good are they?

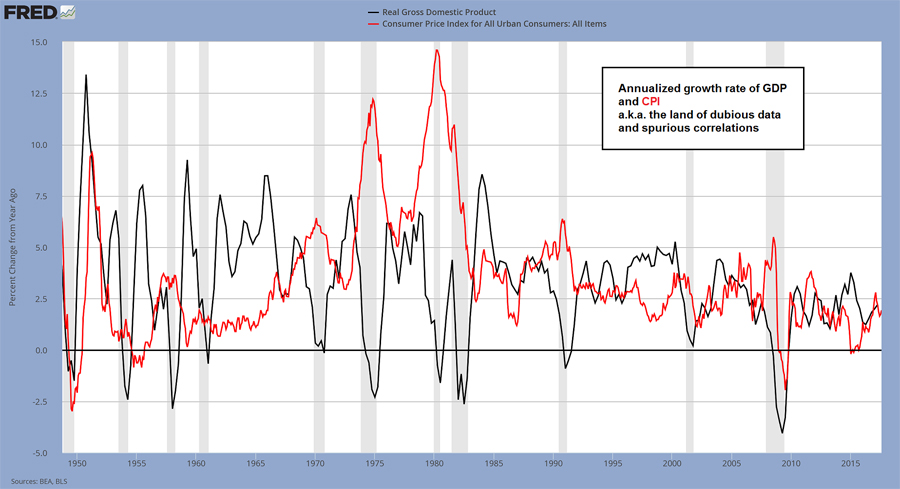

GDP and CPI, y/y change rates. Apart from the fact that the methodologies used to compile these data are questionable and not entirely free of political considerations, many of the things they purport to “measure” are actually not measurable; and to the extent that the data are measurable, they only have value to economic historians and to those who wish to meddle in the economy. Bureaucratic meddling in the economy is apodictically certain to worsen its performance, but it usually does create short term advantages for select interest groups. [PT] – click to enlarge.

On Monday, in an article titled, My Take on Inflation, Kashkari demonstrated his full faith and convictions in government data – and the Fed’s ability to use it to pilot the economy. We won’t waste your time with his many rambling explanations. But in the spirit of observing a lost man navigating through the wilderness using butterflies as reference markers, we offer Kashkari’s well considered conclusion:

“If I am correct that the Fed’s own actions are an important factor driving surprisingly low inflation and falling inflation expectations, the implication is that our policy should focus on supporting inflation to ensure that we are on track to return to our 2 percent target. My preference would be not to raise rates again until we actually hit 2 percent core PCE inflation on a 12-month basis, unless we have seen a large drop in the headline unemployment rate signaling that we have used up remaining labor market slack, or a surprise increase in inflation expectations.”

Do you follow the logic? If not, consider it confirmation that your brain hasn’t been turned to mush by what passes today as learned economic thought.

Federal Reserve President Kashkari’s Masterful Distractions

Indeed, these are the words of the true believer. There is no consideration that the data might be garbage. Kashkari likely never considered the possibility. Instead, he goes about his dubious profession with the certainty of a carpenter hanging kitchen cabinets. But unlike the carpenter, Kashkari doesn’t need to measure twice as to cut once. He operates with unmatched precision.

Kashkari, without question, is a true believer in extreme economic intervention. If you recall, as federal bailout chief, he functioned as the highly visible hand of the market. In early 2009, he arrived at work each day with a smile and went about the business of rapidly dispersing Henry Paulson’s $700 billion of TARP funds to the government’s preferred corporations. He did so under the pretense that he was destroying capitalism to save it.

Yet it is questionable work experience like this that allows a person to rise to the level of a Federal Reserve President. Moreover, if Kashkari continues his zealous dedication to his craft, there is no reason he cannot ascend to Fed Chairman or Managing Director of the International Monetary Fund. In fact, Jeffrey Gundlach believes Kashkari will be the next Chairman of the Federal Reserve.

The point is, Kashkari and his cohorts have aided and abetted the growth in public and private debt well beyond their serviceable limits. They have debased the dollar to less than 5 percent of its former value and propagated bubbles and busts in real estate, stock markets, emerging markets, mining, oil and gas, and just about every other market there is. At the same time, they’ve been remarkably successful at enriching private bankers.

They don’t dare call it a bubble… establishment rag “The Economist” notices that asset prices might be a tad elevated. Gee, we wonder how that happened! Could it be all that money printing? [PT]

Hence, the true believers that keep the charade going via pseudo academic distractions about inflation targets, headline unemployment, labor market slack, supply gluts and other aggregated nonsense, are promoted for running interference. When it comes to being a tool for the big banks, Kashkari’s distractions are masterful.

Dulling the dollar – this Federal Reserve policy-induced vanishing act has gravely retarded economic growth and technological progress, enriched the already rich at the expense of the poor, and corroded the moral fabric of society. It is the reciprocal of the bubbles mentioned above. Call it a symptom of insidious plunder. We have no idea what’s supposed to be good about that. [PT].

Charts by: St. Louis Fed

Chart annotations and image captions by PT

MN Gordon is President and Founder of Direct Expressions LLC, an independent publishing company. He is the Editorial Director and Publisher of the Economic Prism – an E-Newsletter that tries to bring clarity to the muddy waters of economic policy and discusses interesting investment opportunities. MN Gordon is President and Founder of Direct Expressions LLC, an independent publishing company. He is the Editorial Director and Publisher of the Economic Prism – an E-Newsletter that tries to bring clarity to the muddy waters of economic policy and discusses interesting investment opportunities.

economicprism.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)