Nuclear Levels of QE Are Coming… The Markets Are About to “Get It”

Graham Summers

The Central Banks are going to go absolutely nuclear within the next 18 months. The Central Banks are going to go absolutely nuclear within the next 18 months.

In the last few weeks we’ve seen the Bank of Japan, the Bank of England, the European Central, and the US Federal Reserve all push for fiscal stimulus instead of monetary stimulus.

What this means is that Central Banks are collectively saying, “We have reached the end of what QE and rate cuts can do, it’s now the Government’s responsibility to juice the system.”

Everyone believes this to signal that the Central Banks are done with monetary policy. They are… but only until the next major problem hits.

The ONLY reason that Central Banks are pulling back now is because the system has calmed down. I GUARANTEE you that as soon as the US is in a confirmed recession, or some other negative issue hits, we will see NUCLEAR rounds of QE announced.

Consider the following, since 2008, Central Banks have announced over 600 interest rate cuts and over $10 TRILLION in QE.

During that time, there has not been a SINGLE month in which there was not at least ONE Central Bank engaged in QE. NOT ONE SINGLE MONTH.

And this was during a “recovery.”

Indeed, consider that as I write this, the ECB and BoJ are engaged in a RECORD QE program of $180 BILLION per month.

And we are not even in another recession yet!

The moment another recession hits we are going to see MASSIVE QE programs announced. How do I know this?

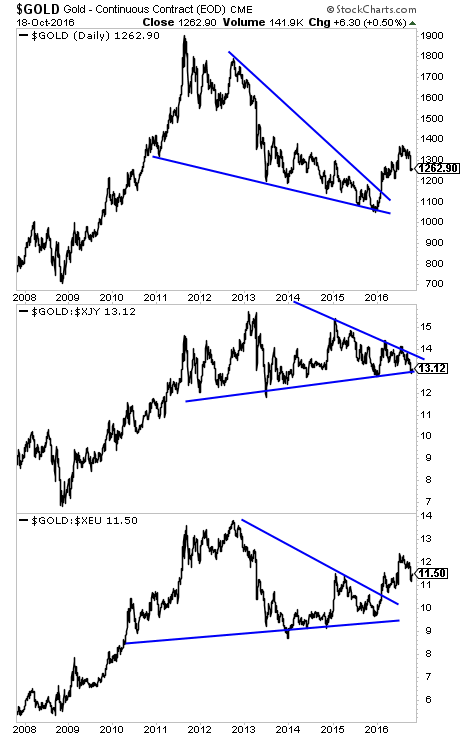

GOLD HAS BROKEN OUT OF ITS MULTI-YEAR DOWNTREND PRICED IN EVERY MAJOR CURRENCY.

Below is Gold’s chart prices in $USD, the Japanese Yen, and the Euro. Gold has BROKEN OUT big time in $USD and Euros. It’s about to do the same in Yen.

Gold has figured it out. NUCLEAR levels of QE are coming. And they will be coming from Every. Major. Central. Bank.

Over 99% of investors have missed this. They continue to focus on stocks. They’re missing a once in 30 years event that has begun in the metals markets.

HUGE money will be made from this trend going forward.

To that end, in the last two weeks Private Wealth Advisory subscribers have opened SIX new inflation trades.

As I write this, ALL SIX OF THEM ARE ALREADY UP BETWEEN 6% and 8%.

Let me be clear, this is just the beginning of this move. By the time we’re done, I expect all six of these to be TRIPLE digit winners.

Seriously at this point, if you’re not taking out a trial subscription to our Private Wealth Advisory newsletter, I don’t know what else to tell you.

First of all, 109 of our last 111 trades were WINNERS.

That is not a typo. We’ve only closed TWO losers in the last TWO YEARS.

This is a record in investing, a winning rate of 98% over a 24 month period.And we’ve done this during one of the most difficult eras in investing history.

In September alone we’ve closed WINNERS of 6%, 8%, 11%, 14% and 19%.

If you don’t believe me, you can take out a trial for 30 days for 98 cents.

If you find Private Wealth Advisory is not what you’re looking for, simply email us and you won’t be charged another cent.

However, I have no doubt you, like our other subscribers will stay with us. Most subscribers make enough money on a single one of our trades to cover the cost of an entire YEAR’S subscription (just $199).

Indeed, less than 10% of subscribers choose NOT to stay with us. And the ones that DO cancel do so because they’re simply not active investors and prefer owning a single mutual fund.

I know you’re not that kind of investor. You’re looking for regular market crushing gains and minimal losers to grow your capital like a rocket ship.

To take out a 30 day trial subscription to Private Wealth Advisory for just…. 98 cents.

CLICK HERE NOW!!!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

PS. I almost forgot, a 30 day trial subscription to Private Wealth Advisory for just 98 cents comes with SIX SPECIAL INVESTMENT REPORTS.

The two most critical right now are:

- The Inflation Secrets Your Broker Won’t Tell You About

- Bullion 101: How and Why to Buy Gold and Silver

These reports are yours to keep EVEN IF YOU CHOOSE TO CANCEL YOUR SUBSCRIPTION.

How’s that for a NO RISK offer?

To take out a 30 day trial subscription to Private Wealth Advisory for just 98 cents.

CLICK HERE NOW!!!

Graham Summers is Chief Market Strategist for Phoenix Capital Research, an independent investment research firm based in the Washington DC-metro area with clients in 56 countries around the world.

Graham’s clients include over 20,000 retail investors as well as strategists at some of the largest financial institutions in the world (Morgan Stanley, Merrill Lynch, Royal Bank of Scotland, UBS, and Raymond James to name a few).

His views on business and investing has been featured in RollingStone magazine, The New York Post, CNN Money, Crain’s New York Business, the National Review, Thomson Reuters, the Glenn Beck Show, and more.

phoenixcapitalresearch.com/

|