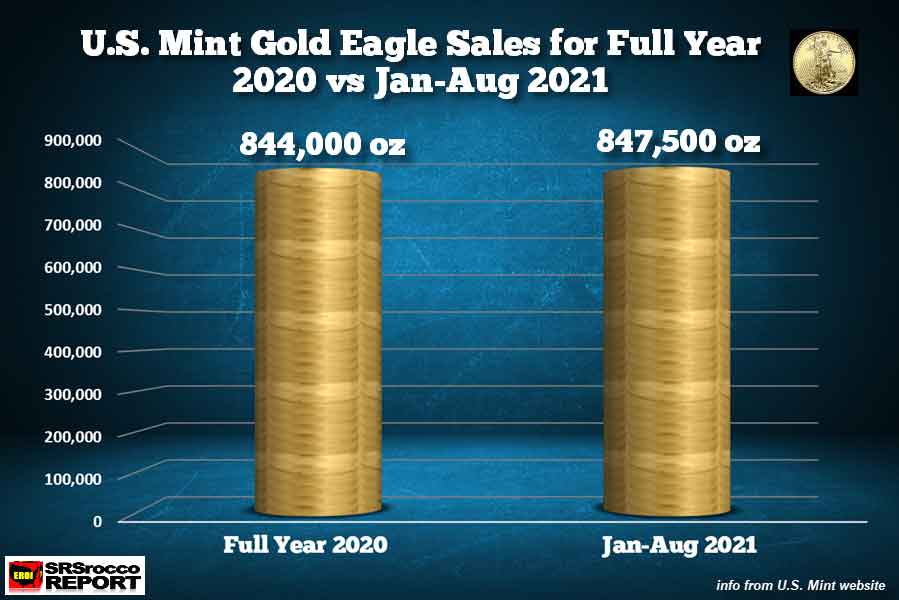

SUPER-STRONG INVESTOR DEMAND: Gold Eagle Sales

Already Surpass Full-Year 2020 Sales

Steve St Angelo

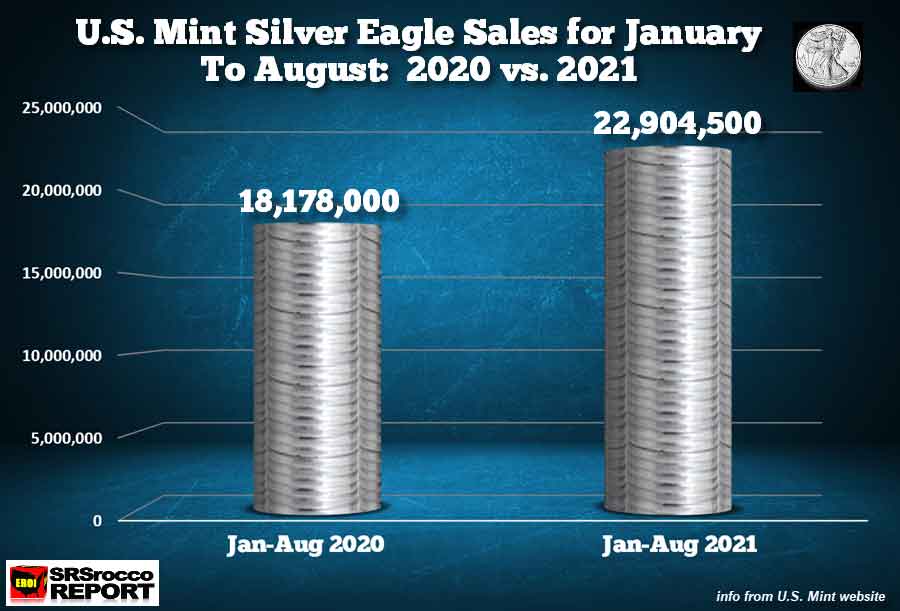

With continued strong demand for precious metals, U.S. Mint Gold Eagle Sales already surpassed last year’s total, and there are still four months remaining in the year. That turns out to be a great deal of investor money. At $1,900 per coin, that’s $1.6 billion so far this year. Also, Silver Eagle sales nearly reached four million in August. Most Dealers are still charging between $9-$10 over spot for the brand-new redesigned 2021 Silver Eagles. With continued strong demand for precious metals, U.S. Mint Gold Eagle Sales already surpassed last year’s total, and there are still four months remaining in the year. That turns out to be a great deal of investor money. At $1,900 per coin, that’s $1.6 billion so far this year. Also, Silver Eagle sales nearly reached four million in August. Most Dealers are still charging between $9-$10 over spot for the brand-new redesigned 2021 Silver Eagles.

The U.S. Mint sold an average of 936,000 Silver Eagles per week and 32,400 oz of Gold Eagles per week in August. Thus, the Silver Eagle to Gold Eagle buying ratio has been lower this year at 27/1 due to the strong demand for gold.

The U.S. Mint updated its website today, reporting 847,500 oz of Gold Eagle sold this month compared to 844,000 oz sold for Full-year 2020.

If sales of Gold Eagles remain strong for the rest of the year, we could see 1.1-1.2 million oz sold. Now, for Silver Eagles, the U.S. mint sold 3,904,500 official coins in August for a total of 22,940,500 for 2021 versus 18,178,000 for the same period last year.

The U.S. Mint has sold nearly 5 million more Silver Eagles this year than during the same period in 2020. With an excellent chance of selling another 10 million Silver Eagles for the last four quarters, total figures for 2021 will be 34 million. Last year, the U.S. Mint sold a bit more than 30 million Silver Eagles. If Silver Eagle sales continue to remain very strong, we could see 35-36 million sold.

I believe we are just beginning to see the first stages of precious metals demand. With the Fed and central banks using PAPER FINANCIAL ENGINEERING to continue a lifestyle that we can no longer afford… ENERGY-WISE, 99% of investors have no idea how unprepared they are for the coming problems.

Independent researcher Steve St. Angelo (SRSrocco) started to invest in precious metals in 2002. Later on in 2008, he began researching areas of the gold and silver market that, curiously, the majority of the precious metal analyst community have left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy. Independent researcher Steve St. Angelo (SRSrocco) started to invest in precious metals in 2002. Later on in 2008, he began researching areas of the gold and silver market that, curiously, the majority of the precious metal analyst community have left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.

Steve considers studying the impacts of EROI one of the most important aspects of his energy research. For the past several years, he has written scholarly articles in some of the top precious metals and financial websites.

You can find many of Steve’s articles on noteworthy sites, such as GoldSeek-SilverSeek, Market Oracle, Financial Sense, GoldSilver.com, SilverDoctors, TFMetals Report, Outsiderclub, SGTreport, BrotherJohnF, Hartgeld, Der-klare-blick, PeakProsperity, SilverStrategies, DollarCollapse, FurtureMoneyTrends, Sharpspixley, FinancialSurvivalNetwork, Pmbull, Deviantinvestor, PmBug, Wealthwire, and ZeroHedge.

srsroccoreport.com

|