Send this article to a friend:

August

22

2018

Send this article to a friend: August |

|

Gold output in key countries to slump to ‘generational’ lows — report

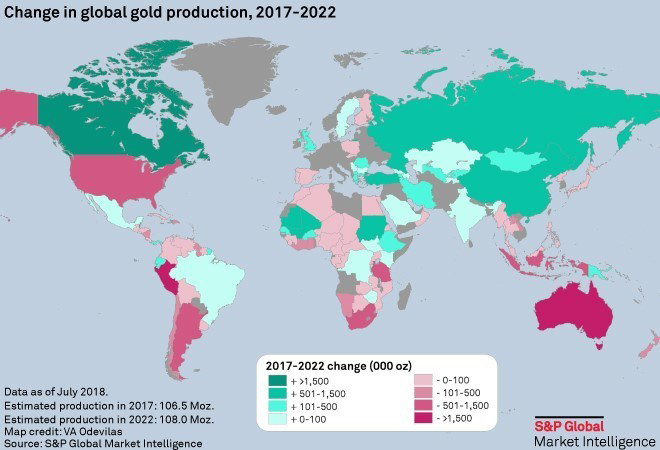

Gold output in key producing countries, such as Australia and Peru, is set to slump to generational lows in the mid-term even though bullion production grew for nine consecutive years, reaching an all-time high in 2017, a new report shows. While S&P Global Market Intelligence does expect output to rise reach new highs this year, to 108 million ounces, as well as in 2019 and 2020, it doesn’t see growth across the board. “In the case of Australia, despite production being on track to hit a 26-year high of 10.2 Moz in 2019, we estimate that Australian gold production will start to decline thereafter,” says S&P analyst Chris Galbraith. West Africa, in contrast, is set to become world's second-largest gold producer after China.In its the Gold Pipeline report, S&P forecasts a 9% fall in gold production for Australia in 2020 and expects the country's production to reach a generational low of 6.8 million ounces by 2022. That is a 33% drop in only three years. Peruvian production is also expected to decline the most by 2022 — by 1.9 million ounces to be exact. This, as no new gold mines have begun production in the country since the start of 2017, and only one project seems likely to go online in the next five years: Southern Copper's Los Chancas, slated to begin operations in 2022 Canada, however, is highlighted as one of the few countries where gold output will continue to increase by potentially 62% above 2017 production. West Africa is also forecast to experience growth with gold output in the region — including Ghana, Mali, Burkina Faso, Guinea, Cote d'Ivoire, Senegal, Liberia, Sierra Leone and Mauritania — rising 16%, which will make it the world's second-largest gold producer after China. Not a shiny outlook The global scenario beyond 2022, however, doesn’t look very positive, according to the report. Much of Canada's near-term growth, for instance, is coming from discoveries made in the past 25 years. At the same time, discovery rates have fallen globally with some of the larger undeveloped projects, including Donlin, Pebble and KSM facing significant delays.

Courtesy of S&P Global Market Intelligence. S&P expects output this year from current operations to fall short of 2017 production by as much as 3% and by almost 15% by 2022 due mainly to depletion or production drops tied to falling grades, such as Barrick’s Pueblo Viejo mine and Nevada complex, as well as Newmont's operations in Nevada.

|

Send this article to a friend:

|

|

|