Could This Rally Be a Head-Fake?

Charles Hugh Smith

If there's nothing supporting this rally but euphoric sentiment arising from orchestrated

buying, any eruption of reality will reveal the rally as a head-fake. If there's nothing supporting this rally but euphoric sentiment arising from orchestrated

buying, any eruption of reality will reveal the rally as a head-fake.

Let's say you wanted to engineer a stock market rally that triggered every technical

"buy" signal and wiped out those who are short the market--what would you do? First,

you'd engineer a new all-time high to signal "all clear for further advances."

Then you'd crush volatility as measured by the VIX, signaling that there is nothing

standing in the way of more advances.

Next, you'd engineer new highs every day for a week or more.

To do this, you'd unleash a wave of strong buying at every bit of "good news," no matter how

jury-rigged, to trigger computer-trading buying: bogus earnings "beats," any M&A activity,

rumors of more stimulus in Japan, a pop up in crude oil, etc.--whatever could be construed

as even modestly good news.

This entire rally has an engineered feel. All the technical "buy" signals are precisely

what you'd expect in a rigged rally.

The rally's strength is reminiscent of the 1999-2000 Internet-era stock market, but

compare the fundamental backdrop of then and now. Back then, earnings, sales, profits

and employment were all up strongly globally, and China and the emerging markets were

experiencing trade-based organic (i.e. not the result of central bank stimulus) expansion.

Can the same be said of the present? No. Employment is stagnant once low-paying

part-time jobs are stripped out of official cheerleading statistics, and corporate

profits are sliding--especially if "one-time charges" and other accounting trickery

are stripped out.

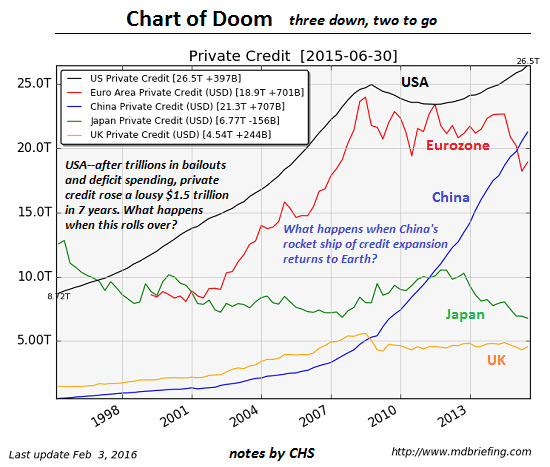

As for global trade--it's stagnant or down. Whatever "growth" is officially reported

is either suspect or based on unsustainable expansion of private credit or central bank/state

stimulus. Consider the following chart: three major economies out of five are already

experiencing declining private credit, and China's rocket-like trajectory is clearly

unsustainable:

The list of global financial weaknesses and potential crises is long and varied. 2016

is not 1999. The list of global financial weaknesses and potential crises is long and varied. 2016

is not 1999.

If there's nothing supporting this rally but euphoric sentiment arising from orchestrated

buying, any eruption of reality will reveal the rally as a head-fake: having exterminated

short-sellers, there won't be many who will benefit should the rally be transformed into

a rout by reality.

My new book is #10 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook,

$8.95 print edition) For more, please visit the book's website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

I was raised in southern California as a rootless cosmopolitan: born in Santa Monica, and then towed by an upwardly mobile family to Van Nuys, Tarzana, Los Feliz and San Marino, where the penultimate conclusion of upward mobility, divorce and a shattered family, sent us to Big Bear Lake in the San Bernadino mountains.

The next iteration of family took us to the island of Lanai in Hawaii, where I was honored to join the outstanding basketball team (as benchwarmer), and where we rode the only Matchless 350 cc motorcycle on the island, and most likely in the state, through the red-dirt pineapple fields to the splendidly isolated rocky coastline. In 1969-70, this was the old planation Hawaii, where we picked pine in summer beneath a sweltering sun.

We next moved to Honolulu, where I graduated from Punahou School and earned a degree in Comparative Philosophy (i.e. East and West) at the University of Hawaii-Manoa. The family moved back to California and I stayed on, working my way through college apprenticing in the building/remodeling trades.

I was quite active in the American Friends Service Committee (Quakers) and the People's Party of Hawaii in this era (1970s).

I next moved to the Big Island of Hawaii, where my partner and I built over fifty custom homes and a 43-unit subdivision, as well as several commercial projects.

Nearly going broke was all well and good, but I was driven to pursue my dream-career as a writer, so we moved to the San Francisco Bay Area in 1987 where I worked in non-profit education while writing free-lance journalism articles on housing, design and urban planning.

Within a few years I returned to self-employment, a genteel poverty interrupted by an 18-month gig re-organizing the back office of a quantitative stock market analyst. I learned how to lose money in the market with efficiency and aplomb, lessons I continue to practice when the temptation to battle the Monster Id strikes.

Somewhere in here my first novel was published by The Permanent Press, but alas it fell still-born from the press--a now monotonous result of writing fiction. (Seven novels and I still can't stop myself.)

I started the Of Two Minds blog in May 2005 as a side project of self-expression, and in an unpredictable twist of evolutionary incaution, that project has ballooned into a website with about 3,500 pages that has drawn almost 20 million page views.

The site's primary asset may well be the extensive global network of friends and correspondents I draw upon for intelligence and analysis.

The blog is #7 in CNBC's top alternative financial sites, and is republished on numerous popular sites such as Zero Hedge, Financial Sense, and David Stockman’s Contra Corner. I am frequently interviewed by alternative media personalities such as Max Keiser, and am a contributing writer on peakprosperity.com.

www.oftwominds.com

|