But in reality, the casino is just adding new kinds of roulette wheels and slot machines, from which society derives exactly zero net benefit.

So it should come as no surprise that the multi-billion-dollar funds that bet on volatility (that’s right, betting on market volatility is now a career) have grown to the point that they can actually cause the volatility they “invest” in – with systemically dangerous results. From Saturday’s Wall Street Journal:

Recent swings in the stock market are threatening to unravel multibillion-dollar bets that rely on calm markets, potentially adding to investors’ jitters over the past week.

Computer-driven volatility-target funds generally scoop up riskier assets like stocks during calmer periods, hoping to gain as markets grind higher. When volatility hits, it sends them scrambling to sell their stocks and move into safer assets like Treasurys. Asset managers like Vanguard Group and insurance companies run some of the bigger strategies of this type.

Because markets have been so quiet this year, with the exception of episodes like Tuesday’s trade-driven pullback, the funds are especially loaded up on stocks. That has left volatility-target funds carrying the highest level of exposure to U.S. stocks since the fall, a troubling sign for those who believe the funds exacerbated some of the market’s worst selloffs in 2018.

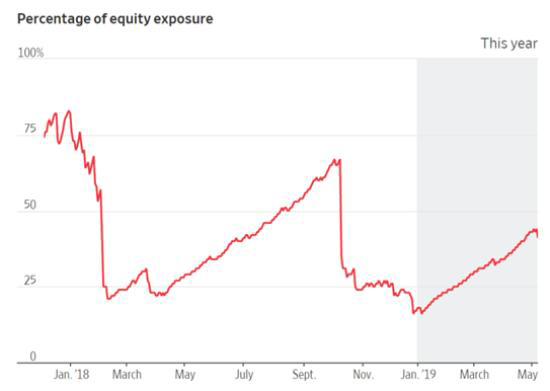

Volatility-targeting funds had an estimated 44% equity exposure Tuesday. That marked their highest level of equity exposure since early October, when they had a more-than 60% exposure to stocks, according to Pravit Chintawongvanich, an equity derivatives strategist at Wells Fargo Securities.

After stocks tumbled Tuesday, Mr. Chintawongvanich estimates those funds sold about $10 billion in stocks a day later, knocking their allocations down to 41%—still around their highs for the year.

“If the next spike [in volatility] is higher, then you’ll see a more extended downmarket and we’d remove equities. You can get easily whipsawed,” said Duy Nguyen, a portfolio manager and chief investment officer of Invesco Solutions, who helps manage these strategies.

That’s especially true because analysts estimate volatility-target funds manage as much as $400 billion in assets—giving them considerable heft in the stock market.

Critics argue that such funds, along with the growing prevalence of automated trading, have altered the market’s natural tendencies, from sharpening moves in the S&P 500 to fueling historic stretches of tranquility, like in 2017.

With dozens of volatility-targeting funds employing similar, but nuanced, automated approaches around insulating investors from the stock market’s shocks, they typically sell stocks simultaneously during the worst downdrafts, analysts said. The group’s equity allocations swung from 83% in late December 2017 to 21% in February following 2018’s initial selloff, according to Wells Fargo. Allocations rose again in subsequent months, hitting 67% in early October, prior to the market’s decline, and bottomed out at 16% in late December.

Those moves weren’t spread over a long period. Instead, funds sold most of those assets over a few trading sessions, making their impact on the market that much more apparent, analysts said. If Tuesday’s decline had been more severe, on the scale of a 3% pullback in the market, Wells Fargo estimates that volatility-targeting funds would’ve sold roughly $36 billion worth of stocks.

“You can see these funds moving together,” said Damian McIntyre, a portfolio manager at Federated Investors, who manages a volatility-targeting fund that is near the top of its equity-allocation range. “That can exacerbate any selloff.”

Why is the propensity of volatility funds to intensify crashes systemically dangerous? Because there’s now so much bad debt in the world that a garden variety equities bear market can spread to previously more-or-less unrelated sectors like emerging market debt, energy sector junk bonds and Italian government paper. Let several such dominoes fall together and a localized crisis becomes global.

Meanwhile, volatility funds are just one part of a growing constellation of strategies that rely on algorithms to move money in response to changing market dynamics. The interesting part of their story will be when they (as they eventually must) all move the same way at the same time.

This multi-market interconnectedness is one of the reasons the world’s central banks abandoned their tightening plans so quickly when US stocks fell late in 2018. They know what happens if such a decline accelerates. And the wiser among them know that contagion is coming no matter what they do to stop it.

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble (DollarCollapse Press, 2014) andÊThe Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)