Three Reasons Natural Gas Is Heading A Lot Higher

Martin Tillier

Commodity pricing is a complex thing, with a whole host of things affecting the price at which buyers and sellers transact, but almost all of those things fall into one of three categories; the fundamental, the political and the technical. These three things are often in conflict, but when they all point to the same thing a major, sustained move is coming. That is the case right now with U.S. natural gas and the resulting move could easily push prices to levels not seen for years. Commodity pricing is a complex thing, with a whole host of things affecting the price at which buyers and sellers transact, but almost all of those things fall into one of three categories; the fundamental, the political and the technical. These three things are often in conflict, but when they all point to the same thing a major, sustained move is coming. That is the case right now with U.S. natural gas and the resulting move could easily push prices to levels not seen for years.

Supply & Demand Fundamentals

Commodity specific fundamental factors such as supply and demand are the most influential thing on price. The basic economic theory of pricing tells us that, but it also suggests that the market will automatically adjust to changing conditions. When demand outstrips supply, for example, prices rise which slows demand and the higher price makes additional marginal production profitable, increasing supply. Those two things rebalance the market and price returns to the mean. After a big drop in natural gas a couple of years ago the market is now in the process of rebalancing, but a few things suggest that the pace of that change is increasing and some overshoot now looks inevitable.

Firstly what was, until recently, a closed market is opening up. Exporting natural gas from the U.S. has never been a practical proposition, given that the country has always used more than it produced. A combination of high oil prices a few years ago and the fracking revolution changed all that though, and the move to export began. Building new liquefaction and export terminals takes time though and the first wave are now coming on line. According to the EIA America will have the capacity to export 40% of its production by 2020, up from zero just a short while ago.

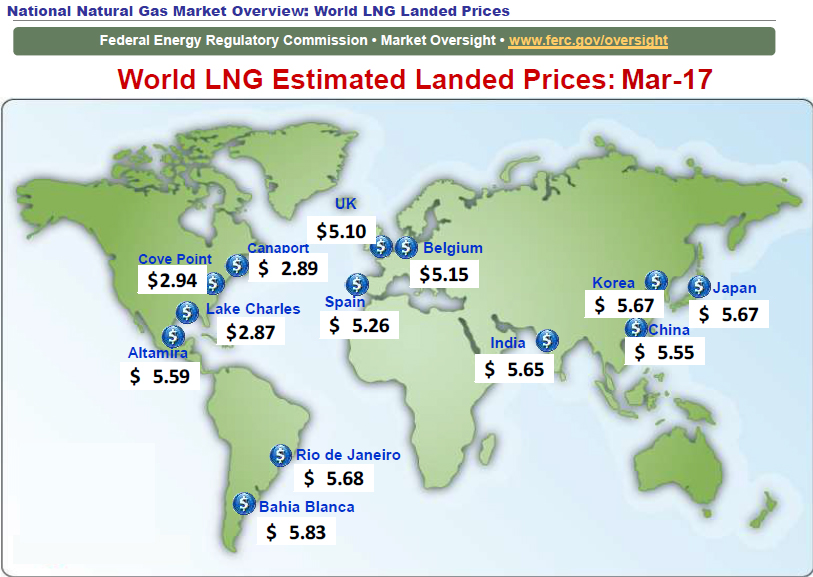

The lack of export capacity as production increased has had a serious effect on North American prices, as the Federal Energy Commission graphic below shows. The price differential makes it obvious that if U.S. producers get access to overseas markets they will export, at least up to the point where the U.S. price catches up, and that is where politics comes in.

Politics

Second in direct influence is politics, both domestic and international. Changes to the legal and regulatory environment in producing countries as well as geopolitical concerns that have the potential to affect either side of the supply/demand equation can cause major moves in price.

One might expect that the Trump administration’s determination to open up Federal lands for drilling and reduce environmental protections associated with oil and gas production would be a negative for gas prices by increasing supply but the opposite is true. That may be the case for oil, but for natural gas greater pipeline capacity and faster, easier approval of export facilities will more than offset that.

Similarly the belief that less of a focus on greenhouse gas emissions and a coal-friendly administration will reverse the demand increases that there have been for gas over the last few years ignores some basic facts. The main drivers of that growth have been power plants that have switched to natural gas as their fuel. Those changes cannot be reversed in a hurry. Even if they could it would make no sense. The current administration is not going to force utilities to switch to coal fired stations but there is every chance that a future one would mandate closing them.

Technical Factors

Usually technical analysis is useful only to predict short term moves but sometimes a longer term trend can be clearly seen.

The two charts above show U.S. natural gas futures prices for the last 6 months (top) and the last 3 years (bottom). As you can see in both cases the current price is in the bottom half of a clearly defined upward channel. Natural gas has been volatile recently, so technical analysis can only be relied upon so much, but the basic, long term trend is definitely bullish.

In short then all three major influences on natural gas are suggesting a move higher, and when that happens, even a natural contrarian such as me has to sit up and take notice. There will no doubt be some bumps on the road as that is the nature of markets, but over the next six months to a year a return to natural gas prices nudging at the $5 mark certainly looks on the cards.

By Martin Tillier of Oilprice.com

Oilprice.com is the most popular energy news site in the world. Our analysis focuses on Oil and Gas, Alternative Energy and Geopolitics.

Oilprice works with the largest names in financial news and provides news and analysis to sites such as: CNBC, Yahoo Finance, Nasdaq, Fortune, TIME Magazine, Huffington Post, USA Today, CNN Money, Business Insider and hundreds of others.

oilprice.com

|