|

Underfunded American Pensions Are “An Unsolvable Problem”

Lance Roberts

Math is math. It does not play politics. It does not care who has enough to eat or a place to live. It barrels ahead, executing equations, no matter what. To lament math is to lament the truth.

The math locomotive that is barreling down the railroad tracks to which criminally underfunded pensions are bound is inevitably going to make things extremely messy. There are going to be a whole lot of impassioned speeches, political posturing, and chest-thumping about this over the coming years.

None of which will slow the train one bit.

It is no surprise that public pension funds are completely overwhelmed, but they still have not come to the realization that markets do not compound at an annual return of 8% annually. This has led to a continued degradation of funding levels as liabilities continue to pile up.

If the numbers above are right, the unfunded obligations of approximately $4-$5.6 trillion, depending on the estimates, would have to be set aside today such that the principal and interest would cover the program’s shortfall between tax revenues and payouts over the next 75 years.

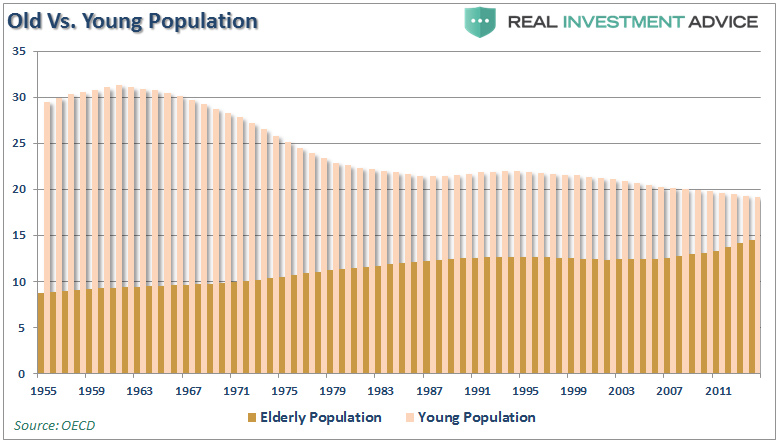

With pension funds already wrestling with largely underfunded liabilities, the shifting demographics are further complicating funding problems.

One of the primary problems continues to be the decline in the ratio of workers per retiree as retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers.)

However, this “support ratio” is not only declining in the U.S. but also in much of the developed world. This is due to two demographic factors: increased life expectancy coupled with a fixed retirement age, and a decrease in the fertility rate.

With rates pushing higher, economic growth slowing and Central Banks extracting liquidity, we are already closer to the next major bear market than not.

The next crisis won’t be secluded to just sub-prime auto loans, student loans, and commercial real estate. It will be fueled by the “run on pensions” when “fear” prevails benefits will be lost entirely.

It’s an unsolvable problem. It will happen. And it will devastate many Americans.

It is just a function of time.

Finally, investing that makes sense. Lance Roberts has a unique ability to bring the complex world of politics, economics, investing and personal financial wealth building to you in simple, easy and informative way. Rather than just regurgitating the news of the day, Lance looks at the “raw data” to bring a unique and “unspun” perspective to the conversation. Lance deep understanding of fundamental, technical and economic perspectives, combined with his unique focus, helps listeners, readers and investors understand how it impacts their family, their money and their life.

Having been in the investing world for more than 25 years, from private banking and investment management to private and venture capital, Lance has pretty much "been there and done that" at one point or another. His common sense approach, clear explanations and “real world” experience has appealed to audiences for almost two decades.

After building an extremely successful Registered Investment Advisory firm in Houston, Texas with almost $700 million in AUM, Lance is back at it building the next generation wealth advisory firm incorporating new tech with old money.

Lance is the Chief Editor of the Real Investment Report, a weekly subscriber based-newsletter that is distributed globally. He is also writes a daily blog which is read by tens of thousands from individuals to professionals, and his opinions are frequently sought after by major media sources.

Lance’s investment strategies and knowledge have been featured on CNBC, Fox Business News, Business News Network and Fox News. He has been quoted by a litany of publications from the Wall Street Journal, Reuters, Bloomberg, The New York Times, The Washington Post all the way to TheStreet.com. His writings and research have also been featured on several of the nation's biggest financial blog sites such as the Pragmatic Capitalist, Credit Writedowns, The Daily Beast, Zero Hedge and Seeking Alpha.

realinvestmentadvice.com

|