He Ran Into My Knife Ten Times

Gary Christenson

The song “Cell Block Tango” from the Oscar winning movie “Chicago” included the line, “He Ran Into My Knife Ten Times.” The song “Cell Block Tango” from the Oscar winning movie “Chicago” included the line, “He Ran Into My Knife Ten Times.”

Those seven words suggest anger, bleeding and murder…

The American people have “run into a financial knife” many times in the last century. (Solutions listed at the end.)

- In 1913 congress approved The Federal Reserve, the U.S. central bank which created dollar devaluation, massive unpayable debts, transfers of wealth to the financial cartel and more. This knife cut deep and caused huge economic blood loss.

- The Income Tax (1913). Massive blood loss occurred from this knife blow. No discussion needed.

- The 1929 stock market crash. “Good times” do not last forever. The economic boom of the 1920s suffered a death blow in 1929. Will 2018 be the new 1929?

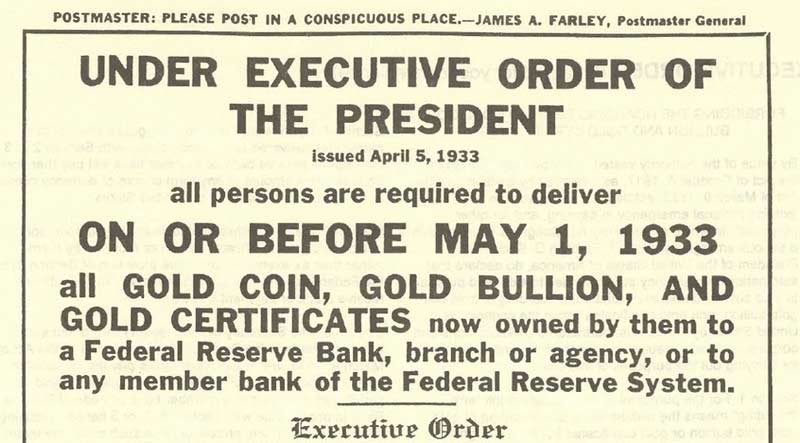

- President Roosevelt (1933) confiscated gold and made private gold ownership illegal. Exceptions occurred, but citizens lost most or all gold coins. Double eagles ($20 gold coins) no longer circulated. Silver dollars and paper certificates remained in circulation.

- President Johnson demonetized silver in 1965. Real silver coins disappeared from circulation. “Bad money drives out good money.”

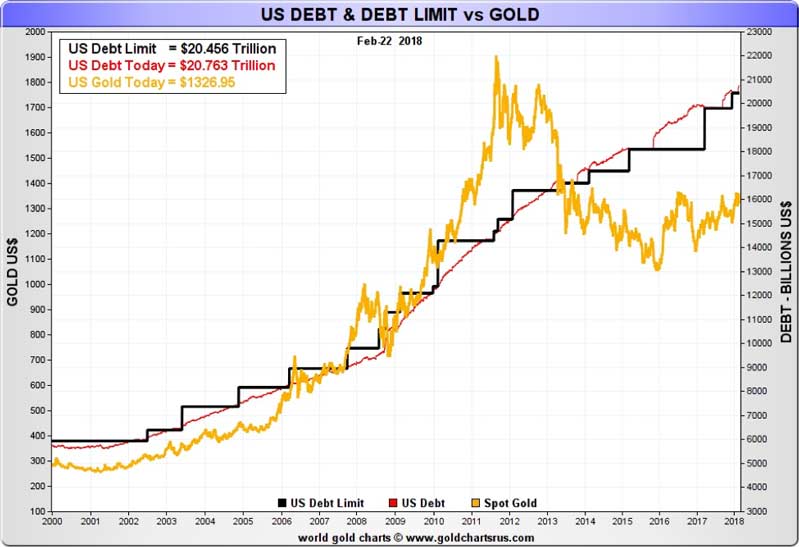

- President Nixon (1971) closed the “gold window” and severed the last connection between gold and the U.S. dollar. He refused to redeem (per Bretton Woods) dollars presented by foreign nations for gold bullion. The dollar rapidly devalued, consumer price inflation soared, and gold prices rose from $42 to over $800 in nine years. The piper must be paid, one way or another.

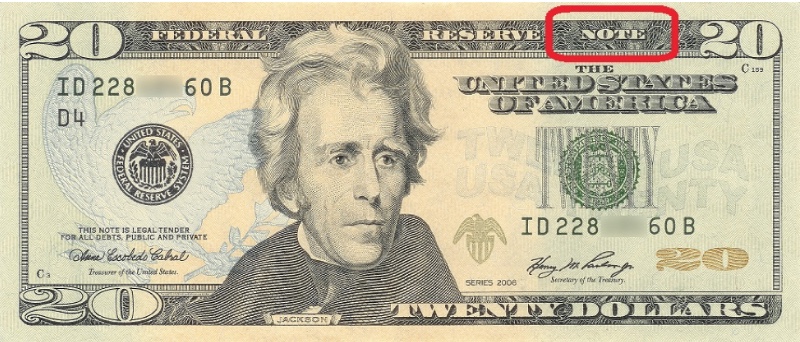

- Federal Reserve Notes circulated in place of money. The notes are IOU’s from the Fed – DEBTS OF THE CENTRAL BANK. Currency devolved from gold and silver coins, to only silver coins, to paper silver certificates, to paper and digital debt notes issued by the Fed. The knife struck again and the bleeding continued.

- September 11, 2001 attack in New York by… the official story is problematic… but the consequences are clear. The “warfare state” rose to prominence while the “welfare” people demanded their “fair share.” The bleeding continues and the recent passage of the $1.3 trillion supplemental spending bill by congress and President Trump shows warfare and welfare spending triumphed over good-sense, responsible actions, and intelligent fiscal management. Another knife wound and more bleeding…

Official National debt on September 11, 2001: $5.7 trillion

Official National debt on March 26, 2018: $21.1 trillion

- Financial Crisis and Crash of 2008. The FASB ruling allowed banks to “mark to myth,” TARP bailout of banks, real estate foreclosures, Federal Reserve purchase of Mortgage Backed Securities from commercial banks and Quantitative Easing. More wounds and continued bleeding…

- The crash of 2018-2020 is in progress. How and when is less certain, but rising interest rates on tens of $trillions in public and private debt, another real estate collapse, trade wars, retail sales decline, shooting wars, bankruptcies, and deflation of prices for stocks and bonds guarantee more bleeding.

AND THE SOLUTIONS ARE:

- Stop the bleeding! Use honest money, eliminate central banks and balance budgets. This is not a viable option.

- Recognize that debt based assets are over-valued. What is the value of a 10 Year Note issued by a government that can repay the loan ONLY by devaluing and borrowing more? What is the value of currency units “printed” with almost no limit? Ask the people of Venezuela to describe the value of paper currency units printed in excess.

- Recognize that stock market prices rise and fall in long cycles. They are high now and the next large move appears downward. Buy low occurred in 2009 and 2010. Sell high is now relevant.

- Gold and silver are valuable and necessary even though they are no longer used as currency units. Markets established their value over several millennia. The financial and political elite in Russia and Asia know the value of gold. Wise investors in the western world appreciate the importance of gold.

- If gold were unimportant, the paper markets (COMEX and LBMA) would not “manage” prices.

- If gold were unimportant, central banks would sell their bullion for debt-based currency units.

- If gold were unimportant, the Treasury would allow an audit of Fort Knox gold and publish the results, even if embarrassing.

- Be your own central banker. Back your savings and retirement with gold and silver coins and bullion. Store them safely outside the banking system.

- The powers-that-be promote financial bleeding (excluding them) and more debt. Politicians spend more than revenues received, thereby devaluing currency units. Central bankers accelerate the creation of debt and devaluation of currency units.

- Gold will retain its purchasing power as the warfare and welfare big-spenders accelerate the bleeding. Silver’s purchasing power will increase for many years. Silver investments may heal a few financial knife wounds and minimize blood loss.

Miles Franklin sells silver and gold. Thousands of happy clients have protected their savings and retirement from financial knife wounds and uncontrolled economic bleeding. I suggest you join them.

Gary Christenson

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of the book, “Gold Value and Gold Prices 1971 – 2021.” He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy and central banking.

|