The Pain Is Almost Over

David Brady

My apologies for the tardiness of my article this week, but given my focus on bond yields and the implications for precious metals and miners, I wanted to wait to hear what the chief ‘Facilitator of Spending’, Fed Chair Powell, had to say during a Wall Street Journal conference today. My apologies for the tardiness of my article this week, but given my focus on bond yields and the implications for precious metals and miners, I wanted to wait to hear what the chief ‘Facilitator of Spending’, Fed Chair Powell, had to say during a Wall Street Journal conference today.

Here are the highlights with my comments below:

“We expect that as the economy reopens and hopefully picks up, we will see inflation move up through base effects,” Powell said. “That could create some upward pressure on prices.”

- This is old news. Inflation is already on the rise. Just look at commodity markets or go to your local grocery store. Powell is just acknowledging what is already happening whether the economy continues to reopen or not.

With respect to the need to raise interest rates, he said: “There’s just a lot of ground to cover before we get to that,” even if the economy sees “transitory increases in inflation … I expect that we will be patient.”

- Said differently, the Fed has no plans to raise interest rates in the foreseeable future. I do take issue with the use of the term “transitory” with respect to the inflation already under way and would argue that this is solely to justify not having to raise rates.

“We’re very mindful and I think it’s a constructive thing for people to point out potential risks. I always want to hear that,” he said. “But I do think it’s more likely that what happens in the next year or so is going to amount to prices moving up but not staying up and certainly not staying up to the point where they would move inflation expectations materially above 2%.”

- This appears to contradict the Fed’s new goal of getting inflation up to an average of 3% over three years. This means that Powell is either admitting they are going to fail before they have even started trying to reach that goal, or more likely, he is attempting to justify doing nothing to stem rising inflation any time soon.

Financial markets were hoping for an increase in QE to stem the rapid rise in bond yields recently, and their disappointment was reflected in yields jumping higher on the news while stocks and precious metals fell.

Such expectations were wildly optimistic, in my opinion. I can’t remember the last time the proverbial house was on fire and the Fed screamed “Dial 911!”, because they never have. Remember “Subprime is contained”? Instead, they try to talk down yields with words like ‘transitory’ and ‘patient’.

In reality, I believe they know exactly what is going on and fully plan to cap bond yields in the very near future. They have no alternative. A further sharp rise in the cost of debt would raise some very difficult questions about the solvency of U.S. finances, which could risk the collapse of all markets. The key question is: when will they intervene?

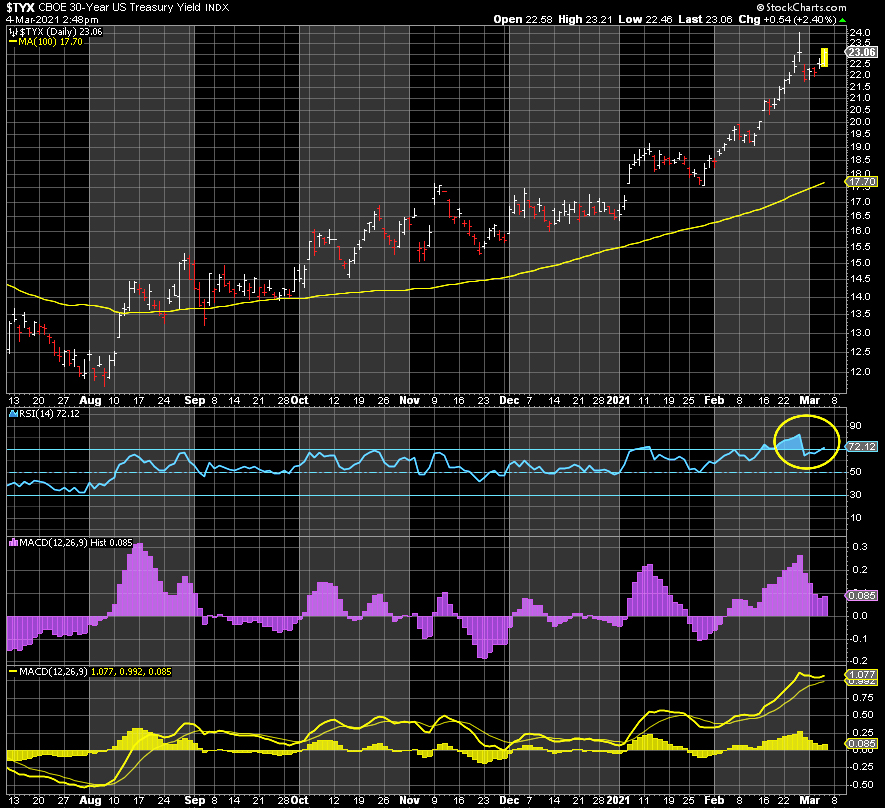

Last week, I shared my belief that the 30-year Yield cannot be allowed to go above 2.75%-3.00% and that I am looking for a negatively divergent higher high in yield above the prior of 2.41%. At either or both of those points, the Fed must intervene. When they do, yields will fall and Gold, Silver, and the miners will begin their next rally to new highs. The same thing happened in reverse last August when yields bottomed out.

Far from being a negative for precious metals and miners, today’s comments from Powell accelerate the time it takes to reach those yield targets, the subsequent intervention by the Fed, and finally the bottom in Gold and Silver.

The alternative is that the government does the job for them by mandating a Federal lockdown of the U.S. economy in April. This would instantly reduce inflation expectations and cause bond yields to fall naturally. Either way, the result is the same for precious metals and miners. The pain is almost over.

David Brady has managed money for over 25 years for major international banks and corporate multinationals both in Europe and the US, with experience in Bonds, Equities, Foreign Exchange, and Commodities

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

www.sprottmoney.com

|