The Fed’s Failures Are Mounting

Danielle DiMartino-Booth

In the decade between “60 Minutes” interviews, the central bank has sparked a recovery without inflation but not much else In the decade between “60 Minutes” interviews, the central bank has sparked a recovery without inflation but not much else

Friday marks the 10-year anniversary of the Federal Reserve Chairman Ben S. Bernanke’s groundbreaking “60 Minutes” interview. To listen to current Fed Chairman Jerome Powell on the same show a decade later, the central bank’s best laid plans since then would seem to have played out according to script with one glaring exception: the Fed’s balance sheet.

When “60 Minutes” reporter Scott Pelley asked Bernanke if the Fed was printing money, his reply was, “Well, effectively. And we need to do that, because our economy is very weak, and inflation is very low. When the economy begins to recover, that will be the time that we need to unwind those programs, raise interest rates, reduce the money supply, and make sure that we have a recovery that does not involve inflation.”

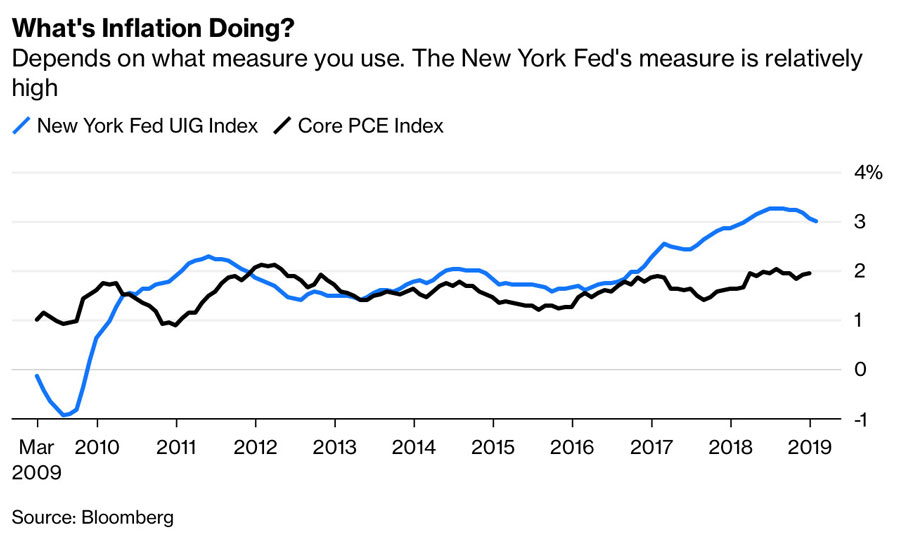

If the primary goal was recovery without inflation, the Fed delivered. Since the onset of recovery in June 2009, the core personal consumption expenditures index, which measures the prices paid by consumers for goods and services net of food and energy prices that tend to be more volatile, has been above 2 percent in in just five months in 2018, four in 2012 and one in 2011.

Critics of the central bank suggest that the massive surge in financial assets over the past decade starkly illustrates the need for the Fed to incorporate inflation gauges that take into account price gains of real estate and securities. One such gauge, the Underlying Inflation Gauge (UIG) created at the Federal Reserve Bank of New York, has hovered around the 3 percent level since last February. In other words, the UIG has been running north of the Fed’s 2 percent inflation target since November 2016. The justification for raising interest rates thus depends on the gauge used to guide policy.

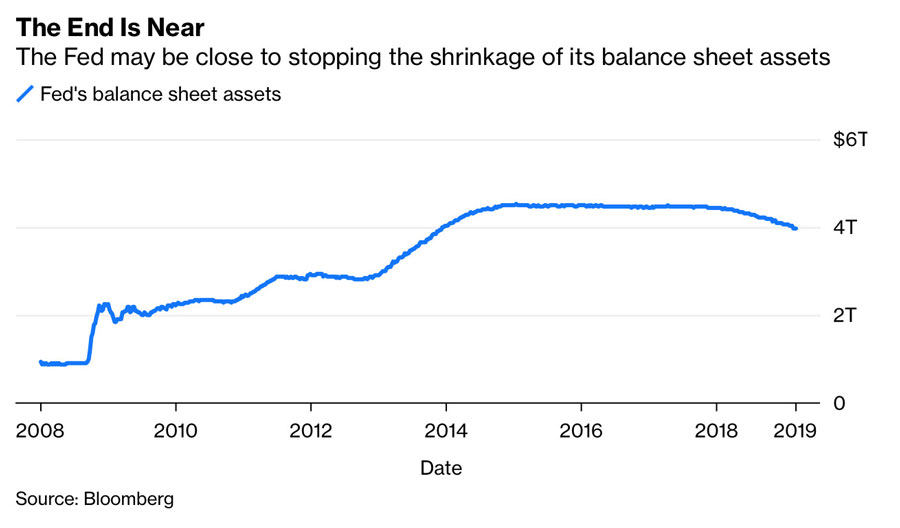

As for Bernanke’s commitment to unwind unconventional monetary policy, it’s looking increasingly as if only a small portion of his promise can be fulfilled. Since last meeting in January, Fed officials have been publicly unified in their intention to present a road map to end quantitative tightening (QT) at next week’s Federal Open Market Committee meeting. The 16 percent to 17 percent of GDP estimate Powell offered Congress as the terminal size of the balance sheet implies QT will end with the Fed holding about $3.5 trillion in securities, compared with the peak of about $4.52 trillion in January 2015. (The Fed held less than $1 trillion of balance sheet assets before the financial crisis.)

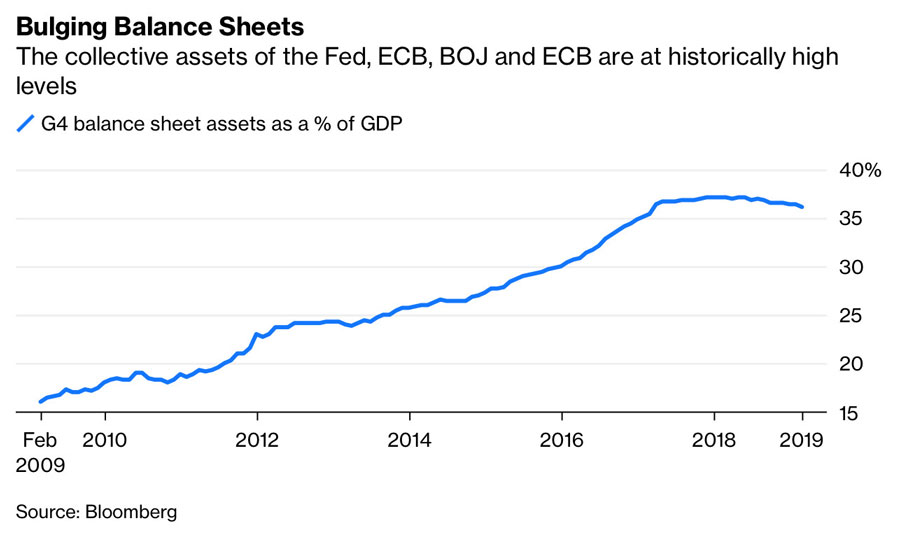

Running monetary policy looser than need be for such a protracted period has benefited global asset prices. Even after the Fed began tapering its bond purchases, its central banking peers more than took up the slack. As of February, the collective balance-sheet assets of the Fed, European Central Bank, Bank of Japan and Bank of England stood at 36.3 percent of their countries’ total GDP, little changed over the past two years.

When Pelley asked Bernanke about banks that had paid perks and bonuses after taking bailout money, Bernanke replied: “The era of this high living, this is over now. And that they need to be responsible and use the money constructively. I’d say that their job right now is to find a way to make loans to creditworthy borrowers, to get their banks back on the path of making good loans, safe loans, and to have a reasonable sense of humility based on, you know, what’s happened in the last 18 months.”

But at the National Association for Business Economics recent annual conference, University of California-Berkeley economics professor Gabriel Zucman presented his findings on the widening divide between the “haves” and “have nots” in the U.S. His conclusion: “Both surveys and tax data show that wealth inequality has increased dramatically since the 1980s, with a top 1 percent wealth share around 40 percent in 2016 vs. 25 – 30 percent in the 1980s.” Zucman also noted that increased wealth concentration has become a global phenomenon, albeit one that is trickier to monitor given the globalization and increased opacity of the financial system.

That is not to say the most powerful players in finance haven’t had to adapt to a post-crisis world. The inability to undertake risky lending under tightened regulation has pushed business to an increasing degree out of the conventional banking system into the shadow banking industry. Private equity presides over more than $2.1 trillion in committed capital to be deployed outside the purview of regulators’ watchful eyes, according to research firm Preqin.

While, Powell acknowledged that risks had built up among highly leveraged companies, he said the scale is not “the kind of thing that we saw in the…subprime mortgage crisis. It doesn’t seem to be like that, generally. But at the same time, it could be an amplifier in a downturn.”

As for any notion that Fed policy has elevated asset prices and left behind those without the means to benefit, circumstances that have skewed both wealth and income inequality, Pelley asked, “Where are we headed in this country in terms of income disparity?” Echoing his predecessors, Powell replied, “Well, the Fed doesn’t have direct responsibility for these issues.” Except that the Fed does have direct responsibility. If the “wealth effect” used to justify a generation of quantitative easing hasn’t kicked in yet, trickling down to those who need it most, it’s past time the Fed acknowledged its failings and opened the door to a new policy framework.

Danielle DiMartino Booth, a former adviser to the president of the Dallas Fed, is the author of “Fed Up: An Insider’s Take on Why the Federal Reserve Is Bad for America,” and founder of Quill Intelligence.

Read more opinion

Follow @DiMartinoBooth on Twitter

Danielle DiMartino Booth is CEO and Director of Intelligence at QuillIntelligence.com

Click HERE to SUBSCRIBE.

For a full archive of my writing — www.DiMartinoBooth.com

Click Here to buy Fed Up: An Insider’s Take on Why the Federal Reserve is Bad for America.

Amazon.com | Barnes & Noble.com | Indie Bound.com | Books•A•Million

Danielle DiMartino Booth is a global thought leader on monetary policy and economics. She is the author of FED UP: An Insider’s Take on Why the Federal Reserve is Bad for America (Portfolio, Feb 2017). FED UP rose to #22 on Amazon’s Best Seller List.

DiMartino Booth founded Money Strong LLC in 2015. Through her economic consultancy, she has published a weekly newsletter for 140 consecutive weeks. Her writings are regularly featured on Linked In, Seeking Alpha, Nasdaq, Talk Markets and dozens of other websites. In affiliation with Quill Intelligence, DiMartino Booth also publishes a weekly newsletter subscribed to by institutional investors.

DiMartino Booth is a full-time columnist for Bloomberg View, a business speaker, and a commentator frequently featured on CNBC, Bloomberg, Bloomberg Radio, Fox News, Fox Business News and other major media outlets.

Prior to Money Strong, DiMartino Booth spent nine years at the Federal Reserve Bank of Dallas where she served as Advisor to President Richard W. Fisher until his retirement in March 2015. She continues to research, write and speak on the financial markets, focusing recently on the ramifications of credit issuance and how it has driven global fixed income, equity and real estate market valuations. Sounding an early warning about the housing bubble in the 2000s, DiMartino Booth has earned a reputation for making bold predictions based on meticulous research and her unique perspective honed from years of experience in central banking and on Wall Street. DiMartino Booth began her career in New York at Credit Suisse and Donaldson, Lufkin & Jenrette where she worked in the fixed income, public equity and private equity markets. DiMartino Booth earned her BBA as a College of Business Scholar at the University of Texas at San Antonio. She holds an MBA in Finance and International Business from the University of Texas at Austin and an MS in Journalism from Columbia University.

dimartinobooth.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)