|

Gold: The Piper Must Be Paid

John R. Ing

In his State of the Union victory lap, the president crowed that the “great American comeback” entered this decade with the longest bull run in American history. Unsaid is that in dancing to all time highs, the bond and stock markets are priced for perfection. In normal times, this would not be as dangerous as it is today. In his State of the Union victory lap, the president crowed that the “great American comeback” entered this decade with the longest bull run in American history. Unsaid is that in dancing to all time highs, the bond and stock markets are priced for perfection. In normal times, this would not be as dangerous as it is today.

Early in his term, President Trump introduced a trillion dollar tax cut in order to get the economy going. He succeeded. The Democrats even voted for that bill. Some doomsday pundits cautioned that inflation would pick up. It did not. Today a trillion dollars later, stock markets have reached record highs, job growth is strong and unemployment is at the lowest in half a century. U.S. housing starts surged to a 13 year high and Trump pocketed two trade deals. And now, Mr. Trump proposes a $4.8 trillion budget with safety net cuts, including slashing the budget of the Center for Disease Control (CDC), in the middle of the coronavirus pandemic.

This time Democrats won’t help him because history shows that incumbent presidents fighting re- election with a strong economy almost always get re-elected. Not surprisingly, the president has promised another “middle class” tax give-away this summer, just in time for November, taking advantage of an all-time high approval rating of 49 percent in Gallup’s latest tracking poll. However, unmentioned is that 49 percent disapprove of the president’s behavior, with only 1 percent expressing no opinion, showing a decided split nation. Four more years?

The real picture however, is that growth and productivity are lagging beset by the accumulated debt loads, trade wars and now a virus contagion, which are headwinds to sustainable growth. Today a highly indebted central bank is still supporting demand with yet another round of quantitative easing, buying more government debt to bailout the US repo market, the epicentre of the last financial crash in 2008.

Amid the market’s euphoria, slower world growth is looming as China, the workshop of the world and heart of the world’s global supply chains is closed temporarily. China has stopped producing, consuming and the coronavirus fallout will be felt beyond the production disruption of iPhones, or visits to the Louvre. The Chinese economy is the locomotive for the world and the Black Swan virus consequences haven’t yet hit the global economy, or the markets.

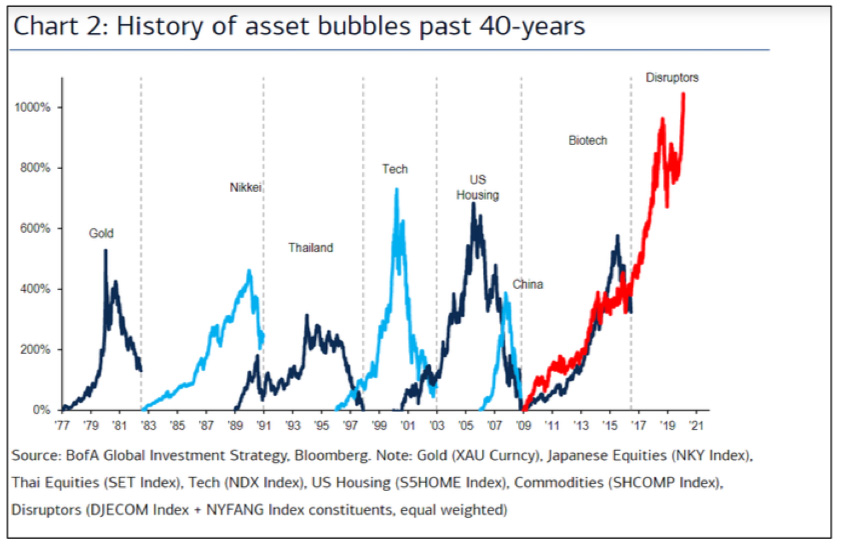

Bubbles, Bubbles and More Bubbles

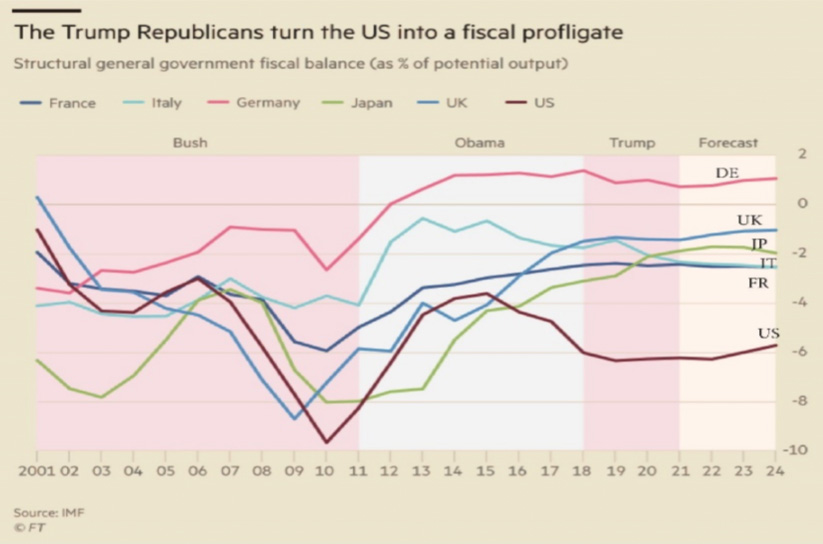

To be sure, while debt remains sky high and growing, America’s tax cuts and ballooning government spending have approached almost 20 percent of GDP, the highest among the rich countries. President Trump’s use of deficit spending has been accommodated by a Fed that has provided the most liquidity since World War II. From stocks to real estate to classic cars, the ensuing bubbles have expanded in risk and scope...and yet the Fed keeps pouring it on. Amidst all this, the Fed has kept rates near zero, disguising the cost and risk of the government’s fiscal mismanagement. Then, for the first time in history, we have more than $13 trillion of government bonds, yielding negative interest rates as buyers are asked to pay for the privilege of holding them to maturity. Central banks have lost control, as negative yields overwhelm the safety buffers of our existing financial ecosystem.

Hence, there is justification for investor worries, with balance sheets flooded with red ink, led by a Fed that creates unlimited sums of money at zero cost, needed when America relies on debt to pay for spending. Yet, with a Dow 30,000, why worry? The disconnect is due to the fact that despite near record debt levels, the cost of carrying that debt is minimal, leading to investor complacency.

It is no coincidence that the current bull market began with the bailout of the Wall Street banks after the 2008 crash, following the collapse of Lehman Brothers. The resultant three rounds of quantitative easing, poured billions and trillions into the economy, igniting the longest bull market in history. Tesla’s market cap at $160 billion is more than the combined value of General Motors, Fiat Chrysler and Ford despite Tesla having made money selling cars in only one quarter. Tesla’s exponential rally stirs memories of past market bubbles, including Qualcomm, the dot-com bubbles, oil bubble in 2005 and bitcoin only three years ago. This US equity juggernaut takes no prisoners. Just so we have record prices, we have record optimism. Bears are in retreat. Moral hazard has been dumped as investors believe that central banks will always bail them out with more monetary stimulus, producing instead the mispricing of capital and productivity declines. Investors forget that after every bubble burst, equity prices fell soon after, often more than 50 percent.

Computer Trading

Meantime, computers now trade more than half of the daily volume on the major stock exchanges. First, there were the high-frequency trading bots with black box algorithms. Today, there are thousands of black boxes trading trillions daily. Regulators are only now expressing concern of the super high speed algorithmic trading and that computer-driven trading might exacerbate swings

in the stock market. Hedging algorithms are believed to have a hand in propelling Tesla to the heavens. Computer strategies have accelerated change in the structure of our capital markets, altering the plumbing of stock markets which so far has evaded regulatory insight. Until now.

A good example is the recent decision by the largest pension fund in the world, $1.6 trillion Japanese Government Pension Investment fund (GPIF) to stop lending shares to short-sellers. Short-sellers borrow shares they don’t own, sell them with the expectation they can buy them back at lower prices. Index players also borrow shares to create syndicated synthetic or derivative indexes. GPIF earned about $100 million a year from the stock lending business on its foreign holdings worth almost $400 billion which is a big profit generator for most big pension funds. Why did Japan's pension fund make this move? The big pension fund has put environment, social governance (ESG) concerns at the center of its investment ethos and are concerned about the long- term benefits to the capital market.

The Fog of Economic War

Overlooked still, is that the geopolitical climate is getting darker as America’s retrenchment from the global role it once embraced, encourages growing cooperation between Washington's economic rivals. Investors are a spectator as America and China battle for technological and economic supremacy.

America has turned inward on multiple fronts, particularly since its homegrown energy independence has resulted in a lessening of influence in the Middle East. For decades, Iran a regional power has been calling for the US to withdraw from the region, and now America is happy to accommodate. Slowly a new bipolar world is emerging with America on one side and a new alignment of countries with Russia, China and key Middle East players on the other. Indeed, America’s energy self-sufficiency, transformed by American shale has widened the diplomatic hole as both Russia and China, embark on their first joint naval exercises in the Gulf, in a blatant challenge to US influence in the Middle East. Mr. Trump even hinted that NATO, an alliance he once derided as obsolete, to become “much more involved” in the Middle East process. In shrinking its global footprint, the US will have come full circle from their disastrous invasion of Iraq in 2003.

Possibly another unintended consequence is that ally, Saudi Arabia and rivals, Iran, Iraq, Russia and Venezuela have created a significant consortium that will hold the largest reserves in the world, giving them an excellent opportunity to tie up their biggest customer in the world, China. China has emerged as an alternative in this new global framework. Beijing’s economic power could thus be fueled by this consortium while the United States excuses itself from this picture. In withdrawing from the Middle East, Trump’s “America first” policy is reminiscent of the days of pre-World War II, when America was a quiet island. Then in the Sixties after losing the war in Vietnam, it again retreated, allowing China to fill the vacuum and become a superpower in only two decades. Then, after winning the Cold War, America influenced globalisation for a quarter of century, but that too has changed. Mr. Trump has changed the axis of power, just not in the way he envisioned.

Contagion

America's fiscal profligacy and hegemony is its blind spot. Currently it is thought that foreigners own about one third of America's money supply, up to one third of America's assets and bought 35 percent of the $1.3 trillion of debt issued last year. America’s current account deficit has widened to almost 3 percent of GDP.

Contagion, not the virus has hit the repo market. As discussed in our last missive, a major concern is the turmoil in the short term lending market, the epicentre of the last financial crisis that has again taken everybody by surprise. Repo loans are made overnight between Wall Street banks, hedge funds and money market players. For the first time since the financial crisis of 2008, the Fed was forced to provide tens of billions in September after overnight borrowing rates spiked to 10 percent from less than 2 percent, when the repo market seized up, sending shockwaves through the financial system.

As a lender of last resort, the Fed normally provides the banks and dealers with cheap and ready liquidity in times of duress, but six months later the Fed has injected almost a trillion dollars to solve a cash shortage, that was thought to be a one time problem. There is some speculation that the clog in the financial system’s plumbing was attributable to the unwinding of the Federal Reserve's mammoth balance sheet from $5.75 trillion to $4.5 trillion and the draining of cash, hurt liquidity. When the Fed stopped buying Treasuries, others stepped up, draining cash from the system. Yet ironically with the recent repo bailout, the Fed has started expanding its balance sheet again and could hit the all time peak reached in 2015 in a stealth type QE4, a sign of deeper problems.

Such is the context that while unwinding the Fed’s balance sheet is blamed for the cash shortage in the repo market, there are others who believe that there is a counterparty problem, because the five big Wall Street banks hold 90 percent of the market. However, we believe that the shortfall is due more to the geo-political flow of cash. Of concern is that in injecting billions into the system in order to liquefy the repo system, the Fed has left the US dollar and its financial hegemony exposed. Dollar supremacy is not forever.

The Piper Must Be Paid

In the last half century, while America printed money without limitation, no one seemed concerned that the cheap dollars went offshore and that a major part of the world’s dollar deposits are today controlled by foreigners. The market has become too complacent to recognize the full implications of this situation. Two thirds of the world’s assets are denominated in a fiat currency, issued by a country which does not seem to care that they are debasing this currency. As America weaponizes its currency and financial system, others will seek alternatives. The world has a vote on America’s debt and the system of dollar imperialism. We believe China has already voted.

We have opined here of the concern that over the past decade, the Fed’s money-printing binge flooded the world with freshly minted dollars, that lifted the stock markets to all-time highs. Few notice that China has been a major factor behind America's finances. China has become a net- supplier of savings to the rest of the world as two decades of accumulated trade surpluses resulted in the Chinese owning trillions of US assets and securities. In becoming a net exporter to the US and the world, the workshop for the world, China today owns some $1.1 trillion of US Treasuries in its foreign exchange reserves which ultimately gives it a say in any new monetary order.

In the economic war with the United States, China does not need to dump its Treasuries to drive up yields, it only has to let the holdings mature or simply repatriate its funds. We believe that this is the beginning of the decline in the US dollar as China dedollarises the trade flows and in repatriating their funds, convert dollars into gold, other currencies or real assets. We consequently believe that America's repo market collapse is linked to the repatriation of funds from America. China deals with all the major Wall Street banks and the repatriation of funds would force those banks to cash in China’s chips, resulting in a shortage of cash and the repo problem.

Weaponization of America Hegemony

It is a matter of concern that the global trade uncertainty has resulted in a tug-of-war between global investment headwinds and domestic problems. Nations have become more polarized in a world of trade wars and sanctions, with the weaponization of digital taxes or border taxes joining tariffs. Long standing though Beijing’s and Washington’s enmity, the immediate context of the trade truce was a chain of events as political reality prompted both sides to compromise. However, the truce was only a respite because any deal is better than no deal.

Pointedly, we believe the combination of the conflict between cheap money and trade related risks from the US, the erection of China’s bamboo curtain, and now a virus that threatens the markets’ stability will cause a shift in assets from the record breaking stock market which will trigger steeper sell offs, exacerbating the crisis. The problems in America’s repo market is only the beginning.

With global debt above levels at the beginning of 2008, and continued high levels of borrowing leading to bubble-like credit markets, the printing press was the only mechanism to ensure that more debt could ultimately be sold without a dramatic spike in interest rates. The consequence, however is that the US dollar, the unit for most international trade and medium for exchange is particularly vulnerable to any change in sentiment. The IMF reported that 90 percent of the world's economies are experiencing a synchronized economic slowdown and while record stock market highs make daily headlines, we believe that this disconnect has fueled investor complacency. Can investor complacency last that long?

Gold Is an Alternative to the Dollar

There are few havens to hide. Gold has topped $1,600, the highest since 2013 as the corona virus contagion continues. Few notice that central banks are quietly accumulating gold as an alternative investment to the greenback, increasing their holdings by 14 percent since 2009, or some 5,000 tonnes worth more than $200 billion according to the World Gold Council. Last year central banks bought 650 tonnes of gold. Holdings in gold-backed exchanged traded funds (ETFs) also rose to their highest levels in seven years with negative yielding debt driving money into gold as an alternative. With a seven year base, we continue to believe gold will top $2,200 an ounce. In euros, gold has already achieved a record high.

To America, it matters little that the US dollar has become more of a risk asset despite higher interest rates elsewhere. However rising geopolitical turmoil, trade wars, the corona virus and America’s financial hegemony have seen more interest in gold as governments enthusiastically stock enormous stores of gold rather than dollars. Mr. Trump has exposed the world to the dollar- centric vulnerability and his policies are eroding America’s fiscal stability, trustworthiness and the strength of its institution. Russia has expanded the use of the euro, renminbi, rubles for settling energy transactions rather than rely on dollars. China has boosted its gold reserves and plans to launch a digital currency as means for interbank settlements. According to the Financial Times, China has filed some 84 patents related to digitising the renminbi. Europe and India are creating alternatives to SWIFT, the dollar denominated payment system. Europe has created INSTEX to allow EU members trade with Iran and sidestep US sanctions.

America has become the largest debtor in the world at a staggering $23 trillion, with trillion dollar deficits as far as the eye can see. Consequently, America’s reliance on foreign capital to finance its consumption has eroded confidence in the dollar. Mr. Trump’s repeated use of financial weaponry, sanctions and engaging in financial warfare has prompted others to break free from American hegemony. Because the US consumes much more than it produces and owes much more

than it owns abroad, China has too many dollars. One of these days, having expanded its manufacturing base, captured world markets, China may flex its financial muscle and decide to digitise and peg its currency, not to the dollar but to gold. They know that the dollar is likely to depreciate over time in the face of large deficits. To them, gold is a good thing to have, and is an alternative to the dollar.

Above all, gold has retained its value, over centuries. One can detect the decline in confidence. Neither party today in Washington stands for sound money. In fact, under a President Sanders, government spending would double overnight. In November, the Americans will elect another inflationary president – that will be good for gold and bad for the dollar.

Recommendations

Last year, the mining industry saw more than $20 billion of mergers and acquisitions (M&A) activity, kicked off by Newmont's $10 billion acquisition of Goldcorp. Last year, Barrick Gold acquired Randgold Resources in a $6 billion merger that started a beehive of activity and consolidation as other producers sought to bulk up while the mid-tiers feasted on the castoffs. Kirkland Lake Gold acquired Detour Gold for almost $5 billion in a share exchange that boosted Kirkland's short-lived reserve life that also shrunk its premium as investors and insiders initially sold because of dilution of shares and grade. Still Kirkland paid less than $275 per ounce for in situ reserves, among the cheapest of the midcaps and now boasts 20 million plus ounces in reserves. Newmont sold two of its Australian producers as part of pruning its eclectic portfolio. The Chinese too were active buying into Colombia whilst Teranga boosted its reserves and production profile with the acquisition of Barrick’s Massawa project.

We believe the raison d'être for this active M&A activity was that the mining industry experienced peak gold last year, and the majority of miners had trouble replacing their depleting reserves. Also, after rebuilding their balance sheets and cutting costs, lower grades and production problems depressed margins. Thus chastened, the miners have become much more selective on the acquisition front.

Still while it appears that the mining industry is playing a game of musical chairs, there are fewer chairs left and we believe the remaining chairs will be filled in a rush, as the mining industry discovers that it is cheaper to buy reserves on Bay Street rather than spend scarce capital on exploration and development.

Among the seniors, we continue to recommend Barrick Gold and despite stubbing its toe, Agnico Eagle for its potential to boost not only reserves but production. Among the mid-caps, we prefer B2Gold and like junior Centamin as a possible takeover target. We also like Lundin Gold as they bring the highest grade deposit into production this year. McEwen Mining will benefit from turnarounds at Black Fox and newly commissioned Gold Bar in Nevada. We have removed Detour Gold from our coverage list because of its acquisition by Kirkland Lake.

Agnico Eagle Mines Limited

Despite a record fourth quarter, Agnico Eagle shocked the Street by lowering its guidance for the year due to a slower start-up at newly built Meliadine and Amuruq in Nunavut. Meliadine’s open pit water problems are now resolved. We believe the experienced miner will solve the start-up production woes as they did with Goldex a few years ago. This year, capex will approach $740 million and next year, Agnico should produce 2.1 million ounces benefiting from these

expenditures. At Canadian Malartic, Agnico and joint venture partner Yamana are studying the prospect of going underground at Odyssey. Agnico has eight operating mines in Canada, Finland and Mexico and while a slower ramp-up hurt guidance, Agnico will benefit over the intermediate term from Kittila and the Nunavut expansions. Agnico has a strong balance sheet and thus is able to ride out any delays. Disappointing however was that gold reserves declined to 21.6 million ounces but grades improved to 2.83 g/t. Agnico has $328 million in cash plus an undrawn $1.2 billion credit line, sufficient to pay down or refinance $360 million debt, which comes due in April. We like the shares on the pullback.

Barrick Gold Corp.

Barrick Gold again surprised the Street by unveiling a 10 year production profile showing a steady 5 million plus ounces of annual production that focuses attention on their core assets, specifically newly created Nevada Gold Mines (NGM) joint venture, the fourth largest producer in the world, Veladero in Argentina and even Hemlo, their only Canadian producer. Under Thornton and Bristow, Barrick has focused on free cash flow, pruning costs and expanding its core assets with the consolidation of Nevada and at long life Pueblo Viejo in the Dominican Republic while optimizing their Latin America assets. Of interest is that Bristow is not yet finished and with a stronger balance sheet, there is room for acquisitions. Barrick has flattened its corporate structure, reduced G&A ahead of schedule and pushed decision-making down to the regional mines resulting in free cash flow growing from $365 million to $1.1 billion. However, at Pascua Lama, Barrick remains cautious as the new numbers don't add up, revealing a new discipline...., it is not all about growth but profitability. Finally, as long promised, Barrick resolved its problems with the Tanzanian government and production will begin. Barrick boosted its reserves to a whopping 71 million ounces at 1.68 g/t, although Donlin and Pascua Lama are included. Nonetheless, we continue to like the shares here as the go-to name for institutions.

B2Gold Corp.

B2Gold came in with a solid fourth quarter with contributions from Masbate, Otjikoto and Fekola. B2Gold also unveiled more information on the Gramalote project in Columbia which is a large low grade open pit project shared with Anglo Gold but with a whopping capex of almost a billion dollars, we believe the project is more of an option on the gold price. In the latest quarter, the Fekola mine boosted its reserves, making B2Gold one of the fastest-growing intermediate producers. B2Gold remains a low-cost producer having sold its Nicaraguan assets and the company has a strong growth profile. Cash flow from its mines in the Philippines, Namibia, Mali and Burkina Faso generated about $700 million cash, adequate to pay down debt, leaving B2Gold with a stronger balance sheet. We like the shares here.

Centamin PLC

Centamin reported strong results from the high grade Sukari open pit in Egypt. Centamin has one of the strongest balance sheets with cash and liquid assets of $349 million, allowing the company to boost and pay a dividend for the sixth consecutive year. Operating cash flow was some $250 million and the company maintained its production guidance of 510,000 ounces to 540,000 ounces at a cash cost of $650 per ounce. Of note is that exploration in the surrounding area of the Sukari facilities has focused on a major discovery at Horos Deeps which is about 200 m below the current underground. Centamin is also upgrading the vent system in order to exploit higher grade ore underground. Centamin was a takeover target earlier in the year as Endeavour offered 1.4 billion pounds but management deemed the price too low. Nonetheless, there is blood in the water and notwithstanding geographic risk, the shares are attractive here, particularly as a takeover target. Of

note Egypt has opened its borders to investment by loosening restrictions and introducing new regulations to attract mining and boost exploration. Centamin is well situated to benefit after operating a decade in Egypt. Buy.

Centerra Gold Inc.

Centerra reported strong production from Mount Milligan in B.C. and Kumtor yet lowered its guidance for 2020 due to plans to process lower grade material from Kumtor in the Kyrgyz Republic. Also the Mount Milligan copper/gold results were disappointing with another flat year. On the good news front, Centerra is bringing on Oksut in Turkey but that is not enough to replace the lower grades from Mount Milligan and Kumtor. Centerra has a strong balance sheet and repaid a promissory note but its mining problems caused the shares to sell off. We would prefer B2Gold here.

Kinross Gold Corp.

Kinross reported flat production at 2.5 million ounces and notwithstanding its array of assets in the US, Brazil, Chile, West Africa, and Russia, the company's seems to be spinning its wheels. Paracatu in Brazil produced 620,000 ounces at $666 per ounce which was offset by the higher cost Nevada assets. After a couple decades in Russia and notwithstanding the geographic discount, Kinross doubled down by acquiring Chulbatkan. In the past, Kinross has spent big dollars at Tasiast in Mauritania, Chile and Nevada but has shown little free cash flow, thus it appears that they are stuck on a treadmill. Production this year will drop to 2.4 million ounces and Kinross’ reserve picture has slipped to 24.3 million ounces even with the addition of Chulbatkan’s 4 million ounces. We prefer Agnico Eagle for their profitability and geographically secure mines.

IAMGold Corp.

Midtier IAMGold had a disappointing quarter lowering guidance due to production problems at flagship Rosebel in Suriname. IAMGold spent $250 million to complete nearby Saramacca which will boost Rosebel’s life, however, cash costs are increasing. Ground weakness at Westwood in Quebec remains a problem with Essakane in Burkina Faso also facing a weaker quarter. IAMGold replaced CEO Letwin with Gordon Stothart, who now faces a major clean up of IAMGold’s underperforming assets. Little was said of Iamgold’s Côté Lake, the on and now off again project which is still included in reserves. Sell.

Lundin Gold Inc.

Lundin poured their first gold bar in November at Fruta del Norte in Ecuador, one of the world’s largest undeveloped deposits. The mine is almost complete on time and within budget, with commercial production anticipated in the next quarter. Lundin Gold's, Fruta del Norte is a low- cost operation due to the highest grades in the world. Lundin has about $230 million in cash which is more than enough to finish construction. Reserves are a whopping 29 million ounces with expected AISC under $700 an ounce. We like the shares here and expect a bump up in valuation once the mine produces commercially. Buy.

New Gold Inc.

New Gold had a disappointing quarter due to lower grades and higher costs at Rainy River. A new life of mine plan (LOM) shows the need for more capital to improve profitability. However, of $700 million of total debt, New Gold has $400 million to pay off in two years and thus is capital constrained. Simply New Gold’s two mines need too much capital for little return. Meantime, free cash flow is not evident. New Afton's mine life is declining and needs to build out the C zone but

a return is not expected until after 2021. While Rainy River itself does not generate free cash flow, no one will spend good money after bad. Sell.

Yamana Gold Inc.

Yamana had a flat quarter with debt reduced to $1 billion which is still too high despite selling cash cow Chapada last year for $800 million. Yamana also released its guidance and management is focusing on operations such as the Phase 1 optimization at Jacobina and exploration at Cerro Moro, which produced 120,000 ounces. A prefeasibility study for Phase II Jacobina expansion may optimize Yamana’s flagship. El Penon in Chile produced 48,000 ounces which was a slight improvement for the former flagship. Yamana did boost reserves to 7.8 million ounces due to joint venture Malartic. We prefer Lundin Gold here because of a superior upside and balance sheet. Sell.

John R. Ing

[email protected]

(Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure (click here).

Maison Placements Canada Inc. is a leading independent Canadian research-based institutional investment dealer. Maison was established in 1955 and is a participating organization of the Toronto Stock Exchange, the Montreal Exchange, and a member of the Investment Dealers’ Association and CIPF. Our firm has a reputation for quality research and provides a well-established investment banking business. Maison is also engaged in value-added equity sales and trading. Maison Placement continues the tradition of independence and excellence by focusing exclusively on institutional investors around the world.

maisonplacements.com

|