Send this article to a friend:

January

30

2020

Send this article to a friend: January |

|

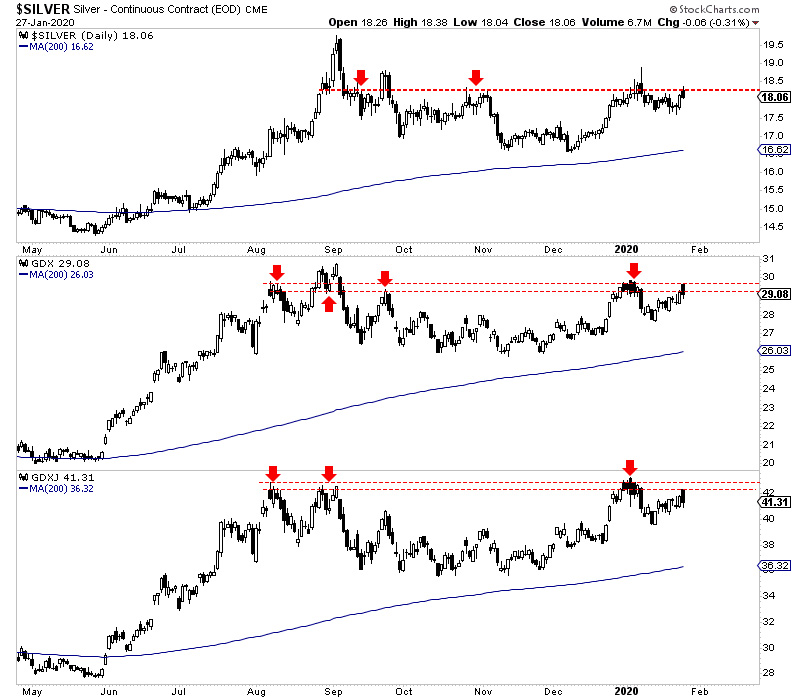

Sweet Spot for Gold’s Fundamentals

Let me explain. The most bearish points for Gold (aside from a blowoff in inflation) are when an economic recovery gains traction or when the Fed raises rates to combat inflation. All three scenarios entail stable or rising real interest rates and, therefore, no investment demand for Gold. At present, the Fed is seeking higher inflation while trying to keep the economy from falling into a recession. Do not expect higher real interest rates anytime soon. Hence, Gold has held its summer gains quite well and even built on them. Moreover, unlike any other time in Gold’s history, it is performing well despite strength in the US Dollar, which has perked up in recent weeks. My Gold against foreign currencies basket (or Gold multiplied by the US Dollar Index) closed last week at a new all-time high. It is trading 7% above its 2011 high! One of the reasons Gold cannot lose is strength in the US Dollar has become a bullish catalyst for Gold. The US and global economies are not on firm footing, and therefore, a stronger dollar is a trigger for easier Fed policy (rate cuts) and, in effect, lower real interest rates. With all that said, the near-term risks for the sector are primarily technical. The net speculative positions in both Gold and Silver are extreme in nominal terms and elevated as a percentage of open interest. At present, Gold has been the strongest part of the sector. That is a sign you are in a correction or consolidation. When precious metals are ripping higher, the laggard is Gold. On Monday, those other parts of the sector (Silver and the gold stocks) tested but failed at resistance. Below we plot Silver, GDX, and GDXJ. The red lines and red arrows highlight the key levels.  Silver and the gold stocks have tested these levels enough times that odds are they break resistance sooner rather than later. They have held their gains very well since the summer surge, and that also reflects the very strong macro-fundamentals for Gold. The sector could correct a bit or consolidate into February, and it would not change anything. The fundamentals are strong, and the uptrends are strong and intact. You want to be a buyer and almost fully invested before Silver, and the gold stocks surpass those resistance levels. When they do, momentum and speculation will increase, and junior miners will move quickly. We continue to focus on identifying and accumulating the juniors with significant upside potential in 2020. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

|

Send this article to a friend:

|

|

|